- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Zscaler Stock Falls 14% as Palo Alto Networks Plunges 28%

Zscaler (ZS) stock fell 14% today, mirroring a 28% plunge in shares of cybersecurity competitor Palo Alto Networks (PANW). Palo Alto Networks lowered its guidance, citing a shift in its go-to-market strategy that would impact revenue and billings growth over the next 12 to 18 months.

Despite the drop, Zscaler stock, trading around $214, is still up 11% since late November when the company reported a 40% revenue increase in fiscal Q1 (Oct.), doubling Palo Alto’s growth rate in the same quarter. Zscaler is set to release FQ2 (Jan.) results on February 29.

In FQ1, Zscaler reported revenue of $496.7 million, surpassing estimates by 4.9%. Billings grew 34% to $456.6 million, exceeding the consensus of $442 million. Deferred revenue rose 39% to $1.399 billion, and total remaining performance obligations (RPO) increased 30% to $3.5 billion. Dollar-based net retention stood at 120%, down just 100 basis points from the previous quarter.

Zscaler continues to attract large organizations, with the total number of customers generating annual recurring revenue (ARR) of more than $100k increasing by 22% to 2,708. There are now 468 customers with ARR above $1 million, up 34% from the previous year.

In FQ1, Zscaler saw strong new logo wins, with 14 large deals bringing in more than $1 million in ARR. Nearly half of new logo customers purchased all three of Zscaler’s core products (ZIA, ZPA, and ZDX), boosting the average deal size. Additionally, the federal vertical contributed record new annual contract value (ACV).

For FQ2, Zscaler expects revenue of $505 million to $507 million (30% to 31% growth), with EPS of 57 cents to 58 cents. The FY’24 (July) revenue outlook of $2.09 billion to $2.10 billion represents growth of 29% to 30%, with billings expected to grow 24% to 26% for the fiscal year.

In November, Zscaler hired Mike Rich from ServiceNow (NOW) as its new chief revenue officer and president of global sales. Rich’s extensive experience at ServiceNow, where he served for over 12 years, is expected to bolster Zscaler’s sales efforts.

Despite the strong performance, Zscaler’s management remains cautious in its guidance assumptions, citing a leadership change and a slightly more conservative approach to deal close rates for the January quarter. This caution led to the decision not to raise the FY’24 billings forecast from the initial outlook given in September.

Several cybersecurity trends are driving Zscaler’s growth, including ongoing cloud migrations, security modernization, adoption of Zero Trust principles, a distributed global workforce, and a rise in targeted breaches. Stifel and Citi have raised their price targets for Zscaler, citing the company’s strong positioning in Zero Trust and long-term growth potential.

Zscaler’s cloud-delivered approach is seen as effective in stopping ransomware attacks from spreading, leading more organizations to realize the inadequacy of legacy security methods. Stifel believes this realization is driving the healthy demand environment for Zscaler.

The cybersecurity landscape is expected to become more hostile, with cybercriminals becoming more sophisticated. Macquarie predicts a rise in data breach costs, particularly in ransomware demands, as attackers coordinate their attacks and standardize ransom amounts based on victims’ profiles and revenue.

Despite the increasing threat, organizations hit by data breaches are planning to boost their security investments. Incident response planning/testing, employee security awareness training, threat detection, and response automation are key areas for additional investment.

Zscaler’s new Risk360 service, powered by AI and machine learning, quantifies and visualizes cyber risk, offering CISOs a comprehensive dashboard for security risk management. Recent enhancements to Risk360 now include cybersecurity maturity assessments powered by Zscaler’s in-house developed custom LLMs.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense44

- AI32

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires230

- Boats & Planes1

- Business308

- Careers13

- Cars & Bikes66

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech156

- CxO1

- Cybersecurity53

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games135

- GIG1

- Healthcare74

- Hollywood & Entertainment156

- Houses1

- Innovation37

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle10

- Manufacturing1

- Markets20

- Media184

- Mobile phone1

- Money13

- Personal Finance2

- Policy544

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney23

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized6

- Vices1

- Watches & Jewelry2

- world's billionaires200

Related Articles

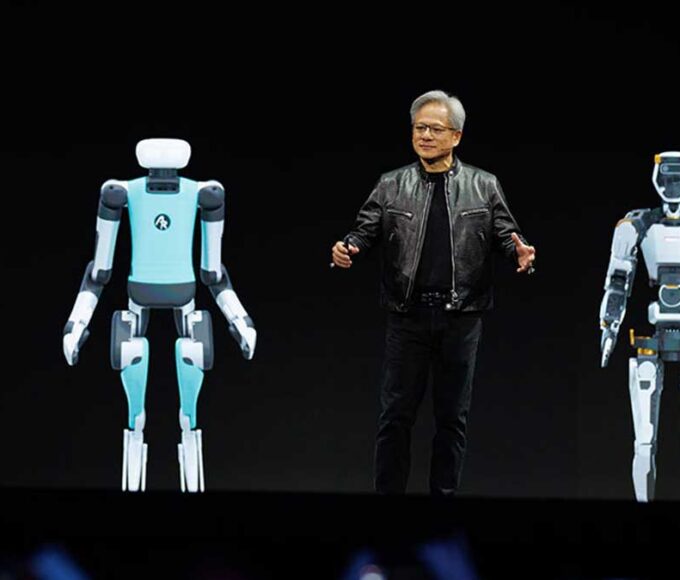

Jensen Huang Sees Physical AI as the Next Big Leap

Nvidia CEO Jensen Huang believes that Physical AI will be the next...

By 193cc Agency CouncilAugust 10, 2024Could AI Be the Next iPhone Moment?

The term “iPhone moment” describes a technological breakthrough that pushes innovation into...

By 193cc Agency CouncilJuly 8, 2024AI Surge Boosts Demand for Memory and Storage Innovations

The rise of artificial intelligence (AI) is significantly boosting the need for...

By 193cc Agency CouncilJuly 5, 2024Generative AI Set to Transform Finance Jobs

Generative AI is poised to revolutionize the financial services industry by automating...

By 193cc Agency CouncilJune 10, 2024

Leave a comment