- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

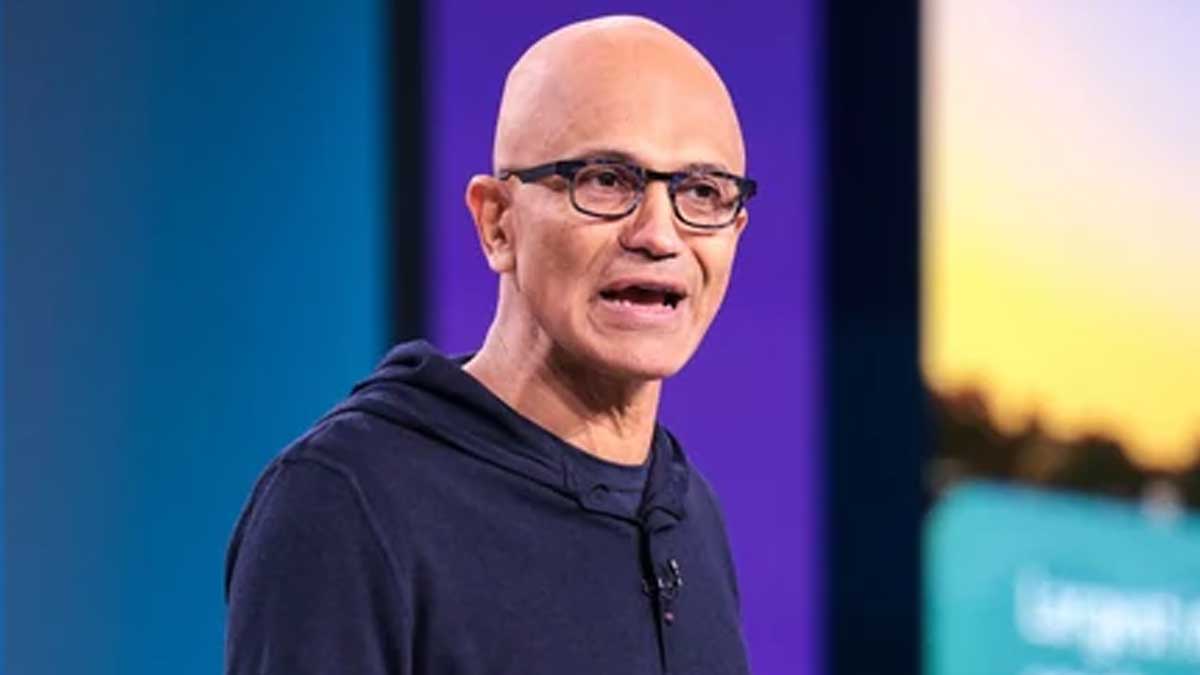

Microsoft Stock Falls as AI Growth Misses Expectations

Microsoft reported robust earnings for the quarter ending June 30, revealing a mixed picture that failed to meet Wall Street’s high expectations, particularly in its artificial intelligence (AI) sector. Although the company posted impressive revenue and earnings figures, the stock experienced a sharp decline of approximately 7%, extending a previous drop of over 8% from the past three weeks. This significant drop underscores growing investor concerns about Microsoft’s AI growth prospects, despite the company’s overall strong financial performance.

In its earnings report, Microsoft exceeded expectations with diluted earnings per share (EPS) of $2.95, surpassing the consensus forecast of $2.94 and marking a 10% increase compared to the previous year. The company also reported quarterly revenue of $64.7 billion, beating the anticipated $64.4 billion and reflecting a 15% year-over-year growth. Despite these positive results, the market reaction was negative, largely due to disappointing performance in Microsoft’s AI business, which overshadowed the otherwise strong financial figures.

A key factor contributing to the stock’s decline was the underperformance in Microsoft’s AI operations. The Azure cloud computing unit, central to the company’s AI strategy, reported a 29% revenue increase. However, this fell short of the projected 31% growth, raising concerns about the future trajectory of Microsoft’s AI growth. Additionally, the intelligent cloud division, which is heavily focused on AI, generated $28.5 billion in revenue. This result was below the expected $28.7 billion, further dampening investor sentiment and highlighting the challenges Microsoft faces in meeting its ambitious AI growth targets.

Following the earnings announcement, Microsoft’s share price fell to below $400 in after-hours trading, marking its lowest intraday level since May 2. This 7% decline represents the company’s most significant drop since October 2022. The volatility observed in after-hours trading exacerbates the stock’s fluctuations and reflects heightened investor anxiety about the company’s future performance, particularly in its AI sector.

The fiscal year 2024 was significant for Microsoft, as the company achieved record-breaking revenue and profits. Microsoft’s total revenue for the fiscal year reached $245.1 billion, a substantial increase from the previous year’s $211.9 billion. The company also reported a record net income of $88.1 billion, or $11.80 per share, surpassing the prior record of $72.4 billion. This impressive financial performance highlights Microsoft’s strong growth over the past year, despite the recent challenges in its AI business.

Microsoft’s reaction in the market mirrors similar trends observed with other tech giants, such as Google’s parent Alphabet, which also experienced a stock decline despite strong earnings results. This trend reflects broader market skepticism about future growth prospects in the tech sector, particularly in emerging areas like AI. The market’s response suggests that investors are increasingly focused on long-term growth potential rather than short-term financial metrics.

For the fiscal year 2024, Microsoft’s revenue aligns with the GDP of Greece or New Zealand, demonstrating the company’s significant economic impact. This achievement is particularly notable given Microsoft’s origins as a small computer club in the 1960s, illustrating the company’s remarkable growth and evolution over the decades.

Historically, Microsoft has been a leading force in technology, but its recent successes have been driven by a strategic focus on AI. Over the past two years, Microsoft has capitalized on the AI boom, significantly boosting its stock through its cloud computing operations and investment in generative AI startup OpenAI. Despite recent setbacks, Microsoft’s stock has increased by more than 50% over the past two years, outperforming the S&P 500’s 30% gain. The company’s market capitalization has surpassed $3 trillion, underscoring its dominant position in the tech industry.

This week, Microsoft is among several major technology companies reporting earnings. Facebook’s parent company, Meta, will release its results on Wednesday, followed by Amazon and Apple on Thursday. These reports are anticipated to provide further insights into broader trends in the tech industry and the performance of individual companies.

Microsoft is approaching Apple in terms of profitability, with its fiscal year 2024 profits of just under $90 billion trailing Apple’s projected $102 billion. Analysts forecast that by 2026, both companies will be closely matched in profitability, with Apple expected to generate $118 billion and Microsoft $116 billion. This projection represents a significant shift from the more than $30 billion profit gap that existed between the two companies in 2022. Microsoft last surpassed Apple in profitability in 2010.

In conclusion, while Microsoft’s overall financial performance remains strong, the company’s AI growth challenges have led to a notable decline in its stock price. As the tech industry continues to evolve, Microsoft’s ability to navigate these challenges and maintain investor confidence will be critical to sustaining its market leadership and financial success.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Tesla Recalls 700,000 Vehicles Over Tire Pressure Issue

Tesla has announced its latest recall of nearly 700,000 vehicles in the...

By 193cc Agency CouncilDecember 20, 2024MicroStrategy Stock Rallies on Nasdaq 100 News

Shares of MicroStrategy surged on Monday following the announcement that the company...

By 193cc Agency CouncilDecember 16, 2024Stanley Recalls Millions of Mugs After Burn Injuries

In a significant recall, Stanley, the well-known brand behind popular stainless steel...

By 193cc Agency CouncilDecember 12, 2024Adobe Shares Drop 12% After Lowering Revenue Outlook

Shares of Adobe experienced a significant drop of over 12% on Thursday,...

By 193cc Agency CouncilDecember 12, 2024

Leave a comment