- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

US Home Equity: More ‘Underwater’ Homes, South Affected

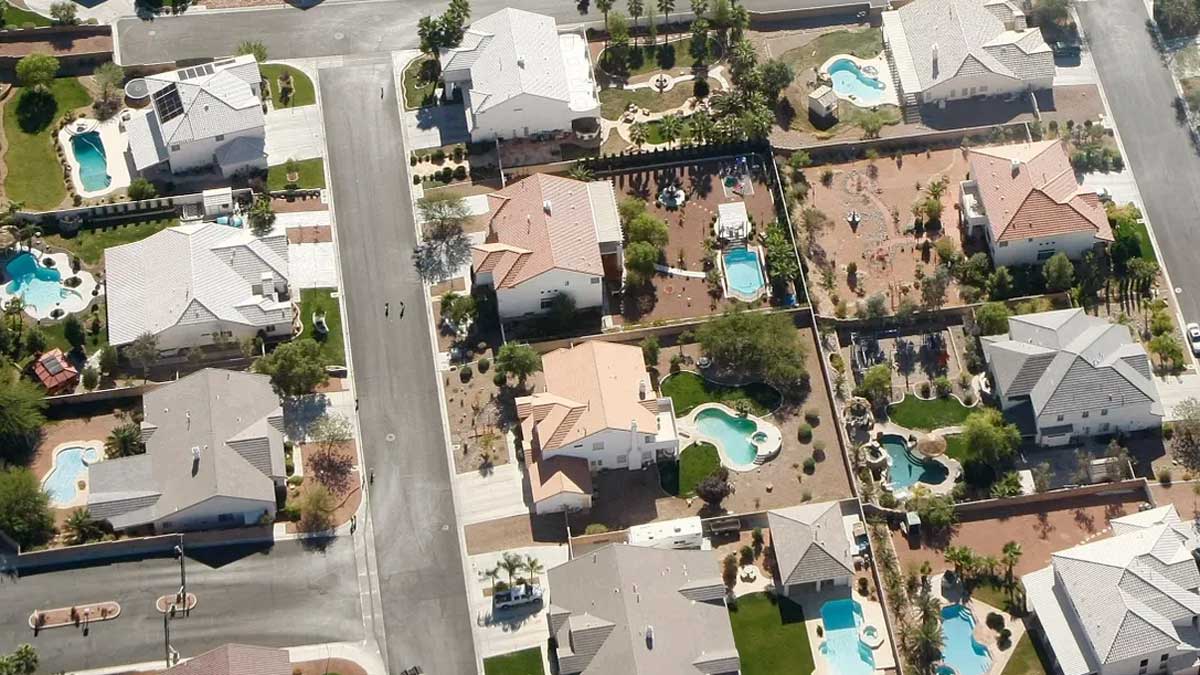

Recent data on the United States housing market paints a nuanced picture, revealing a concerning uptick in the number of “seriously underwater” mortgaged residential properties. These are homes where the outstanding mortgage balance exceeds the property’s current market value by at least 25%. This increase, though slight, is noteworthy, particularly as it reflects a broader trend of falling house prices, potentially hindering homeowners from selling their properties.

According to the U.S. Home Equity & Underwater Report by real estate data firm ATTOM, the first quarter of this year saw one in 37 mortgaged homes nationwide classified as seriously underwater, slightly worse than the previous quarter’s ratio of one in 38. While still below pre-pandemic levels, this trend suggests a notable shift in the market dynamics.

The southern states, in particular, witnessed a significant rise in the ratio of seriously underwater homes, indicating a more pronounced decline in property values in these regions. Kentucky, for instance, experienced the most substantial increase, with the proportion of homes with outstanding balances at least a quarter more than their market value rising to 8.3% in the first quarter from 6.3% in the previous quarter. West Virginia followed closely, with an increase from 4.4% to 5.4%, highlighting a concerning trend in these areas.

In contrast, some states bucked this trend. Missouri, for example, saw a decrease in seriously underwater homes, dropping to 4.5% from 5.6%, marking a significant improvement in the state’s housing market. Similarly, Mississippi stood out as one of the few southern states to see declines, dropping to 8% from 7.1%, suggesting a more nuanced regional variation in housing market performance.

The report also sheds light on a broader trend of declining equity-rich homeowners, down to 45.8% from 46.1% in the previous quarter. This indicates that fewer mortgage owners could profit from selling their properties, reflecting a more challenging landscape for homeowners looking to capitalize on their investments.

Overall, the housing market dynamics seem to be influenced by a range of factors, including the Federal Reserve’s rate hikes aimed at curbing inflation. Despite the rise in mortgage rates above 7%, home prices have continued to increase, contributing to the rise in seriously underwater properties.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Tesla Recalls 700,000 Vehicles Over Tire Pressure Issue

Tesla has announced its latest recall of nearly 700,000 vehicles in the...

By 193cc Agency CouncilDecember 20, 2024MicroStrategy Stock Rallies on Nasdaq 100 News

Shares of MicroStrategy surged on Monday following the announcement that the company...

By 193cc Agency CouncilDecember 16, 2024Stanley Recalls Millions of Mugs After Burn Injuries

In a significant recall, Stanley, the well-known brand behind popular stainless steel...

By 193cc Agency CouncilDecember 12, 2024Adobe Shares Drop 12% After Lowering Revenue Outlook

Shares of Adobe experienced a significant drop of over 12% on Thursday,...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment