- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Nvidia Shares Fall to $120 After Stock Split

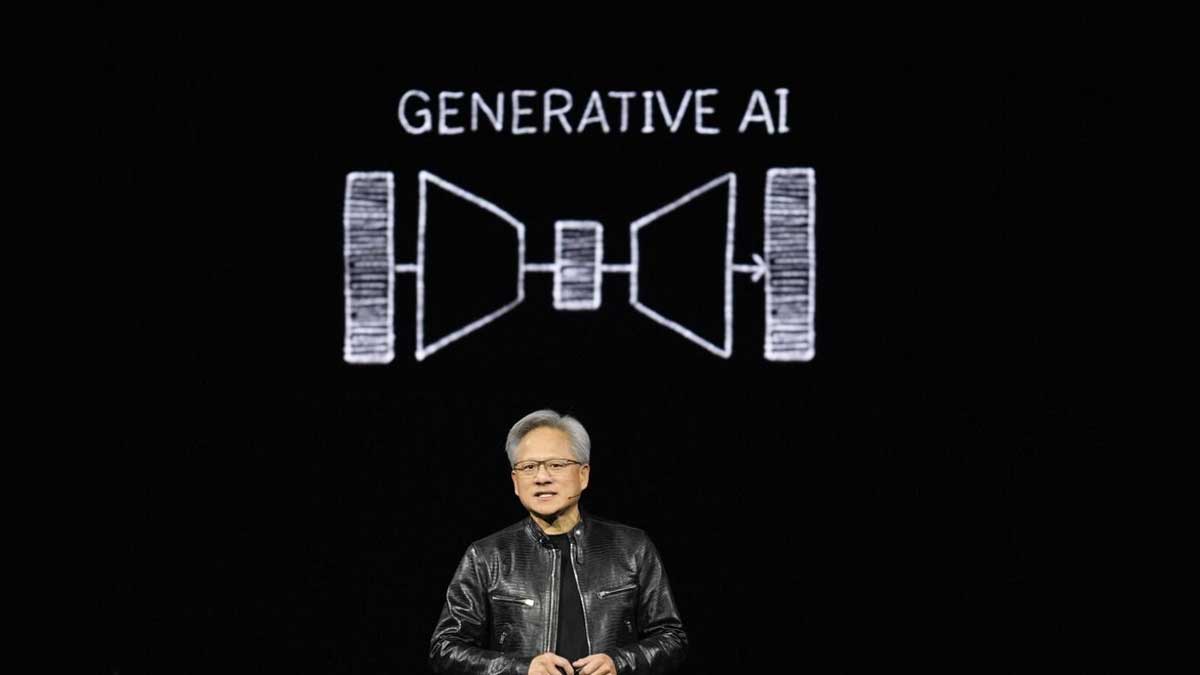

Nvidia’s share price has hit its lowest level since late 2022 after the company implemented a long-planned stock split. This move, which underscores Nvidia’s impressive stock market performance driven by its role in the artificial intelligence (AI) sector, resulted in a significant adjustment in share value.

Monday marked Nvidia’s first trading day post-split, which saw the company’s shares divided on a 10-for-1 basis. This means that for every share held previously, shareholders received 10 new shares. The split was based on Friday’s closing price of $1,210 per share, leading to an initial trading price of approximately $120 per share on Monday. Despite a slight dip, Nvidia shares remain within 5% of their split-adjusted high of $125.59 from the previous week.

Stock splits are a routine measure for companies experiencing significant share price increases, aimed at improving liquidity and making shares more accessible to a broader range of investors. Nvidia’s split follows a period of remarkable growth, driven by the company’s strategic positioning to capitalize on the AI revolution.

On Monday, Nvidia’s stock traded at an adjusted price equivalent to its unadjusted value from October 2022. This highlights the company’s dramatic valuation increase over the past 20 months, surging from a market capitalization of less than $300 billion to nearly $3 trillion. This leap has positioned Nvidia as the third-largest company globally.

Nvidia, which calls itself the “engine of AI,” is renowned for designing crucial hardware for AI applications, including the data storage systems for generative AI and the graphics processing units (GPUs) essential for machine learning. Over the past decade, Nvidia has transformed from a relatively obscure Silicon Valley entity valued at around $10 billion into a major player on Wall Street. Its dominance in the AI chip market has driven substantial profit growth, attracting major clients like Amazon, Apple, and Microsoft.

This significant rise is largely attributed to the booming AI sector over the last two years, which has made Nvidia’s stock performance particularly notable. Nvidia’s stock price, when adjusted for splits, was under $1 as recently as 2016. By Friday, Nvidia was among the top ten most expensive stocks in the S&P 500. Post-split, its share price is more aligned with the S&P 500 median of $118 per share.

Nvidia’s stellar market performance has not only bolstered its valuation but also played a critical role in lifting the S&P 500 from its 2022 lows to record highs this year. The company’s impressive returns have significantly contributed to the overall market’s recovery and growth.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires494

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires463

Related Articles

Tesla Recalls 700,000 Vehicles Over Tire Pressure Issue

Tesla has announced its latest recall of nearly 700,000 vehicles in the...

By 193cc Agency CouncilDecember 20, 2024MicroStrategy Stock Rallies on Nasdaq 100 News

Shares of MicroStrategy surged on Monday following the announcement that the company...

By 193cc Agency CouncilDecember 16, 2024Stanley Recalls Millions of Mugs After Burn Injuries

In a significant recall, Stanley, the well-known brand behind popular stainless steel...

By 193cc Agency CouncilDecember 12, 2024Adobe Shares Drop 12% After Lowering Revenue Outlook

Shares of Adobe experienced a significant drop of over 12% on Thursday,...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment