- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

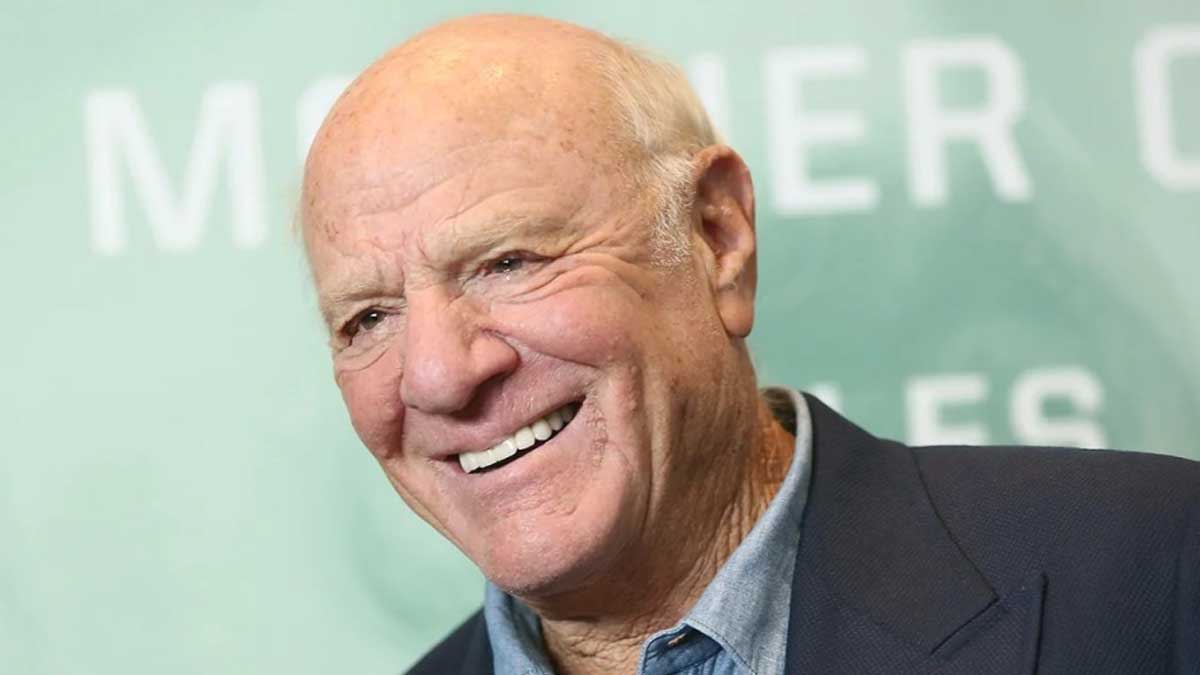

Barry Diller Eyes Paramount After Skydance Bid Fizzles

Billionaire media magnate Barry Diller is reportedly engaging in advanced negotiations with National Amusements, the parent company of Paramount Pictures, to potentially gain control of the storied entertainment company. This move comes in the wake of Skydance Media’s recent failed attempt to merge with Paramount, according to a detailed report by The New York Times. The ongoing discussions between Diller’s media conglomerate, InterActiveCorp (IAC), and National Amusements signify a strategic effort to assert influence over Paramount without executing a full acquisition.

Diller’s InterActiveCorp has reportedly signed nondisclosure agreements with National Amusements, a critical step that facilitates the exchange of sensitive and confidential information between the two parties. These agreements are designed to protect proprietary data during the negotiation process, ensuring that both sides can share key details necessary for evaluating the potential deal. The agreements were reportedly finalized following the collapse of merger talks between Paramount and Skydance Media in mid-June. According to two anonymous sources with direct knowledge of the situation, these discussions have yet to yield a concrete agreement or outline specific terms, leaving the current status of the negotiations somewhat ambiguous.

The financial and strategic implications of a potential deal are significant. National Amusements holds a substantial 77% stake in Paramount’s Class A shares, which represents a controlling interest in the company. If Diller and IAC were to succeed in their negotiations, they could effectively gain control over Paramount without requiring a full acquisition of the company. However, this opportunity comes with notable financial challenges. Paramount is currently encumbered with approximately $14 billion in debt, a substantial liability that would transfer to any new owner of National Amusements. This debt burden adds complexity to the negotiations and could influence the structure and terms of any potential deal.

Diller’s net worth is estimated at $4.1 billion, placing him among the top 800 wealthiest individuals globally. Despite his significant financial resources, the challenge of managing Paramount’s substantial debt and navigating the intricacies of the media industry’s competitive landscape will be formidable. Diller’s interest in Paramount is rooted in a long history of attempted acquisitions. In the 1990s, Diller sought to acquire Paramount for $9.5 billion but was ultimately outbid by Sumner Redstone. Redstone’s family now controls the company through Shari Redstone, who holds the majority of voting shares.

The recent collapse of Skydance Media’s bid for National Amusements highlights the volatility and high stakes of media mergers and acquisitions. Skydance’s bid, valued at approximately $1.7 billion, was the most serious attempt to merge with National Amusements in recent years, surpassing other potential suitors. Previous proposals, including a notable $26 billion all-cash offer from Sony and Apollo Management, were also considered but have since been re-evaluated internally at Sony due to investor concerns and shifting strategic priorities.

As the discussions between Diller and National Amusements continue, the outcome remains uncertain. Both Paramount and InterActiveCorp have yet to provide public statements regarding the negotiations, leaving industry observers and stakeholders keenly watching for developments. The potential takeover of Paramount by Diller could have profound implications for the entertainment industry, influencing the future direction of one of Hollywood’s most iconic companies.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Tesla Recalls 700,000 Vehicles Over Tire Pressure Issue

Tesla has announced its latest recall of nearly 700,000 vehicles in the...

By 193cc Agency CouncilDecember 20, 2024MicroStrategy Stock Rallies on Nasdaq 100 News

Shares of MicroStrategy surged on Monday following the announcement that the company...

By 193cc Agency CouncilDecember 16, 2024Stanley Recalls Millions of Mugs After Burn Injuries

In a significant recall, Stanley, the well-known brand behind popular stainless steel...

By 193cc Agency CouncilDecember 12, 2024Adobe Shares Drop 12% After Lowering Revenue Outlook

Shares of Adobe experienced a significant drop of over 12% on Thursday,...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment