- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

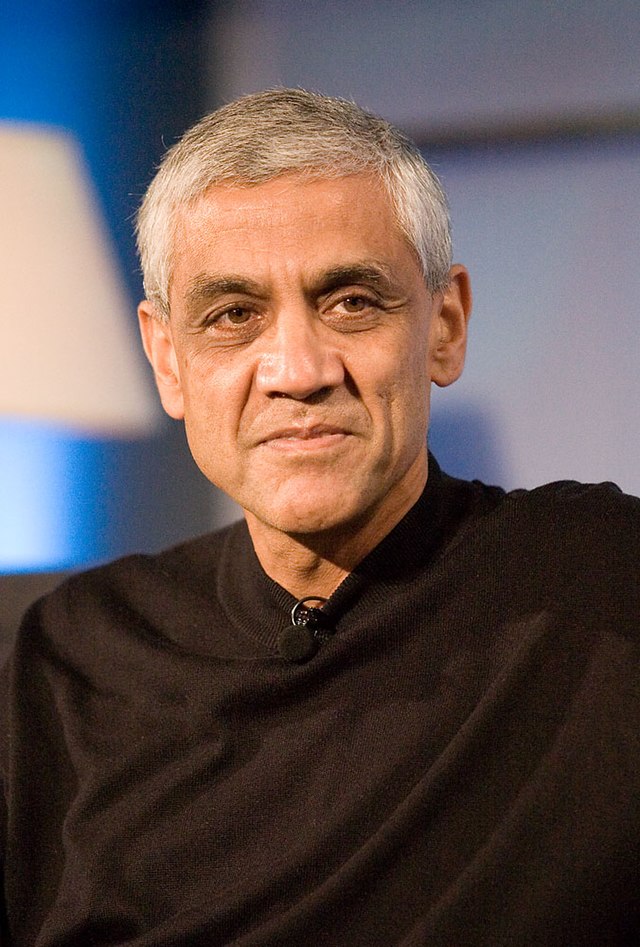

Vinod Khosla: A Journey of Innovation, Entrepreneurship, and Success

Vinod Khosla is a name that resonates deeply in the world of venture capital, innovation, and entrepreneurship. As the founder of Khosla Ventures, a prominent Silicon Valley venture capital firm, Khosla has shaped the landscape of cutting-edge technologies and groundbreaking startups. His career is a testament to the power of vision, risk-taking, and a relentless drive to push boundaries. Over the years, Khosla has made significant contributions to various industries, from biomedicine to robotics, all while building a legacy of both financial success and transformative innovation.

Born in India in 1955, Vinod Khosla displayed early academic brilliance, which led him to pursue a degree in engineering. He earned his bachelor’s degree in electrical engineering from the Indian Institute of Technology (IIT) Delhi, one of India’s most prestigious institutions. After completing his undergraduate studies, Khosla moved to the United States, where he pursued a master’s degree in biomedical engineering from Stanford University. It was at Stanford that Khosla’s entrepreneurial spirit began to take root. The environment of the university, known for its culture of innovation and creativity, nurtured Khosla’s ambitions and aspirations to make a mark on the world.

In 1982, Khosla co-founded Sun Microsystems alongside Andy Bechtolsheim, Bill Joy, and Scott McNealy. Sun Microsystems became one of Silicon Valley’s most successful and influential companies. It revolutionized the computer hardware industry by creating powerful workstations and introducing the widely adopted Java programming language. Sun Microsystems was a giant in the world of technology, and its success propelled Khosla into the limelight. During his time with the company, Khosla focused on driving the firm’s vision, overseeing key product development, and building a culture of innovation.

Despite Sun Microsystems’ success, Khosla’s journey was far from over. After his tenure at Sun Microsystems, he joined the venture capital firm Kleiner Perkins Caufield & Byers (now known simply as Kleiner Perkins). Over the course of 18 years, Khosla worked with the firm to identify emerging technologies and promising startups. His time at Kleiner Perkins provided Khosla with invaluable experience, and it was here that he honed his skills in identifying and investing in breakthrough technologies. He played a pivotal role in the firm’s investments in companies like Amazon, Google, and Intuit, all of which would go on to become household names. The opportunity to work alongside some of the brightest minds in the venture capital and tech world further solidified Khosla’s reputation as a strategic and insightful investor.

However, despite his success at Kleiner Perkins, Khosla was ready to embark on his own entrepreneurial venture. In 2004, he left the firm and founded Khosla Ventures, a venture capital firm that focuses on experimental and high-risk technologies. His vision was to create a platform that would fund and support visionary entrepreneurs working on transformative projects that could change the world. Khosla Ventures focuses on a wide range of industries, with particular emphasis on biomedicine, clean technology, artificial intelligence, and robotics. The firm’s mission is to back disruptive technologies that can solve some of the most pressing challenges facing humanity, from healthcare to environmental sustainability.

