- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

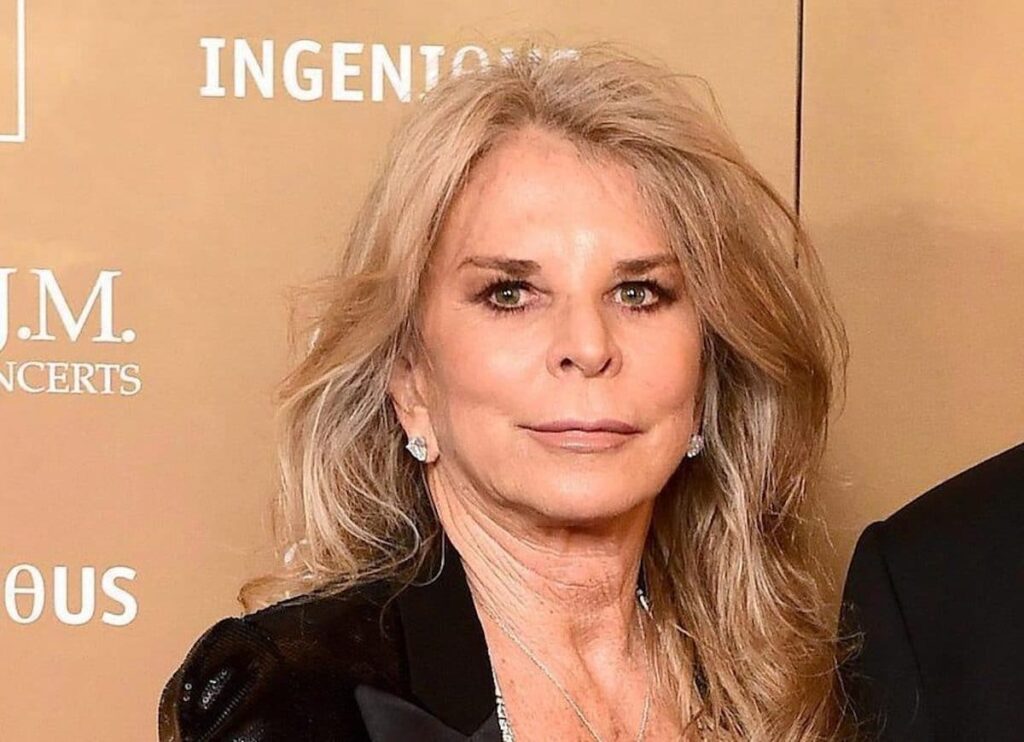

Cristina Green: The Rise and Fall of a Retail Empire

Cristina Green, alongside her husband Philip Green, was once at the helm of the sprawling Arcadia Group, a retail empire that encompassed iconic brands like Topshop, Top Man, and Dorothy Perkins. For years, the couple stood as a symbol of success in the retail industry, but their fortunes took a dramatic turn during the Covid-19 pandemic when the company filed for bankruptcy. The story of Cristina Green is one of ambition, wealth, controversy, and the challenges of navigating a rapidly changing retail landscape.

Cristina Green’s rise to prominence began through her marriage to Philip Green, a retail tycoon known for his aggressive business strategies and high-profile acquisitions. Together, the Greens built Arcadia Group into a powerhouse in the UK fashion scene. At its peak, the company boasted hundreds of stores across the country and generated billions in revenue. Topshop, one of the flagship brands, became a global trendsetter, attracting a younger audience with its affordable yet stylish designs.

The couple’s lifestyle reflected their immense wealth. Cristina Green, often described as the quieter and more reserved partner, managed significant aspects of their financial portfolio. The Greens amassed an enviable collection of luxury assets, including three yachts valued at approximately $140 million and nearly $40 million in real estate. Investigative reports later revealed that some of these properties were purchased through offshore companies, sparking debates about tax avoidance and financial ethics.

However, the Greens’ success was not without controversy. In 2016, the collapse of BHS, a home retailer once owned by Philip Green, marked a turning point in public perception. BHS’s demise left 19,000 workers at risk of losing their pensions, sparking outrage across Britain. Although the couple had sold the company a year before its collapse, they were heavily criticized for failing to safeguard the pension fund. This scandal, compounded by parliamentary inquiries, painted the Greens as emblematic of corporate greed. Philip Green was stripped of his knighthood in 2019 as a result.

For Cristina Green, the backlash brought both personal and public scrutiny. Critics questioned the couple’s management practices and their lavish lifestyle in the face of widespread job losses and financial instability for employees. As public trust eroded, the Greens retreated from the limelight, though they continued to exert influence behind the scenes.

The Covid-19 pandemic dealt the final blow to the Arcadia Group. With lockdowns forcing store closures and consumer habits shifting rapidly to e-commerce, the company struggled to adapt. Arcadia filed for bankruptcy in 2020, leading to the sale of its most recognizable brands, including Topshop, Top Man, and Dorothy Perkins. The dismantling of Arcadia was a stark contrast to the empire that Cristina and Philip Green had spent decades building.

Despite these setbacks, Cristina Green remains a figure of intrigue. While her public persona is more understated compared to her husband’s, she has been a key player in managing the family’s wealth and investments. The Greens’ assets, though diminished, still represent significant financial power. Their collection of yachts, including the 90-meter Lionheart, symbolizes their enduring opulence even as their business fortunes have waned.

The Greens’ financial dealings, particularly Cristina’s involvement in purchasing real estate through offshore firms, have fueled ongoing debates about wealth inequality and corporate responsibility. While legal, such practices have drawn criticism for highlighting disparities in how the wealthy navigate tax systems compared to the average citizen.

In the broader context of the retail industry, Cristina Green’s story is a cautionary tale about the challenges of adapting to change. The collapse of Arcadia underscores the importance of innovation and agility in an era where e-commerce dominates and consumer preferences evolve rapidly. Critics argue that the Greens were slow to invest in online platforms, a misstep that contributed significantly to the downfall of their brands.

Cristina Green’s legacy is intertwined with that of Arcadia Group—a legacy marked by both remarkable achievements and significant controversies. Her role in the family’s financial empire highlights the complexities of managing wealth on a global scale, particularly in an age where transparency and accountability are increasingly demanded by the public.

Today, Cristina Green’s future, much like that of her family’s business ventures, remains uncertain. The couple has retreated from the spotlight, focusing on preserving their remaining assets and addressing legal and financial challenges. For Cristina, this chapter offers an opportunity to reflect on the lessons learned from both their successes and failures.

As the retail industry continues to evolve, Cristina Green’s story serves as a reminder of the dynamic interplay between leadership, ethics, and adaptability. While her name will forever be associated with the rise and fall of Arcadia, her influence on the business world remains a subject of discussion and analysis.

- Arcadia Group

- BHS collapse

- British retail

- business controversies

- business downfall

- Business Empire

- business ethics debates

- business lessons

- Business Management

- consumer habits

- corporate ethics

- corporate greed

- corporate responsibility

- COVID-19 impact

- Cristina Green

- Cristina Green biography

- Dorothy Perkins

- e-commerce shift

- Economic Challenges

- entrepreneurial challenges

- fashion industry

- fashion retail collapse

- financial controversy

- financial ethics

- Financial resilience

- luxury lifestyle

- luxury yachts

- offshore firms

- pension protection

- pension scandal

- Philip Green

- Philip Green knighthood

- public scrutiny

- Real Estate Investment

- retail bankruptcy

- retail empire

- retail industry

- retail innovation

- retail mismanagement

- Retail Transformation

- tax avoidance

- Top Man

- Topshop

- Topshop legacy

- UK business scandal

- wealth inequality

- Wealth Management

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires446

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires415

Related Articles

Robert Kraft: From Paper Fortune to Sports Empire

Robert Kraft is a name that resonates with success in both the...

By 193cc World's BillionairesDecember 22, 2024Donald Newhouse: A Legacy of Media Influence and Business Leadership

Donald Newhouse, a name synonymous with media moguls and influential business figures,...

By 193cc World's BillionairesDecember 22, 2024Ricardo Salinas Pliego: A Legacy of Business Innovation and Family Success

Ricardo Salinas Pliego is a name that resonates in the world of...

By 193cc World's BillionairesDecember 22, 2024Judy Love: A Legacy Built on Hard Work and Family

Judy Love’s name is synonymous with one of the most successful and...

By 193cc World's BillionairesDecember 22, 2024

Leave a comment