- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

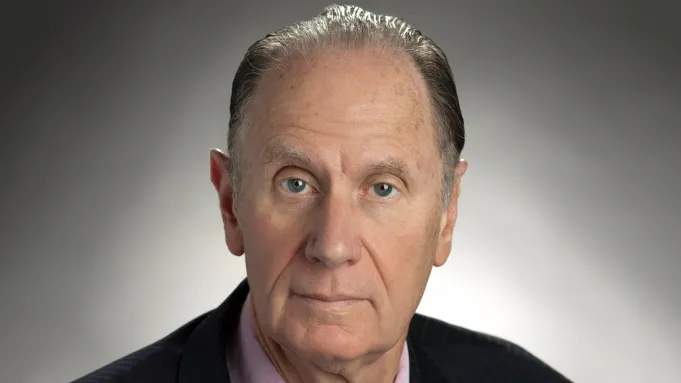

David Bonderman: A Legacy of Private Equity, Philanthropy, and Conservation

David Bonderman, a name synonymous with success in the world of private equity, was a pioneering figure who co-founded the global investment giant TPG. His life story is one marked by a series of groundbreaking business ventures, a profound commitment to philanthropy, and a reputation for his deep influence in both the financial and conservation sectors. Bonderman’s legacy is defined not just by his extraordinary wealth but also by his strategic vision, bold investment decisions, and dedication to creating lasting social impact.

Born in 1942, David Bonderman’s career trajectory began in the legal field after he graduated from Harvard Law School in 1966. However, it was in the world of finance that he would truly leave his mark. In the late 1980s, Bonderman worked under billionaire Robert Bass, a partnership that would serve as the foundation for his later ventures. During this time, Bonderman met Jim Coulter, who would become his long-time business partner. The pair’s shared vision for the future of private equity led to the formation of TPG in 1992, a move that would reshape the landscape of global finance.

In 1993, just a year after founding TPG, Bonderman and Coulter made their first major investment that would set the stage for their firm’s rise to prominence. They invested $66 million in the struggling Continental Airlines, a deal that would ultimately yield them a $640 million profit. This deal proved the strength of their investment strategies and laid the groundwork for the incredible growth TPG would experience in the years to come.

TPG’s success can be attributed to Bonderman’s ability to identify opportunities in companies that were undervalued or underperforming. His financial acumen, combined with Coulter’s complementary skills, made the firm an influential player in the private equity industry. As TPG expanded, Bonderman became known for his hands-off approach to management, preferring to allow the businesses in which TPG invested to flourish on their own, with guidance and strategic oversight when necessary.

Throughout his career, Bonderman maintained a low profile, preferring to focus on the work rather than seeking attention. Operating primarily from Fort Worth, while Coulter managed TPG’s San Francisco office, Bonderman’s leadership style reflected his belief in empowering others to drive success. He was instrumental in overseeing TPG’s growth, which included significant investments in industries ranging from healthcare and technology to energy and consumer goods. By the time Bonderman stepped back from the day-to-day operations of the firm, TPG had grown into one of the largest private equity firms in the world, managing billions of dollars in assets.

Despite his immense success in business, Bonderman was also deeply committed to philanthropy. In 1995, he established the Bonderman Travel Fellowship at the University of Washington, a program that has since allowed hundreds of fellows to travel to at least six countries over the course of eight months. The program was designed to broaden participants’ perspectives by immersing them in diverse cultures, and it remains one of Bonderman’s most enduring legacies.

Bonderman’s philanthropic efforts were not limited to the travel fellowship. He was also a passionate supporter of conservation, using his wealth and influence to protect the environment. As a board member of The Wilderness Society, Bonderman helped to advocate for the preservation of natural landscapes across the United States. His conservation work reflected his deep belief in the importance of safeguarding the planet’s natural resources for future generations.

Bonderman’s personal philosophy was grounded in his belief that wealth and influence should be used to create positive change. His charitable work, combined with his business success, has left a lasting impact on a variety of sectors. He not only revolutionized the private equity industry but also made significant contributions to causes that align with his values, particularly in the areas of environmental conservation and global travel education.

As a businessman, Bonderman’s legacy will live on through TPG’s continued success, with the firm’s investments and strategic decisions continuing to shape industries worldwide. However, his contributions were not confined to the corporate world. His philanthropic endeavors have inspired a new generation of business leaders to think beyond profits and focus on the social and environmental impact of their work.

David Bonderman passed away in December 2024 at the age of 82, leaving behind a remarkable legacy in the world of private equity and beyond. His ability to build a successful business while maintaining a focus on conservation and philanthropy serves as an enduring example of how financial success can be coupled with a commitment to making the world a better place.

Bonderman’s life and work stand as a testament to the power of strategic thinking, bold decision-making, and a strong sense of social responsibility. His legacy will continue to inspire future generations of business leaders, investors, and philanthropists for years to come.

- Bonderman Travel Fellowship

- Bonderman’s influence

- Bonderman’s vision

- Bonderman’s work

- Business Growth

- Business Leadership

- Business Legacy

- business strategy

- Charitable Foundation

- conservation

- conservation efforts

- Continental Airlines

- Corporate Philanthropy

- Corporate Social Responsibility

- David Bonderman

- environmental causes

- environmental philanthropy

- environmental protection

- Ethical Investing

- financial acumen

- financial influence

- Financial Management

- Financial Markets

- Global Finance

- global investments

- global travel program

- Impact Investing

- investment strategies

- Jim Coulter

- Jim Coulter partnership

- Leadership Style

- low-profile leadership

- personal legacy

- Philanthropy in Business

- Positive Change

- Private Equity

- private equity giant

- private equity pioneer

- Public-Private Partnerships

- Social Impact

- Strategic Investments

- sustainable business

- The Wilderness Society

- TPG

- TPG founding partner

- TPG investments

- TPG’s success

- travel education

- University of Washington

- wealth and influence

- Wealth Creation

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,356

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media327

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized13

- Vices1

- Watches & Jewelry2

- world's billionaires1,325

- Worlds Richest Self-Made Women2

Related Articles

Donald Bren: The Billionaire Behind America’s Largest Private Landholdings

Donald Bren, a name that may not be as instantly recognizable as...

By 193cc World's BillionairesMay 8, 2025The Remarkable Journey of Savitri Jindal & Family

Savitri Jindal, one of India’s most influential industrialists and philanthropists, is a...

By 193cc World's BillionairesMay 8, 2025Carl Icahn: The Relentless Capitalist Who Redefined Wall Street

Carl Icahn is one of the most prominent, controversial, and influential figures...

By 193cc World's BillionairesMay 8, 2025Steve Cohen: The Billionaire Investor Who Rewrote Wall Street’s Playbook

Steve Cohen is a name that resonates deeply within the corridors of...

By 193cc World's BillionairesMay 8, 2025

Leave a comment