- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Nutanix Shares Surge 29% YTD on Strong Enterprise Momentum

Nutanix (NTNX) shares reached a new peak of $66.99 earlier this month, following the company’s strong fiscal Q2 (Jan.) results. With the stock now trading around $61.75, it has climbed 29.4% year-to-date, outperforming the Nasdaq Composite’s 9.1% gain.

The demand for Nutanix’s hybrid multi-cloud software platform remains robust, offering companies a solution to streamline operations, enhance efficiency, and manage costs effectively. This has led to increased interest from larger organizations, expanding Nutanix’s customer base.

In fiscal Q2, total revenue increased by 16% to $565.2 million, surpassing the consensus estimate by 2.5%. Annual contract value (ACV) billings rose by 23% to $329.5 million, exceeding the high end of the guidance range. Total annual recurring revenue (ARR) reached $1.74 billion, up by 26%. The company’s gross margin improved to 87.3%, while operating margin increased to 21.9%.

Nutanix’s Cloud Platform offers customers modernization and a seamless path to the public cloud, enabling them to run and manage workloads efficiently. The platform’s appeal was evident in the company’s significant wins in FQ2, particularly among organizations adopting hybrid multi-cloud operating models.

Looking ahead, Nutanix expects continued growth, with total revenue for FQ3 projected to be between $510 million and $520 million. For FY’24, the company anticipates revenue and ACV billings growth of 15%, with free cash flow estimated to be between $420 million and $440 million. Additionally, Nutanix foresees a larger customer renewal cohort in FY’25, providing further growth opportunities.

Overall, Nutanix’s strong performance and strategic initiatives position it well for continued success in the evolving enterprise tech landscape.

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

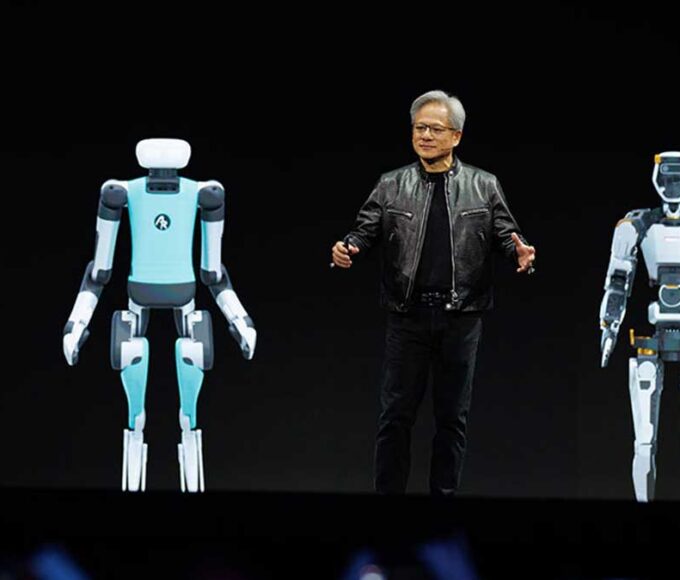

Jensen Huang Sees Physical AI as the Next Big Leap

Nvidia CEO Jensen Huang believes that Physical AI will be the next...

By 193cc Agency CouncilAugust 10, 2024Could AI Be the Next iPhone Moment?

The term “iPhone moment” describes a technological breakthrough that pushes innovation into...

By 193cc Agency CouncilJuly 8, 2024AI Surge Boosts Demand for Memory and Storage Innovations

The rise of artificial intelligence (AI) is significantly boosting the need for...

By 193cc Agency CouncilJuly 5, 2024Generative AI Set to Transform Finance Jobs

Generative AI is poised to revolutionize the financial services industry by automating...

By 193cc Agency CouncilJune 10, 2024

Leave a comment