- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

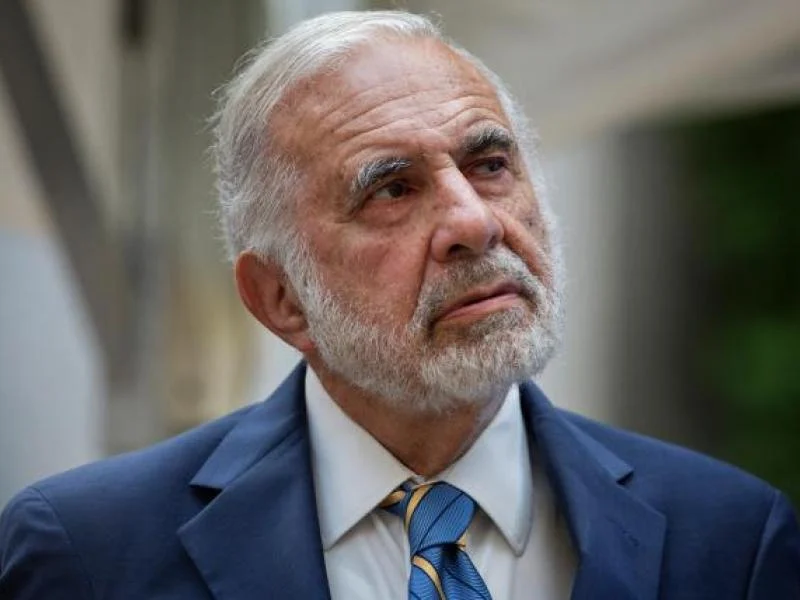

Carl Icahn: A Life of Influence and Investment

Carl Icahn is a name synonymous with bold investment strategies and a reputation that has both earned him the title of corporate raider and made him one of the most influential figures in modern American business. His career, spanning decades, has been marked by his ability to shake up corporate America, and his personal wealth has cemented him as one of the most successful investors in the world. Icahn’s investing empire, primarily through his publicly traded company, Icahn Enterprises, has allowed him to exert a remarkable influence on the companies he targets, often leading to major changes in corporate governance and operations. His work has earned him both admiration and criticism, but there’s no denying that his impact on Wall Street is profound.

Carl Icahn was born in 1936 in Far Rockaway, Queens, a working-class neighborhood in New York City. He grew up in a family of modest means, with his father working as a schoolteacher and his mother a homemaker. Icahn attended Far Rockaway High School before moving on to Princeton University, where he graduated with a degree in philosophy in 1957. While his major seemed to indicate a path toward academia or some other intellectual pursuit, Icahn’s interests soon veered toward business and investing. His time at Princeton had a lasting impact on him, and he has often spoken about the influence that the study of philosophy had on his approach to business, particularly in terms of the critical thinking skills it helped him develop.

After college, Icahn started his career on Wall Street as a stockbroker for Dreyfus Corporation. He quickly realized that his keen mind for spotting undervalued opportunities and his aggressive approach to investing set him apart from his peers. By 1968, he had bought a seat on the New York Stock Exchange, signaling the beginning of what would become a legendary career in finance. Throughout the 1970s and 1980s, Icahn made a name for himself as a corporate raider. He identified undervalued companies, often with inefficient management or underperforming assets, and took large positions in them with the goal of forcing changes that would unlock value.

Icahn’s strategy was simple but effective: buy a large stake in a company, gain influence, and push for changes that would drive up the stock price. In many cases, these changes included leadership shakeups, restructuring, or even the sale of parts of the company. Icahn’s activism often involved intense negotiations, hostile takeovers, and public campaigns against companies he believed were underperforming. One of his most notable moves was his involvement with TWA (Trans World Airlines) in the 1980s, where he launched a successful hostile takeover attempt. His willingness to engage in high-profile battles with CEOs and boards of directors earned him a reputation as one of the most feared investors on Wall Street.

By the 1990s, Icahn had broadened his portfolio to include a range of industries, including energy, real estate, and technology. His ability to identify undervalued assets and unlock hidden value in companies was unmatched. He turned his focus toward more diversified investments through his firm, Icahn Enterprises, a publicly traded conglomerate that gave him the capital and flexibility to make investments in a wide variety of sectors. Icahn Enterprises has since become a key vehicle for his investments, and its holdings include stakes in major companies such as Hertz Global, CVR Energy, and Blockbuster.

Icahn’s personal wealth has grown significantly over the years. He is estimated to have a net worth in the billions of dollars, but his wealth is not the only source of his influence. Through Icahn Enterprises and his personal fund, Icahn has been able to influence a number of major companies. His reputation as a hands-on investor, one willing to shake up corporate structures to unlock value, has made him a highly sought-after figure in the world of corporate governance. He is known for his ability to pressure companies into making difficult decisions, such as selling off assets or rethinking their strategies in ways that benefit shareholders.

One of the defining features of Icahn’s career has been his advocacy for shareholder rights. He has consistently argued that corporations should prioritize the interests of their shareholders above all else, a philosophy that has often put him at odds with company management and boards. Icahn has also been a strong proponent of corporate governance reforms, advocating for more transparency and accountability within the companies in which he invests. His aggressive tactics and willingness to challenge corporate leadership have earned him both supporters and detractors. To his supporters, Icahn is a champion of the free market, using his skills and resources to ensure that companies operate efficiently and that their boards act in the best interests of shareholders. To his critics, he is a ruthless investor who uses his influence to push through changes that benefit him at the expense of workers and other stakeholders.

Despite the controversies surrounding some of his business practices, Icahn has also demonstrated a commitment to philanthropy. He has donated millions of dollars to charitable causes, including a $200 million donation to what is now the Icahn School of Medicine at Mount Sinai in New York City. This gift has helped to fund medical research and education, further cementing Icahn’s reputation as someone who gives back to society. His charitable efforts are an important aspect of his legacy, showing that while his business practices have been aggressive, he has also sought to use his wealth for the betterment of others.

Icahn’s influence has extended beyond his investments. He has been involved in politics, offering advice to presidential candidates and supporting causes that align with his views on business and economics. His relationships with politicians, especially during election cycles, have often been leveraged to further his interests and to push for regulatory changes that he believes will benefit the business community. His involvement in politics, however, has been a double-edged sword, as some see his influence as indicative of a larger problem with the intersection of money and power in American politics.

Today, Carl Icahn remains a major player in the world of finance. Though he is no longer as involved in the day-to-day management of his investments as he once was, his influence continues to be felt across the business world. He remains an advocate for shareholder rights and a champion of corporate governance reform. While his methods have often been controversial, there is no denying his success and the lasting impact he has had on the landscape of corporate America.

Icahn’s story is one of ambition, intelligence, and an unwavering belief in the power of the free market. From his humble beginnings in Queens to his rise as one of the wealthiest and most influential investors in the world, Carl Icahn has proven that with the right combination of strategy, determination, and a willingness to take risks, one can reshape the very foundations of corporate America. His legacy is one of challenge, innovation, and a relentless pursuit of value, both for himself and the companies he invests in.

- Business

- Business Magnate

- business mogul

- business reform

- business transformation

- Carl Icahn

- corporate activism

- corporate battle

- corporate change

- Corporate governance

- Corporate Leadership

- corporate politics

- corporate raider

- corporate restructuring

- executive leadership

- Far Rockaway

- Finance

- financial empire

- Financial Markets

- financial strategist

- Hedge Fund

- hostile takeover

- Icahn Enterprises

- Icahn family

- Icahn Foundation

- Icahn School of Medicine

- Icahn’s critics

- Icahn’s influence

- Icahn’s legacy

- Icahn’s philanthropy

- Icahn’s strategy

- Icahn’s supporters

- investment

- Investment Portfolio

- Investor

- management change

- Medical Research

- Mount Sinai

- Mount Sinai Medical Center

- New York Stock Exchange

- personal wealth

- Philanthropy

- Philosophy

- Princeton University

- Private Equity

- Risk-taking

- shareholder activism

- shareholder rights

- shareholder value

- stockbroker

- takeover tactics

- TWA

- Wall Street

- Wall Street tycoon

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense46

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires449

- Boats & Planes1

- Business328

- Careers13

- Cars & Bikes76

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech180

- CxO1

- Cybersecurity68

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games141

- GIG1

- Healthcare78

- Hollywood & Entertainment186

- Houses1

- Innovation42

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media193

- Mobile phone1

- Money13

- Personal Finance2

- Policy567

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney33

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized8

- Vices1

- Watches & Jewelry2

- world's billionaires418

Related Articles

Sky Xu: The Visionary Behind Shein’s Fast Fashion Empire

Sky Xu, the cofounder and CEO of Shein, has made an indelible...

By 193cc World's BillionairesDecember 22, 2024The Rise and Resilience of Suleiman Kerimov: A Billionaire’s Journey Through Business, Politics, and Controversy

Suleiman Kerimov, a prominent Russian billionaire and influential political figure, has made...

By 193cc World's BillionairesDecember 22, 2024Marcel Herrmann Telles: From Brazil to Global Business Empire

Marcel Herrmann Telles is a name that resonates in the world of...

By 193cc World's BillionairesDecember 22, 2024Robert Kraft: From Paper Fortune to Sports Empire

Robert Kraft is a name that resonates with success in both the...

By 193cc World's BillionairesDecember 22, 2024

Leave a comment