- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

513K Get Student Loan Forgiveness Due To Health

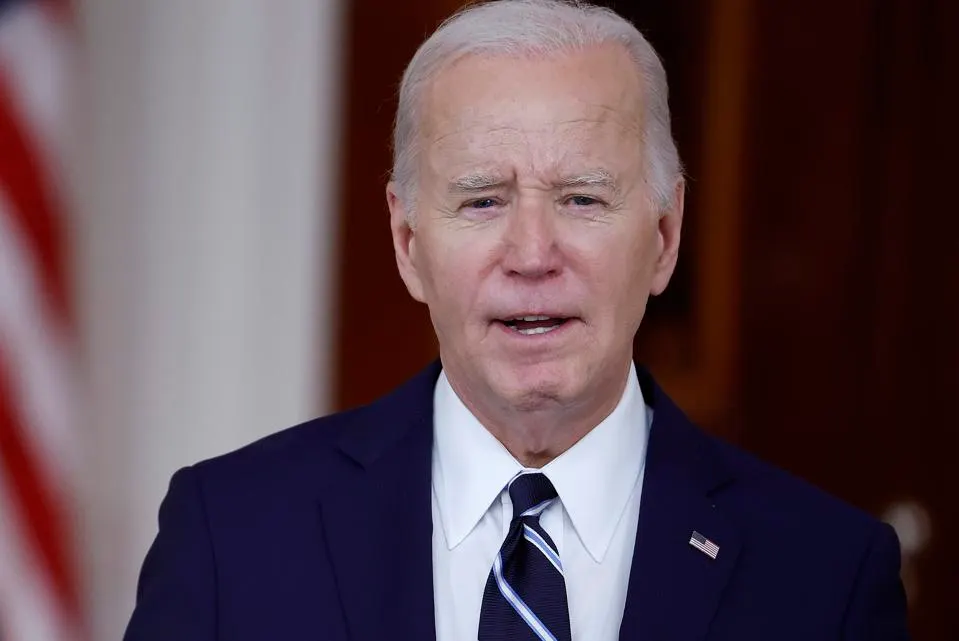

In a sweeping initiative aimed at providing relief to borrowers facing medical hardships, the Biden administration announced that over half a million individuals have received student loan forgiveness. This significant milestone marks a substantial effort to alleviate the financial burden on those grappling with disabling medical conditions.

The program, known as the Total and Permanent Disability (TPD) discharge program, enables federal student loan borrowers to seek debt cancellation due to physical or psychological conditions hindering substantial, gainful employment. Through a series of enhancements introduced by the Biden administration, more borrowers have become eligible for relief, leading to a surge in approvals.

Since 2021, the Department of Education has approved a staggering $11.7 billion in discharges for 513,000 borrowers. This momentum is set to continue this year, offering hope and tangible support to countless individuals facing daunting medical challenges.

Streamlining Relief: How It Works

To qualify for loan forgiveness under the TPD discharge program, borrowers must meet specific criteria. They must demonstrate an inability to engage in substantial gainful activity due to a medically determinable physical or mental impairment. This impairment must have persisted for at least five years, be anticipated to last another five years, or be terminal.

Borrowers can provide evidence in various ways, such as documentation from the Veterans Administration or the Social Security Administration, or a certification form from a designated medical provider affirming their eligibility.

Upon approval, federal student loans are discharged, albeit subject to a three-year post-discharge monitoring period. This period aims to safeguard against potential abuse of the program, ensuring fairness and accountability.

Biden Administration’s Efforts to Facilitate Access to Relief

The Biden administration has actively worked to enhance access to student loan forgiveness through the TPD discharge program. Emergency reforms and regulatory adjustments have been instrumental in simplifying the application process and mitigating reinstatement risks.

During the COVID-19 pandemic, income monitoring during the post-discharge period was waived, alleviating administrative burdens for borrowers. Additionally, a data-sharing initiative between the Social Security Administration and the Education Department was established, identifying eligible borrowers and expediting relief.

Last July, the administration further solidified these efforts by instituting updated federal regulations governing the TPD discharge program. These changes broaden pathways to forgiveness, offering expanded relief categories and involving a wider array of medical providers in the certification process.

Tax Implications and Future Considerations

Despite these strides, potential taxation remains a concern. While federal legislation currently exempts TPD discharges from taxation until 2025, uncertainties loom beyond this timeframe. Borrowers may face tax liabilities if Congress fails to extend this exemption, highlighting the need for legislative clarity.

The Education Department clarifies that for borrowers receiving TPD discharges under specific conditions, the discharge is not considered for tax purposes until after the post-discharge monitoring period ends. However, impending tax implications underscore the importance of prudent financial planning and consultation with tax advisors.

A Glimpse into the Future: Additional Relief Measures

While the TPD discharge program serves as a primary avenue for loan forgiveness, the Biden administration is devising supplementary initiatives. Leveraging the Higher Education Act, a new loan forgiveness plan is in development, targeting various groups of eligible borrowers.

Among these groups, individuals experiencing hardships, including those with disabling medical conditions and recipients of public assistance, are poised to benefit. While details on qualifying hardships remain pending, the forthcoming public hearing promises insights into this evolving landscape.

As the administration continues to prioritize student loan relief, borrowers grappling with health challenges can anticipate further avenues for assistance and support.

In conclusion, the significant strides made in student loan forgiveness underscore the Biden administration’s commitment to addressing the financial burdens faced by individuals with disabling medical conditions. By streamlining access to relief and exploring innovative solutions, efforts are underway to provide tangible assistance and alleviate the hardships endured by borrowers nationwide.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires426

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires395

Related Articles

Capital One Considers Buying Discover in Credit Card Merger

Capital One is reportedly considering acquiring Discover Financial, a move that could...

By 193cc Agency CouncilFebruary 20, 2024

Leave a comment