- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Nvidia’s Stock Soars After-Hours on 265% Revenue Growth

Nvidia’s stock was on the brink of a major decline, according to CNBC, as the AI chip designer’s market value had surged more than five-fold since 2011. However, the company surprised skeptics by reporting exceptional results for the quarter ending January 2024. Following its faster-than-expected growth in the last quarter and an upward revision of guidance for the current quarter, Nvidia’s stock soared over 14% in after-hours trading on February 21.

The company’s pivotal role in the burgeoning adoption of Generative AI, which is still in its early stages, continues to make Nvidia a compelling investment opportunity.

Nvidia’s Q4 2023 Performance And Future Prospects

Nvidia’s fourth-quarter 2023 performance exceeded expectations and offered promising prospects. Here are the key figures reported by CNBC:

- Q4 2023 revenue surged 265% to $22.1 billion, surpassing analysts’ consensus of $20.6 billion for the period ending Jan. 28.

- Q4 2023 adjusted earnings per share surged 804% to $5.15 per share, beating the analyst consensus of $4.59.

- Q1 2024 revenue guidance anticipates 300% growth to $24 billion, exceeding analysts’ consensus of $21.6 billion.

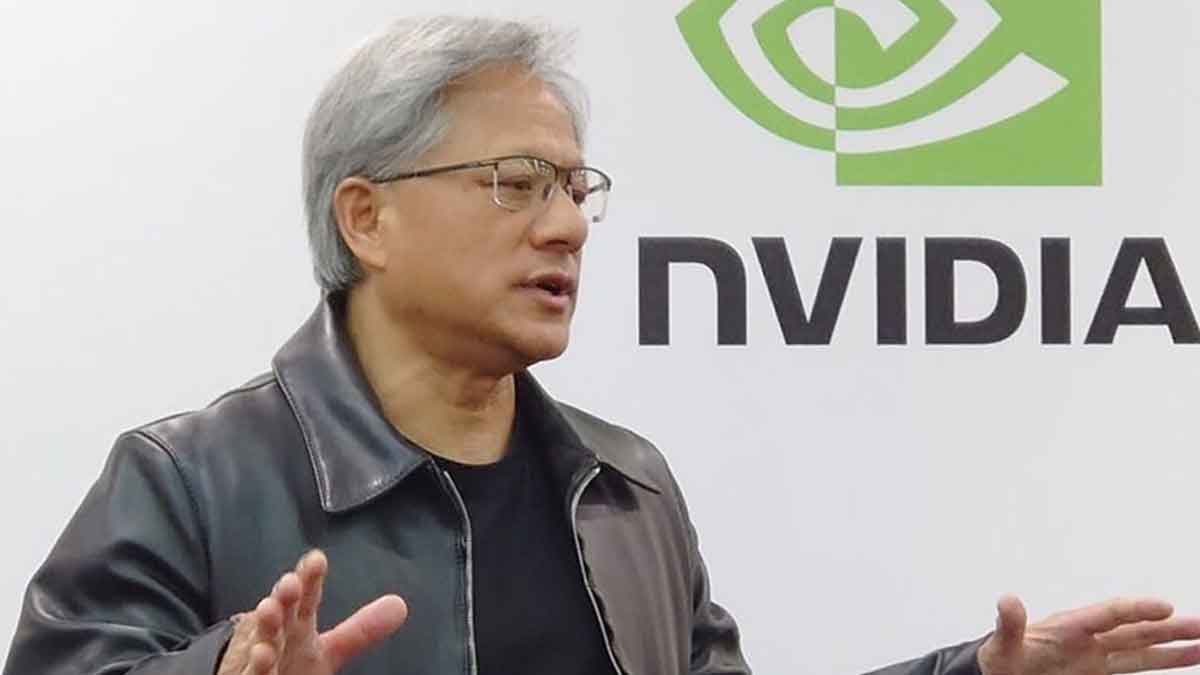

Nvidia’s CEO, Jensen Huang, described AI as reaching a “tipping point,” with a growing demand for computing power to build and operate Generative AI models across companies, industries, and nations.

Why Nvidia Leads The AI Chip Race

Nvidia dominates the AI chip industry with a market share ranging from 80% to 95%, as reported by The Globe and Mail. The company has cultivated competitive advantages over the past 15 years to maintain its leadership position.

Nvidia’s Differentiation Strategy

Nvidia has pursued a differentiation strategy, delivering superior value to customers compared to competing products and charging a premium price. Customers are willing to pay a significant premium for Nvidia’s chips, even waiting over a year to obtain them, as reported by the New York Times. Despite their higher cost, Nvidia argues that their chips enable companies to save time in training their Large Language Models, offsetting the price premium. For instance, the price for each Nvidia H100 chip ranges from $15,000 to over $40,000. AWS Vice President David Brown considers Amazon’s AI chips a bargain compared to Nvidia’s, but Huang argues that Nvidia offers the lowest-cost solution due to the time saved in training.

Nvidia’s Competitive Advantages

Nvidia’s competitive advantages stem from its ability to adapt to new opportunities faster than its rivals and from creating a community of programmers who develop software for its hardware. The company’s early investment in training LLMs and building libraries based on market intelligence has saved developers’ time, further solidifying its position in the AI chip market. The company’s introduction of the RTX 4800 chips for consumer devices and the upcoming B100 system are expected to drive further growth and innovation. Nvidia has also formed partnerships with Big Tech companies and invested in startups, further strengthening its position in the market.

Future Outlook for Nvidia Stock

If Nvidia continues to exceed high growth expectations, its stock is likely to continue rising. However, there are potential headwinds, such as a slowdown in demand from big tech buyers and shorter lead times for GPU orders, which could impact future growth. Despite analysts’ average 12-month price target of $700 per share, representing only a 3% upside according to CNN Business, Nvidia’s stock has already surpassed that target in after-hours trading. Goldman Sachs’ trading desk has dubbed Nvidia “the most important stock on planet earth,” noting its tendency to fall after earnings reports before resuming an upward climb.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires446

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires415

Related Articles

Tesla Q2 Deliveries Up; Is 10% Stock Rise Justified?

Tesla’s Q2 2024 delivery figures have surpassed forecasts, with 443,956 vehicles sold....

By 193cc Agency CouncilJuly 6, 2024Meta Stock Tanks 10% Despite Earnings Beat

Meta, formerly known as Facebook, faced a tumultuous day in the stock...

By 193cc Agency CouncilApril 25, 2024Samsung Surpasses Apple in Q1 2024 Smartphone Shipments

Apple has slipped from its position as the world’s largest smartphone maker...

By 193cc Agency CouncilApril 15, 2024American Express Stock Up 21% YTD: What’s Next?

American Express’ (NYSE: AXP) stock has surged 21% year-to-date, outpacing the S&P500’s...

By 193cc Agency CouncilApril 3, 2024

Leave a comment