Under Khosla’s leadership, Khosla Ventures has become one of Silicon Valley’s most respected and successful venture capital firms. The firm has invested in a number of groundbreaking companies and technologies, many of which have reshaped industries. Khosla’s ability to identify emerging trends and invest in companies that are on the cutting edge of innovation has been instrumental in the firm’s success. One of the most notable examples of Khosla Ventures’ success is its investment in Affirm, an innovative financial technology company that went public in 2021. The firm also saw remarkable exits with IPOs of DoorDash and SPAC listings of QuantumScape and Opendoor in 2020 and 2021, respectively. These exits have solidified Khosla Ventures as one of the most successful venture capital firms in the modern era.

Khosla’s investment philosophy is rooted in his belief that the world’s biggest problems can only be solved by taking big risks. Unlike many investors who are wary of uncertainty, Khosla embraces it. He has often said that the most innovative technologies require risk-taking and an unwavering commitment to the vision. He’s not afraid to back experimental ideas, even if they seem unlikely to succeed in the short term. Khosla’s willingness to take risks has led to investments in fields that are still in their infancy, such as synthetic biology and advanced robotics.

At the same time, Khosla is deeply committed to the idea of using technology to create positive social impact. His investments in biomedicine and clean energy technologies are a testament to his belief that innovation can be harnessed to address global challenges such as climate change, disease, and energy shortages. One of the key aspects of Khosla’s approach to investing is his focus on companies that not only have the potential for financial returns but also the ability to create meaningful societal impact.

Over the years, Khosla’s accomplishments and impact have not gone unnoticed. He has been recognized with numerous accolades and honors, including being named to Forbes’ list of billionaires and receiving accolades for his contributions to the tech industry. His influence in Silicon Valley and beyond is undeniable, and his legacy continues to inspire generations of entrepreneurs and investors.

Vinod Khosla’s life is a story of relentless ambition, visionary thinking, and the pursuit of innovation. His journey from a young engineering student in India to a venture capital titan in Silicon Valley is one of resilience and determination. Khosla has not only built an empire of successful companies but has also championed the idea that entrepreneurship is about more than just financial success—it’s about changing the world for the better. As Khosla Ventures continues to invest in experimental technologies and support disruptive ideas, Vinod Khosla’s influence on the future of technology, innovation, and entrepreneurship will undoubtedly remain profound for years to come,

- advanced robotics

- Affirm

- Amazon

- Artificial Intelligence

- biomedicine

- biomedicine innovation

- breakthrough technologies

- Clean Technology

- Climate Change

- disruptive technologies

- DoorDash

- Entrepreneurial Spirit

- experimental technologies

- Financial Technology

- Future Technologies

- global challenges

- groundbreaking companies

- Healthcare

- Intuit

- Investment philosophy

- IPO exits

- Khosla Ventures

- Kleiner Perkins

- Opendoor

- QuantumScape

- Renewable Energy

- Risk-taking

- robotics

- robotics industry

- Silicon Valley

- Silicon Valley entrepreneur

- Silicon Valley investor

- Silicon Valley success

- Social Impact

- SPAC listings

- Stanford University

- startup ecosystem

- Startup Investments

- Sun Microsystems

- synthetic biology

- tech industry leader

- Technological Advancements

- technology development

- technology ecosystem

- technology investments

- transformative innovation

- Venture Capital

- venture capital firm

- venture capital industry

- Vinod Khosla

- visionary investor

- Visionary Leadership

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,356

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media327

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized13

- Vices1

- Watches & Jewelry2

- world's billionaires1,325

- Worlds Richest Self-Made Women2

Related Articles

Donald Bren: The Billionaire Behind America’s Largest Private Landholdings

Donald Bren, a name that may not be as instantly recognizable as...

By 193cc World's BillionairesMay 8, 2025The Remarkable Journey of Savitri Jindal & Family

Savitri Jindal, one of India’s most influential industrialists and philanthropists, is a...

By 193cc World's BillionairesMay 8, 2025Carl Icahn: The Relentless Capitalist Who Redefined Wall Street

Carl Icahn is one of the most prominent, controversial, and influential figures...

By 193cc World's BillionairesMay 8, 2025Steve Cohen: The Billionaire Investor Who Rewrote Wall Street’s Playbook

Steve Cohen is a name that resonates deeply within the corridors of...

By 193cc World's BillionairesMay 8, 2025

Leave a comment