- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Generative AI Set to Transform Finance Jobs

Generative AI is poised to revolutionize the financial services industry by automating routine tasks, streamlining internal processes, and fundamentally changing how professionals work. This technology, powered by algorithms that create new content based on existing data, has the potential to significantly impact banking and finance.

One key aspect of generative AI is its ability to interpret data, from simple statistics to vast spreadsheets filled with real-time transactional information. Instead of presenting data as complex graphs or charts, AI can quickly highlight key insights and personalize them based on the recipient’s role.

This means professionals will spend less time on routine tasks and more time making decisions, strategizing, and engaging in face-to-face interactions. For example, AI will streamline transaction processing by automating tasks like data entry, validation, and reconciliation, leading to faster and more reliable services.

Additionally, AI can quickly analyze millions of transactions to flag suspicious activities, aiding human risk assessors. It can also assist with analyzing markets, assessing company performance, identifying trends, and evaluating investment strategies, allowing managers to spend more time with clients.

Insurance underwriting is another area that will be revolutionized by generative AI, providing detailed risk assessments and generating synthetic data when real-world data is insufficient. Moreover, AI will help with analyzing complex regulatory texts and legal documents to identify risks of breaches more quickly.

As generative AI transforms information-based work, the role of finance professionals will evolve. Communication, interpersonal skills, decision-making, and teambuilding will become increasingly important. Embracing this change early in the AI revolution will lead to more fulfilling and rewarding careers, not just in financial services but across industries.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires426

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires395

Related Articles

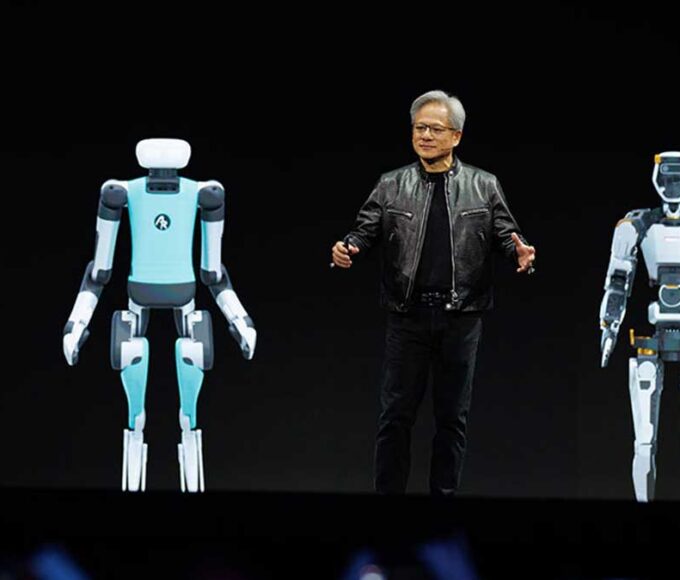

Jensen Huang Sees Physical AI as the Next Big Leap

Nvidia CEO Jensen Huang believes that Physical AI will be the next...

By 193cc Agency CouncilAugust 10, 2024Could AI Be the Next iPhone Moment?

The term “iPhone moment” describes a technological breakthrough that pushes innovation into...

By 193cc Agency CouncilJuly 8, 2024AI Surge Boosts Demand for Memory and Storage Innovations

The rise of artificial intelligence (AI) is significantly boosting the need for...

By 193cc Agency CouncilJuly 5, 2024Microsoft’s AI Monetization and Azure Growth Surge

Microsoft (MSFT) is significantly increasing its monetization of AI technologies across its...

By 193cc Agency CouncilJune 3, 2024

Leave a comment