- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

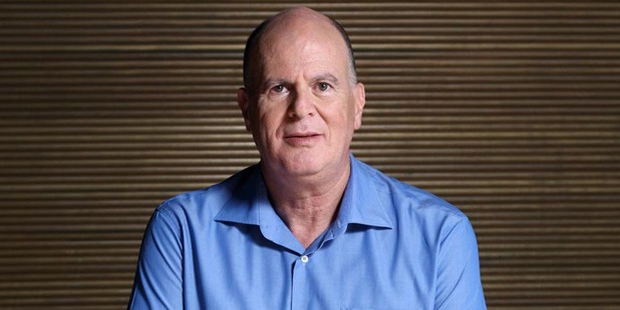

Shaul Shani: A Visionary Investor Who Shaped Global Markets

Shaul Shani is a renowned Israeli investor whose journey through the world of business and finance has made him one of the most influential figures in the industry. Born in Israel, Shani’s success story is built on a foundation of strategic investments, acquisitions, and a keen understanding of emerging markets. His career spans decades, during which he has consistently identified opportunities that many others overlooked, accumulating wealth and influence along the way. His life story reflects not only his business acumen but also his commitment to philanthropy and his role as a leader in both the private and charitable sectors.

Shani’s entrepreneurial career began in the 1980s when he co-founded three companies, marking the start of his journey as an investor and businessman. His first significant venture was Oshap Technologies, a company that specialized in providing innovative solutions to the tech industry. The company was eventually acquired for $210 million, which set the stage for Shani’s future successes. The second company, Tecnomatix, focused on providing software solutions for manufacturing companies, particularly in the areas of digital manufacturing and factory optimization. This venture proved to be highly successful as well, leading to its acquisition for $228 million. These early exits gave Shani the capital and the experience he needed to pursue larger and more complex ventures.

In the late 2000s, Shani expanded his focus internationally, with one of his most significant achievements being the sale of the Brazilian telecom company Global Village Telecom (GVT) to Vivendi in 2009 for a staggering $4.5 billion. This deal was a game-changer, with Shani walking away with a substantial portion of the proceeds — $1.4 billion. The sale of GVT not only solidified Shani’s status as a major player in global business but also marked the beginning of a new phase in his career, as he transitioned into mezzanine lending and further investments in emerging markets.

Mezzanine lending, a hybrid form of financing that sits between debt and equity, became one of Shani’s preferred methods of investment. This type of lending allows investors like Shani to participate in high-risk, high-reward ventures, often in markets that are still developing or where access to capital is limited. Through his investments, Shani played a significant role in helping businesses in emerging economies secure the financing they needed to grow and expand. His ability to spot these opportunities and navigate the risks involved further cemented his reputation as a savvy investor with an eye for potential.

Shani’s focus on emerging markets extended beyond South America. He also became involved in various sectors, including technology, telecommunications, and infrastructure, capitalizing on the growing demand for modernization in developing economies. By identifying these trends early on, he was able to amass a diversified portfolio that spanned different industries and continents, enhancing his financial standing and global influence.

Another pivotal moment in Shani’s career occurred in 2014, when he took control of ECI Telecom, a leading Israeli communications equipment manufacturer. ECI Telecom had been facing financial difficulties and needed strong leadership to navigate the challenges of an ever-evolving tech landscape. Shani’s expertise and strategic vision turned the company around, and by 2019, he had reached a deal to sell the company to Ribbon Communications, a publicly traded telecom company. This acquisition was another testament to Shani’s ability to lead and manage companies in transition, driving them to greater heights of success.

While Shani’s business ventures and investments have earned him millions, if not billions, of dollars, his success is not solely measured in financial terms. In 2021, he became the chairman of Rashi, one of Israel’s largest charities. Rashi is dedicated to promoting social welfare and supporting various initiatives aimed at improving the lives of disadvantaged communities in Israel. Shani’s role as chairman of Rashi highlights his commitment to giving back to society and his desire to make a positive impact on the world. Through his leadership, Rashi has expanded its reach and increased its effectiveness in addressing some of Israel’s most pressing social challenges.

Throughout his career, Shani has been known for his ability to navigate complex financial landscapes and make decisions that others might consider too risky. His success is built on a foundation of deep industry knowledge, a strong network of business contacts, and an ability to identify undervalued assets with significant upside potential. This combination of factors has allowed him to thrive in a competitive and often unpredictable market.

Looking ahead, Shaul Shani continues to be a force in the world of business and investment. His career trajectory serves as a reminder of the importance of innovation, strategic thinking, and a willingness to take risks in order to achieve lasting success. As he continues to expand his portfolio and contribute to both the business world and charitable causes, Shani remains an example of how vision, hard work, and a sense of responsibility can lead to remarkable achievements,

- acquisition

- Brazil

- Business Acumen

- Business Expansion

- business leader

- business portfolio

- business strategy

- business turnaround

- capital markets

- charity leadership

- communication industry

- digital manufacturing

- diversification

- ECI Telecom

- Emerging Economies

- Emerging Markets

- Entrepreneur

- Entrepreneurial Journey

- factory optimization

- financial difficulties

- Financial success

- financing

- Global Business

- Global Village Telecom

- GVT

- high-risk investments

- infrastructure investment

- International Business

- Investment Opportunities

- investor success

- Israel

- Israeli businessman

- Israeli charities

- Israeli investor

- Israeli telecom

- Leadership

- manufacturing optimization

- mezzanine lending

- Oshap Technologies

- Philanthropy

- Rashi charity

- Ribbon Communications

- Risk management

- Shaul Shani

- Social Welfare

- Software Solutions

- Strategic Investments

- Strategic Vision

- Technology

- technology sector

- Tecnomatix

- Telecommunications

- turnaround strategy

- Venture Capital

- Vivendi

- Wealth Creation

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment