- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

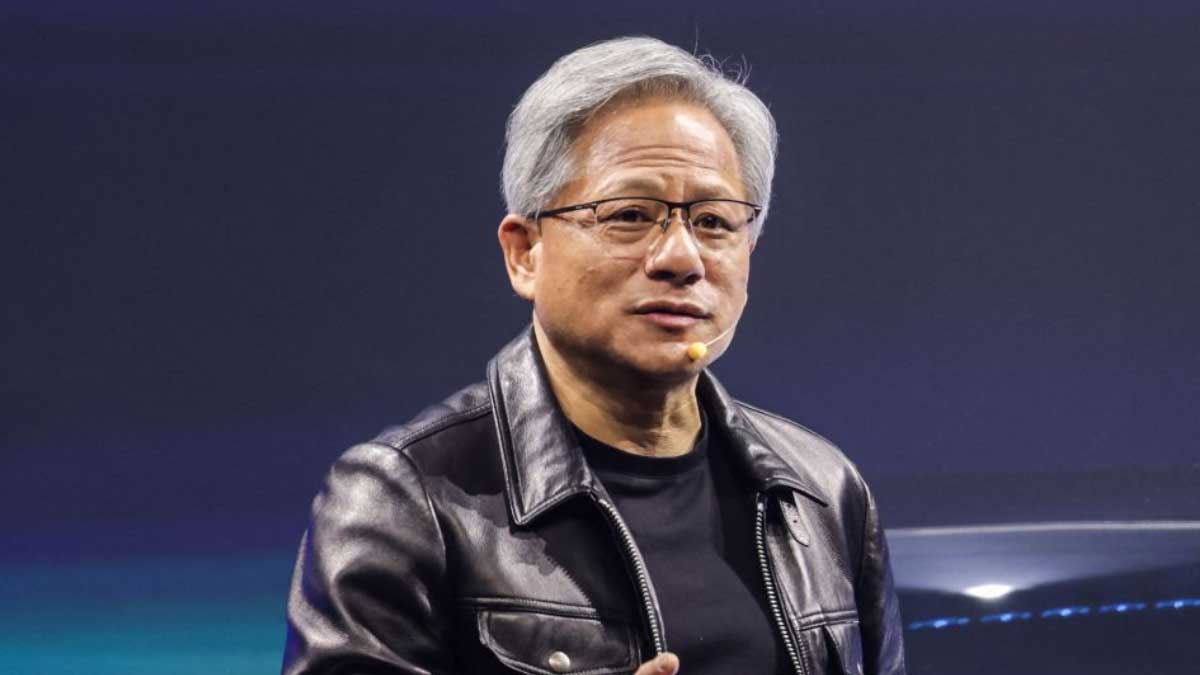

Nvidia Stock Soars 8% on CEO Huang’s Demand Boost

Nvidia’s stock experienced a remarkable 8% increase on Wednesday, fueled by CEO Jensen Huang’s enthusiastic remarks about the soaring demand for the company’s cutting-edge technology. Huang’s comments, made during a Goldman Sachs conference, signaled a surge in Nvidia’s market value by over $200 billion, reflecting the company’s pivotal role in the rapidly evolving tech landscape.

Huang described the current demand for Nvidia’s products as “so great” that it has created a sense of urgency and anticipation among customers. “Everyone wants to be first and everyone wants to be most,” Huang said, as reported by Bloomberg. He characterized the high demand for Nvidia’s semiconductor products, particularly those designed for generative AI applications, as a reflection of their immense value in the modern technological era.

The CEO elaborated on the intensity of the demand, noting that the delivery of Nvidia’s components, technology, infrastructure, and software is emotionally charged for its clients. “Demand is so great that delivery of our components, our technology, infrastructure, and software is really emotional for people,” Huang explained to Yahoo Finance. He emphasized that Nvidia’s technology significantly impacts the financial performance of major clients, including Amazon, Meta (formerly Facebook), and Alphabet (Google’s parent company).

The upbeat sentiment from Huang contrasted with Nvidia’s recent performance. Following a disappointing earnings report on August 28, which saw shares drop over 20% within a week due to concerns about sustaining revenue growth, Nvidia’s stock had been trading mostly lower in the morning. However, Huang’s remarks prompted a dramatic turnaround, with Nvidia shares climbing 8% by the end of the trading day. This rally not only reversed earlier market losses but also turned them into substantial gains.

Huang’s comments about the exceptional demand for Nvidia’s technology came at a critical juncture. Analysts had recently expressed skepticism about Nvidia’s ability to maintain its extraordinary revenue growth. Despite this, Huang’s reassurances and the excitement surrounding Nvidia’s role in AI innovation helped reinvigorate investor confidence.

Nvidia, headquartered in Silicon Valley, is renowned for designing graphics processing units (GPUs), which are essential for handling the vast amounts of data required for AI applications. The release of the ChatGPT generative AI chatbot in late 2022 spurred a significant increase in interest and demand for Nvidia’s products. As a result, the company’s financial performance has seen extraordinary growth. Analysts project Nvidia will achieve $126 billion in sales and $67 billion in net profits for the fiscal year ending in January 2025, a dramatic increase from the $27 billion in sales and $4 billion in profit recorded in the fiscal year ending January 2023. Over the past two years, Nvidia’s stock has surged approximately 700%, driven by the booming demand for its AI systems.

The $216 billion jump in Nvidia’s market capitalization on Wednesday highlights the stock’s volatility. The company is on track to experience its 24th trading session of more than a 5% gain or loss in 2024. In contrast, Microsoft and Apple, the only two companies with higher valuations than Nvidia, have recorded only two instances of such significant daily fluctuations combined this year.

Jensen Huang, who is also Nvidia’s largest individual shareholder, saw the most substantial increase in his net worth among billionaires globally on Wednesday. According to Forbes’ real-time tracker, Huang gained $6 billion, making him the 14th-richest person in the world.

In his remarks, Huang also touched on the transformative impact of generative AI on traditional workflows. “The days of every line of code being written by software engineers, those are completely over,” Huang declared. His statement underscores the profound changes being wrought by AI technology, highlighting how it is revolutionizing software development and other industries.

Nvidia’s stock surge and Huang’s optimistic outlook underscore the company’s critical role in the tech sector and its potential to drive further growth in the AI space. As Nvidia continues to lead in the development of AI technologies, its stock performance and market value will likely remain closely watched by investors and industry analysts alike.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense45

- AI33

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires308

- Boats & Planes1

- Business315

- Careers13

- Cars & Bikes74

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech171

- CxO1

- Cybersecurity59

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare77

- Hollywood & Entertainment175

- Houses1

- Innovation41

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media189

- Mobile phone1

- Money13

- Personal Finance2

- Policy554

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney30

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires278

Related Articles

Adani Denies $250M Bribery Allegations, Vows Legal Fight

Indian billionaire Gautam Adani addressed the recent allegations brought forth by U.S....

By 193cc Agency CouncilNovember 30, 2024Why NotebookLM Will Revolutionize Small Businesses

Last year, I wrote that Google’s NotebookLM was “definitely not open for...

By 193cc Agency CouncilNovember 30, 2024Dell and HP Shares Drop 12% on Weak Forecasts

Shares of personal computer giants Dell Technologies and HP Inc. dropped sharply...

By 193cc Agency CouncilNovember 28, 2024Hyundai Recalls 226,000 Vehicles for Camera Defect

Hyundai has announced its fourth vehicle recall in November, affecting over 226,000...

By 193cc Agency CouncilNovember 27, 2024

Leave a comment