- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

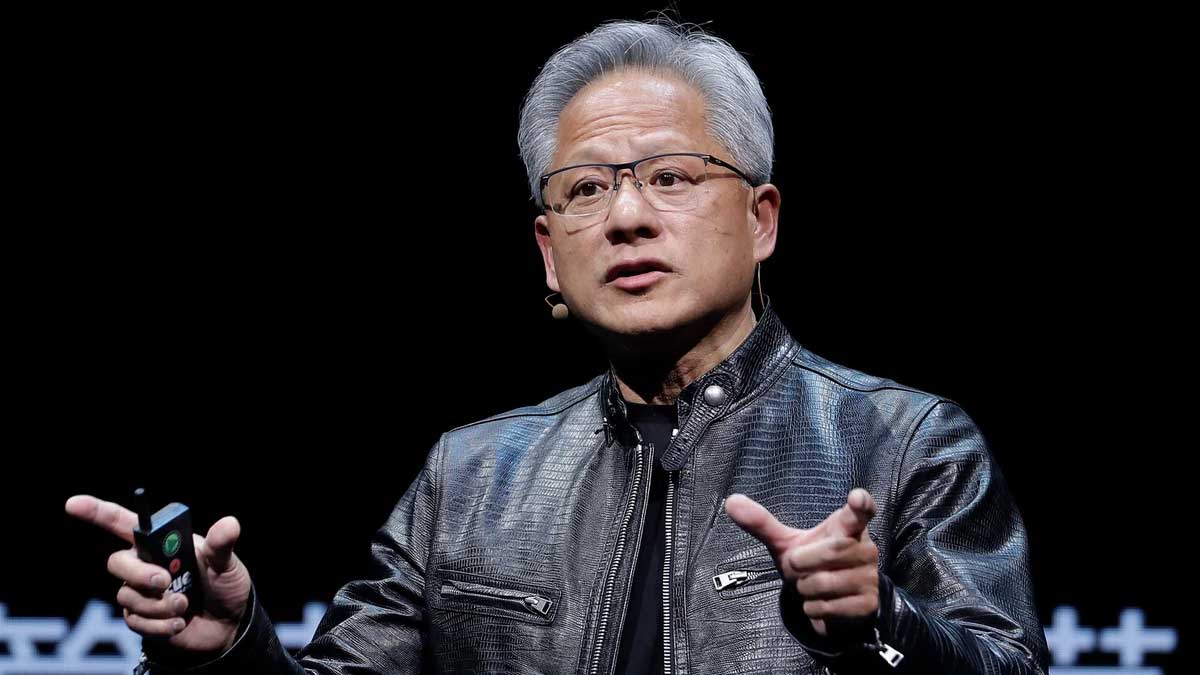

Nvidia’s AI Surge Makes It World’s Most Valuable Chipmaker

The rally in chip stocks continued on Wednesday, driven by Nvidia’s surge after the AI boom propelled it to become the world’s most valuable company. Nvidia’s shares rose by around 0.6% to over $136 during out-of-hours trading on Wednesday morning, following a 3.5% increase on Tuesday that saw the stock reach an all-time high of $135.58 at market close.

Other chip stocks also saw gains, particularly in Asia, home to some of the largest tech manufacturers and Nvidia’s competitors. Taiwan Semiconductor Manufacturing Company (TSMC), a major beneficiary of the AI boom, saw its shares surge by more than 4% by market close in Taipei. Hong Kong-listed Chinese manufacturers Hua Hong Semiconductor and Semiconductor Manufacturing International Corp also experienced gains of 0.4% and 1% respectively.

South Korean chipmakers Samsung Electronics and SK Hynix saw their shares jump by as much as 3% and 7% respectively during trading hours, although these gains moderated later in the day, with Samsung up 1.75% and SK Hynix down 0.43% by market close in Seoul.

In contrast, shares of U.S. chipmaking giants remained relatively flat during out-of-hours trading, with Arm Holdings (ARM) and Micron Technology (MU) up by 0.34% and 0.81% respectively, and Intel showing little movement after a 1% drop on Tuesday.

The rally also had a positive impact on Hon Hai Technology Group, known as Foxconn, which closed more than 2% higher on Wednesday. Foxconn has partnered with Nvidia to build specialized AI data centers using Nvidia’s chips for various applications including robotics platforms, electric vehicles, and large language models.

Nvidia’s remarkable growth from a gaming chipmaker to an AI giant has been swift. The company’s market capitalization has soared from around $16 billion in 2016 to nearly $800 billion in 2021 before dropping to around $300 billion in 2022. However, the boom in generative artificial intelligence, fueled by the release of OpenAI’s ChatGPT in late 2022, has propelled Nvidia’s value to new heights. The company’s market cap has since surpassed $3 trillion, with its shares up over 170% this year alone.

This surge has not only made Nvidia the world’s most valuable public company but has also significantly increased CEO Jensen Huang’s wealth. Huang, who co-founded Nvidia in 1993, is now estimated to be worth $118.7 billion, making him the 11th richest person in the world.

Overall, Nvidia’s rapid ascent and the broader boom in AI have reshaped the landscape of the tech industry, with the company’s specialized AI chips playing a crucial role in driving its growth and market dominance.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Tesla Recalls 700,000 Vehicles Over Tire Pressure Issue

Tesla has announced its latest recall of nearly 700,000 vehicles in the...

By 193cc Agency CouncilDecember 20, 2024MicroStrategy Stock Rallies on Nasdaq 100 News

Shares of MicroStrategy surged on Monday following the announcement that the company...

By 193cc Agency CouncilDecember 16, 2024Stanley Recalls Millions of Mugs After Burn Injuries

In a significant recall, Stanley, the well-known brand behind popular stainless steel...

By 193cc Agency CouncilDecember 12, 2024Adobe Shares Drop 12% After Lowering Revenue Outlook

Shares of Adobe experienced a significant drop of over 12% on Thursday,...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment