- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

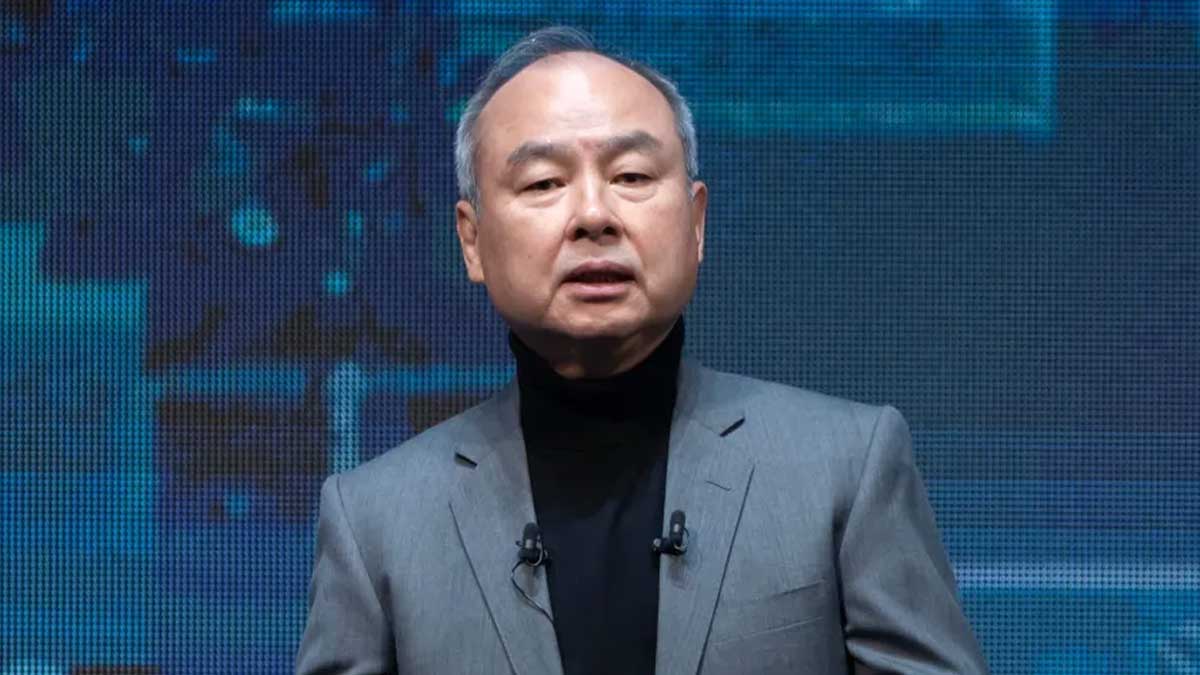

SoftBank founder and CEO Masayoshi Son announced a bold new direction for the company on Friday, telling shareholders that he and his team are on a mission to achieve artificial superintelligence. Son dismissed previous investments as merely preparatory steps, signaling that SoftBank is ready to aggressively pursue ambitious opportunities in the AI sector. His statement marks a significant shift from the company’s recent conservative approach, emphasizing a return to high-stakes investment with a focus on groundbreaking technological advancements.

Speaking at SoftBank’s annual general meeting, Son outlined his vision for artificial superintelligence, an advanced form of AI with cognitive abilities far surpassing human intelligence. He characterized the firm’s past investments, including significant stakes in Alibaba and Arm Holdings, as just a “warm up” for this larger goal. These past investments, some of the most successful in tech history, are now viewed by Son as foundational steps towards a more ambitious future. His remarks highlight a renewed focus on leveraging SoftBank’s extensive resources to pioneer the next wave of technological innovation.

While specifics on how SoftBank plans to achieve artificial superintelligence were sparse, Son identified key sectors like AI robotics, autonomous driving, and data centers as areas of interest. He emphasized the importance of supporting Arm Holdings and ensuring SoftBank remains a pivotal player in the evolving AI landscape. Son’s strategic vision involves not only identifying but also heavily investing in the sectors poised to benefit most from AI advancements. This approach is intended to position SoftBank at the forefront of the AI revolution, capitalizing on the transformative potential of these technologies.

Son’s emphatic declarations mark a notable shift in SoftBank’s strategy. Following a series of setbacks in its Vision Fund, the company had adopted a cautious “defense mode.” This conservative strategy was in response to significant financial losses and aimed at stabilizing the company. However, last year, it began shifting back to an “offense mode” to leverage the AI boom, though its investments have so far been relatively modest. SoftBank holds a substantial stake in AI chipmaker Arm and recently led a $1 billion funding round for the British self-driving startup Wayve, Europe’s largest AI deal to date. These moves indicate SoftBank’s readiness to resume aggressive investments and play a leading role in the AI sector’s rapid expansion.

“This is what I was born to do, to realize ASI,” Son proclaimed, emphasizing that achieving artificial superintelligence is now SoftBank’s primary objective. His declaration underscores a personal and professional commitment to this ambitious vision, suggesting that he views this pursuit as the pinnacle of his career. “Watch me, I will make it happen,” he added, projecting confidence and determination in realizing this groundbreaking goal.

Son’s net worth is approximately $32.5 billion, primarily derived from his stake in SoftBank. This substantial wealth makes him Japan’s second-richest person, behind apparel tycoon Tadashi Yanai. Son’s financial success is closely tied to SoftBank’s performance, and his bold vision for the future could significantly impact both his personal fortune and the company’s valuation.

Despite the ambitious announcements, SoftBank Group shares fell by more than 3% by the close of trading in Tokyo on Friday. This market reaction suggests investor skepticism or caution in response to Son’s bold proclamations, reflecting concerns about the feasibility and risks associated with such an aggressive strategy shift. The share price drop indicates that while Son’s vision is grand, convincing the market of its viability will be a critical challenge moving forward.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Book Review: Unlocking AI’s Power in Everyday Life

In a world where artificial intelligence (AI) frequently makes headlines in the...

By 193cc Agency CouncilDecember 16, 2024OpenAI Pauses Sora Sign-Ups Due to High Demand

OpenAI has temporarily paused sign-ups for its much-anticipated Sora video tool due...

By 193cc Agency CouncilDecember 10, 2024xAI Secures $6 Billion to Advance Supercomputing and AI

Elon Musk’s artificial intelligence startup, xAI, has taken another significant step in...

By 193cc Agency CouncilDecember 7, 2024X Launches Free Version of Grok Chatbot with Usage Limits

X, formerly known as Twitter, has announced the launch of a free...

By 193cc Agency CouncilDecember 7, 2024

Leave a comment