- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

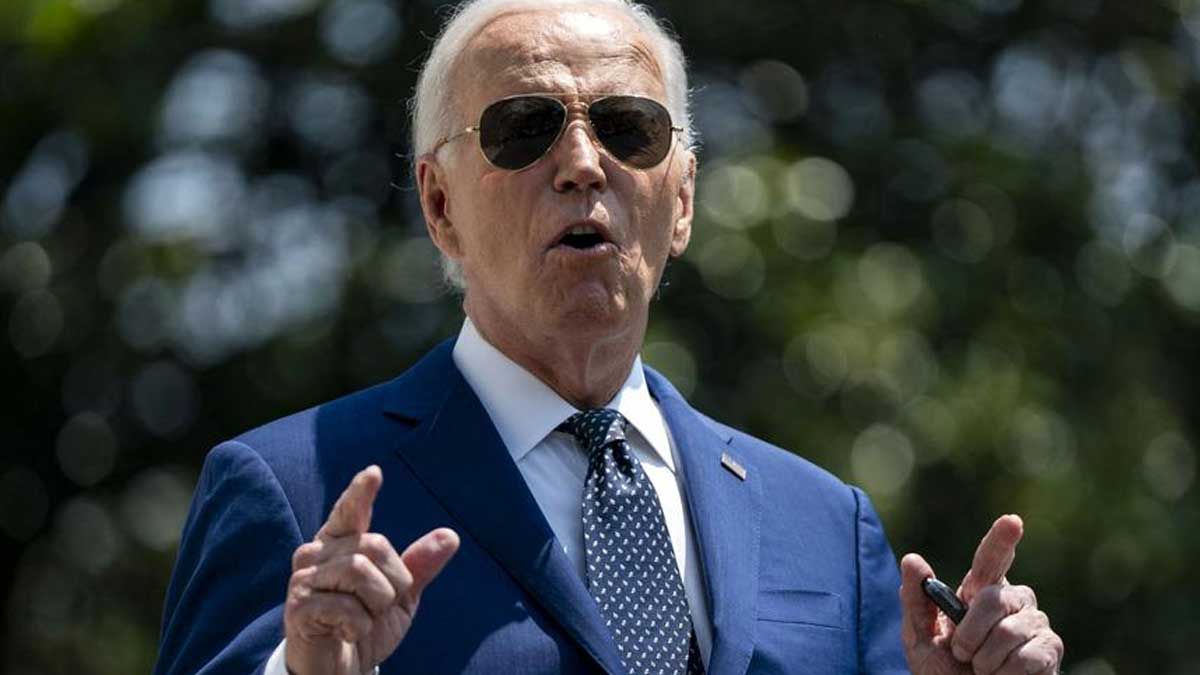

Biden Admin to Notify Millions About New Loan Forgiveness

The Department of Education is preparing to reach out to millions of student loan borrowers this week, announcing a new student loan forgiveness initiative. This move represents the Biden administration’s updated approach to student debt relief, following the Supreme Court’s rejection of its original plan. The new strategy, dubbed Plan B, aims to offer relief to a broader range of borrowers, signaling a shift in the administration’s efforts to address student loan debt.

The updated plan targets four specific groups of borrowers for relief. First, individuals whose current loan balance is greater than their original amount will receive forgiveness for the difference, with the plan canceling $20,000 of the excess debt. Second, borrowers who have been repaying undergraduate loans for over 20 years will qualify for forgiveness. Third, those already eligible for existing forgiveness programs but who have not applied for relief will receive automatic forgiveness. Fourth, borrowers who attended institutions that did not meet the Department of Education’s accountability standards and who enrolled in programs deemed of low financial value will also benefit from the new plan.

For those who have been repaying their loans for more than two decades or whose loan balances have increased, the plan provides substantial relief. Borrowers with income-driven repayment plans earning $120,000 or less annually will have their student loans fully forgiven. The plan also includes provisions for borrowers with undergraduate loans disbursed on or before July 1, 2005, and graduate loans issued on or before July 1, 2000. These individuals will have their student debt completely wiped out. Additionally, borrowers who are eligible for relief under income-driven repayment plans but have not yet applied will receive automatic forgiveness. The plan will also cover those whose loans are eligible for discharge due to institutional closure.

The Department of Education will notify all borrowers with outstanding federal student loans about this new debt relief program via email. These communications will provide updates on the finalization of the plan and specific steps borrowers need to take. Borrowers who wish to opt out of receiving relief must do so by August 30. The implementation of this plan may still face legal challenges, and it remains uncertain how these potential lawsuits might affect the final execution of the program. As such, borrowers should stay informed about any updates that may arise from ongoing or future litigation.

The new forgiveness initiative has the potential to impact over 30 million borrowers, a significant increase from the 4.8 million who have already received relief through previous measures. This expansion reflects the Biden administration’s commitment to addressing the student debt crisis through a more targeted approach.

The Biden administration’s efforts to provide student loan relief have been a central issue, especially as student debt becomes an increasingly prominent concern among voters. Although President Biden has not fully aligned with some Democrats who advocate for complete student loan forgiveness, his administration initially proposed a sweeping relief plan that aimed to cancel up to $20,000 for borrowers earning up to $125,000 annually. However, this ambitious plan faced legal challenges and was ultimately struck down by the Supreme Court in June 2023. The Court ruled that the administration had exceeded its authority by implementing the plan. In response, the Biden administration has shifted to a more incremental approach, focusing on specific borrower groups rather than a blanket relief strategy.

The ongoing litigation related to student debt relief also includes challenges to a separate initiative, the Saving on a Valuable Education (SAVE) repayment plan. GOP-led states have sued to overturn this plan, and the Supreme Court is expected to address some of its provisions. Meanwhile, a lower federal court recently blocked the SAVE plan, adding another layer of complexity to the student debt relief landscape. The outcome of these legal battles will likely influence future relief efforts and borrower experiences.

The Biden administration’s revised student loan forgiveness plan represents a critical development in the ongoing effort to address student debt in the U.S. By focusing on specific borrower groups and offering substantial relief, the administration aims to alleviate the financial burden for millions of Americans. As the plan moves closer to implementation, borrowers should be vigilant about updates and ready to take necessary actions to benefit from the relief offered. The evolving legal landscape will also be a key factor in shaping the outcome of these initiatives.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires446

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires415

Related Articles

Trump Moves $4B Stake in Truth Social Parent, Stock Drops 6%

Donald Trump recently transferred his 57% stake in Trump Media & Technology...

By 193cc Agency CouncilDecember 20, 2024House Rejects Trump-Backed Funding Bill, Shutdown Looms

The U.S. House of Representatives rejected a new government funding bill on...

By 193cc Agency CouncilDecember 20, 2024Trump Named Time’s Person of the Year for Second Time

On Thursday, Time magazine honored Donald Trump as its “Person of the...

By 193cc Agency CouncilDecember 12, 2024Meta Donates $1 Million to Trump’s Inaugural Fund

Meta, the parent company of Facebook and Instagram, has confirmed a $1...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment