- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Mega Millions Jackpot: Winner Takes Home $167.2M After Taxes

The Mega Millions jackpot has surged to a staggering $563 million, marking the eighth-largest prize in the game’s history. This massive sum comes after no winning tickets were drawn in the latest Friday night draw. However, the fortunate winner, who must overcome astronomical odds of one in 302 million, would not actually receive the full amount. After accounting for required taxes, the winner would take home less than half of the total jackpot.

A ticket holder who manages to match all five white balls and the “megaball” to claim the grand prize can opt for either a payout spread over 30 annual installments or a one-time lump sum payment of $265.4 million. However, this lump sum would be significantly reduced after a mandatory 24% federal tax withholding, leaving the winner with approximately $201.7 million. Further reductions could occur based on the winner’s taxable income and other tax deductions, potentially lowering the winnings to $167.2 million if subject to a federal marginal rate as high as 37%.

If the winner opts for annual payments, a 37% federal marginal rate would diminish the annual payments to around $11.8 million. Additionally, some states impose taxes on lottery winnings, with rates ranging from as low as 2.5% in Arizona (resulting in approximately $6.6 million) to as high as 10.9% in New York (equating to about $28.9 million). Notably, states like California or Texas do not tax lottery winnings.

Since the Mega Millions jackpot was last won in December, there have been approximately 14 million winning (non-jackpot) tickets sold. Among these, 25 tickets have won $1 million or more.

Looking ahead, Mega Millions will conduct its next drawing at 11 p.m. EST on Tuesday, while Powerball will hold its next drawing on Saturday night for a $376 million jackpot. The Powerball jackpot offers a lump sum option of $178.5 million, which is reduced to $135.6 million after a 24% federal tax withholding, or to $112.4 million with a federal marginal rate as high as 37%.

The rules for both Mega Millions and Powerball were changed in 2017, increasing the pool of white balls to choose from. This alteration resulted in larger jackpots accumulating for longer periods as the odds of winning were lowered. Over the past eight years, the United States has witnessed the largest lottery prizes in its history, including five jackpots surpassing $1 billion.

On a related note, a Washington D.C. man is suing the organizations responsible for Powerball in the area. He claims that winning numbers that were posted online matched his ticket but were “mistakenly posted.” The lawsuit alleges breach of contract, gross negligence, and emotional distress. The man, John Cheeks, is seeking $340 million—the amount of the jackpot at the time—along with additional compensation for damages.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires426

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires395

Related Articles

IRS Tax Relief Possible for Wildfire Settlements 2020–2025

As wildfires continue to ravage various states across the nation, a glimmer...

By 193cc Agency CouncilFebruary 13, 2024King Charles III’s Coronation: Queen Camilla Crowned at Westminster Abbey Ceremony

On May 6th, 2023, a historic event took place in the United...

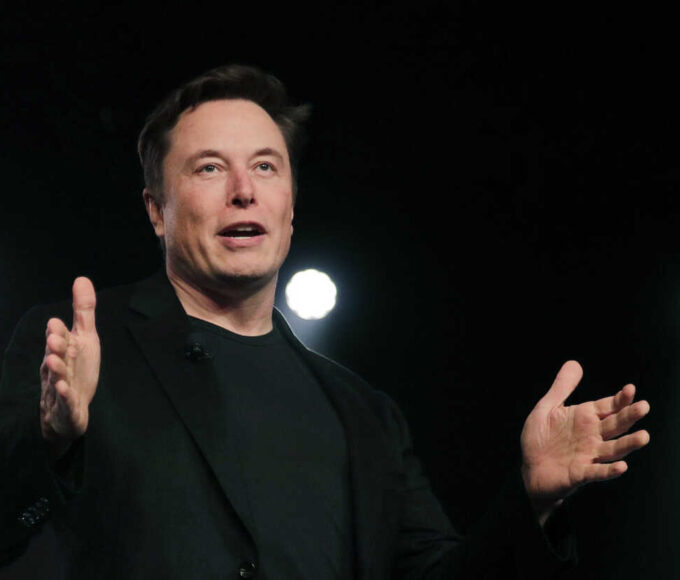

By Catherine lloydMay 6, 2023Elon Musk: A Visionary Entrepreneur Who is Changing the World

Elon Musk is a name that needs no introduction. He is one...

By Catherine lloydMay 6, 2023The Luxury of Responsibility: How LVMH and Bernard Arnault are Leading the Way in Sustainability and Social Responsibility

Bernard Arnault and his family are among the most prominent and influential...

By Catherine lloydMay 6, 2023

Leave a comment