- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

IRS Tax Relief Possible for Wildfire Settlements 2020–2025

As wildfires continue to ravage various states across the nation, a glimmer of hope shines through the dark clouds of devastation for victims. In a significant development, the Tax Relief for American Families and Workers Act of 2024, currently under review in Congress, promises potential relief from IRS taxes on legal settlements related to wildfires that occurred between 2020 and 2025.

The proposed provision, if passed into law, would mark a historic moment for wildfire victims, offering respite from the burden of taxation on compensation received for losses, expenses, or damages resulting from Qualified Wildfire Disasters. These disasters encompass federally declared events arising from forest or range fires, a category including numerous catastrophic incidents like those in California, Washington, Arizona, and beyond.

The implications of this provision are profound. It would mean that individuals impacted by wildfires could exclude from their federal income tax calculations any amounts received as compensation, covering a wide array of losses including additional living expenses, lost wages, personal injury, and emotional distress.

Notably, the legislation seeks to streamline the tax relief process, providing a blanket exclusion applicable to all Qualified Wildfire Disasters within the designated timeframe. This approach contrasts with the current patchwork of state-level exclusions, exemplified by California’s ad hoc measures targeting specific wildfires.

While the potential benefits are clear, there remain nuances and challenges to address. Questions linger regarding the treatment of entities such as family limited partnerships and non-grantor trusts, complicating the application of the exclusion for beneficiaries. Additionally, concerns arise regarding the tax treatment of contingent legal fees, a critical consideration for many wildfire victims navigating complex legal processes.

Furthermore, the proposed legislation confronts the intricate mechanics of casualty gains and losses, necessitating careful calculation of adjusted tax basis and potential implications for future property transactions. However, these challenges pale in comparison to the relief offered by the prospect of tax-free settlements for wildfire victims.

The road ahead remains uncertain as the bill awaits Senate deliberation, but the momentum for change is palpable. If enacted, this legislation would represent a beacon of hope for those grappling with the aftermath of wildfires, providing much-needed assistance as they rebuild their lives and communities.

In the face of tragedy, the prospect of relief from federal taxation offers a ray of optimism for wildfire victims nationwide. As Congress and the IRS continue to refine the details, the potential impact of this legislation cannot be overstated. For those who have endured loss, stress, and uncertainty, the promise of tax relief brings a glimmer of light amidst the darkness of disaster.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires426

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires395

Related Articles

Mega Millions Jackpot: Winner Takes Home $167.2M After Taxes

The Mega Millions jackpot has surged to a staggering $563 million, marking...

By 193cc Agency CouncilFebruary 26, 2024King Charles III’s Coronation: Queen Camilla Crowned at Westminster Abbey Ceremony

On May 6th, 2023, a historic event took place in the United...

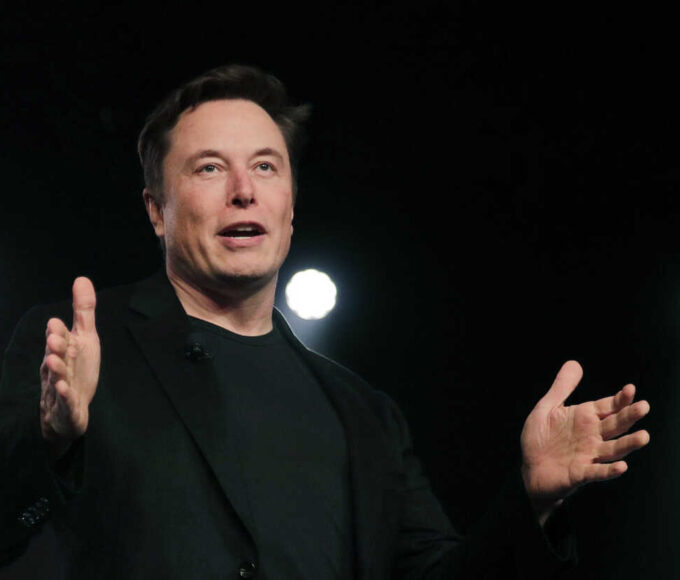

By Catherine lloydMay 6, 2023Elon Musk: A Visionary Entrepreneur Who is Changing the World

Elon Musk is a name that needs no introduction. He is one...

By Catherine lloydMay 6, 2023The Luxury of Responsibility: How LVMH and Bernard Arnault are Leading the Way in Sustainability and Social Responsibility

Bernard Arnault and his family are among the most prominent and influential...

By Catherine lloydMay 6, 2023

Leave a comment