- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Funding Shifts in 2024: Focus on Business Value Beyond Gen AI

In 2024, the focus will be on business value, extending beyond just Gen AI to encompass all technology investments. Most companies, well into their digital transformation journey, now seek greater returns on their investments, moving beyond the initial low-hanging fruit. However, there is a fundamental shift in sentiment regarding investing more to gain more value.

Digital Density plays a significant role in this shift. Companies have either high or low digital density based on their tech investments over the past decade, particularly in cloud migration. Those with high digital density have already moved substantial parts of their tech estate to the cloud. In 2024, there is little appetite or funding available to migrate the remaining low-density estates to the cloud. This marks a shift away from focusing solely on modernizing IT infrastructure to extract value from existing investments.

Decision-makers for technology funding have also evolved, especially with the rise of Gen AI. Previously, IT-driven decisions focused on efficiency gains, but now the emphasis is on creating value for the business. This has led to a shift in funding responsibility from CEOs and CFOs to departmental budget holders who assess the business value of tech investments.

Achieving success with Gen AI requires a multidisciplinary approach, going beyond AI and data expertise. Teams must include members who understand the specific business functions being impacted, data management, and how AI integrates with other technologies to deliver desired outcomes. This poses a challenge for organizations accustomed to hiring specialized skill sets.

For third-party service providers, this shift requires a reevaluation of their approach. The traditional specialist model may not suffice in a multidisciplinary environment. Providers need to adapt their offerings to align with the evolving tech funding landscape, where clear ROI and business value are paramount.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires443

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires412

Related Articles

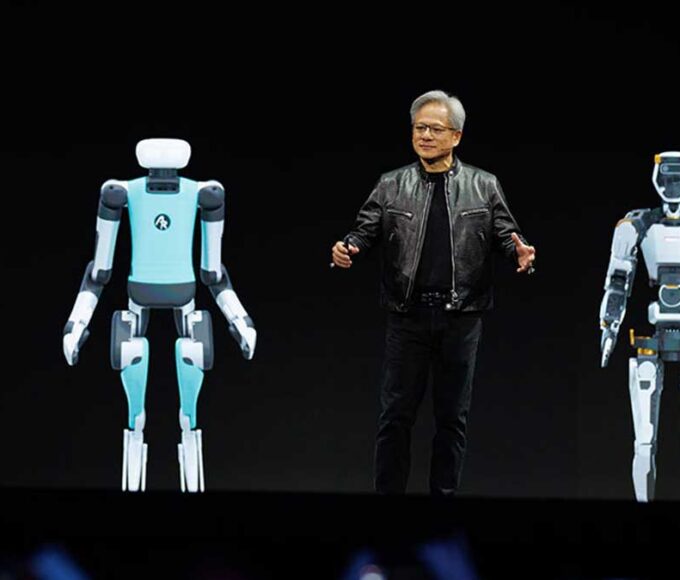

Jensen Huang Sees Physical AI as the Next Big Leap

Nvidia CEO Jensen Huang believes that Physical AI will be the next...

By 193cc Agency CouncilAugust 10, 2024Could AI Be the Next iPhone Moment?

The term “iPhone moment” describes a technological breakthrough that pushes innovation into...

By 193cc Agency CouncilJuly 8, 2024AI Surge Boosts Demand for Memory and Storage Innovations

The rise of artificial intelligence (AI) is significantly boosting the need for...

By 193cc Agency CouncilJuly 5, 2024Generative AI Set to Transform Finance Jobs

Generative AI is poised to revolutionize the financial services industry by automating...

By 193cc Agency CouncilJune 10, 2024

Leave a comment