- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

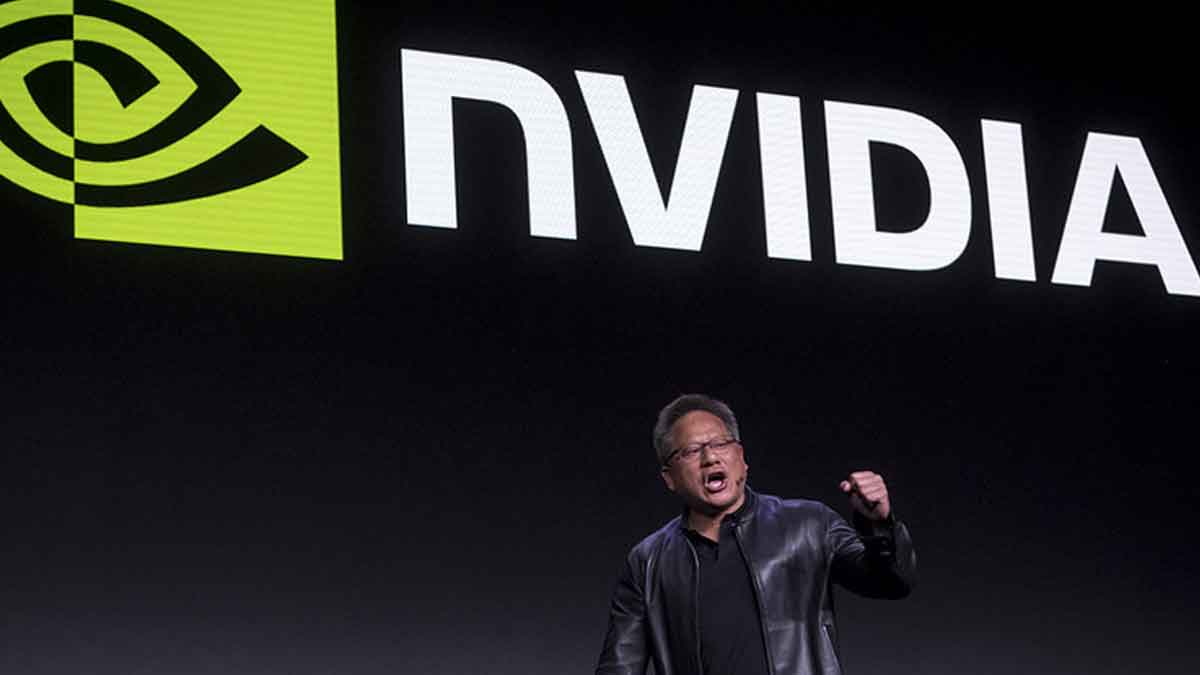

Nvidia’s $250B Surge Lifts S&P 500 to Record High

Nvidia, the AI chip giant, achieved a record valuation on Thursday after surpassing Wall Street’s expectations in its highly anticipated earnings report. This surge not only propelled Nvidia’s stock to an all-time high but also boosted major stock indexes to their highest levels ever.

Nvidia’s stock price surged by more than 16% to close at over $780, resulting in a valuation increase of just over $250 billion. This performance was driven by Nvidia’s impressive earnings report, which exceeded analysts’ estimates across the board.

The impact of Nvidia’s performance extended beyond its own stock, influencing the broader market sentiment. The benchmark S&P 500 index rose by more than 2% to reach a record high of nearly 5,100, while the tech-heavy Nasdaq jumped by more than 2%. Even the Dow Jones Industrial Average, which does not include Nvidia among its 30 members, climbed by more than 1% to a record high of over 39,000.

Notably, Nvidia’s market capitalization increase of more than $250 billion on Thursday stands as the largest single-day valuation gain for any public company on record, according to Bloomberg. This milestone surpasses the previous record set by Meta (formerly Facebook) earlier in the month, when its market cap increased by nearly $200 billion following its fourth-quarter earnings report.

Nvidia’s strong financial performance was driven by its impressive revenue and profit growth. The company reported $22 billion in sales and $13 billion in net income for the quarter ending last month, significantly exceeding analyst estimates. This growth was fueled by Nvidia’s Datacenter segment, particularly its graphics processing units (GPUs) used in generative AI, which saw a revenue increase of 409% on an annual basis to $18.4 billion last quarter.

Investor and corporate interest in AI has been a key driver of Nvidia’s stock price, which has seen a nearly 500% gain since October 2022. This growth has outpaced that of any other S&P constituent, contributing to the index’s overall recovery of more than 40% from its October 2022 bottom.

Bernstein analyst Stacy Rasgon described Nvidia’s performance as “remarkable” and noted that the company is “printing money at this point.” He also expressed confidence in Nvidia’s future growth prospects, highlighting the solid foundation on which the company’s success is built.

In summary, Nvidia’s exceptional performance not only set records for the company itself but also had a significant impact on the broader stock market, underscoring the company’s importance in the tech and AI sectors.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

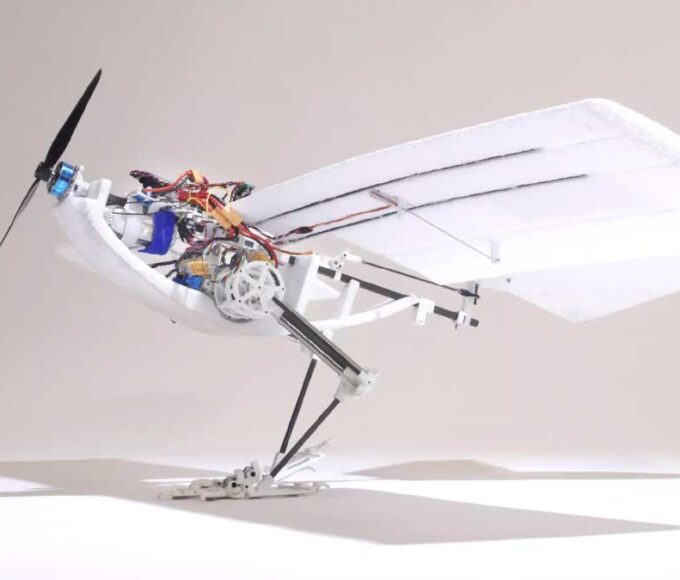

RAVEN Drone: Bird-Inspired Flight, Walking, and Jumping

Imagine a drone that not only flies but can also walk and...

By 193cc Agency CouncilDecember 10, 2024Scientists Uncover Jupiter’s Dark Ovals at the Poles

Jupiter, the largest planet in our solar system, is a constant subject...

By 193cc Agency CouncilNovember 30, 2024Intel Core Ultra 200 Processors to Get Major Performance Boost

Intel’s Core Ultra 200 desktop processors were initially met with disappointment, as...

By 193cc Agency CouncilNovember 30, 2024Bats’ Agricultural Role at Risk, Tech Offers Hope

Bats play a vital yet often overlooked role in U.S. agriculture, providing...

By 193cc Agency CouncilNovember 29, 2024

Leave a comment