- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

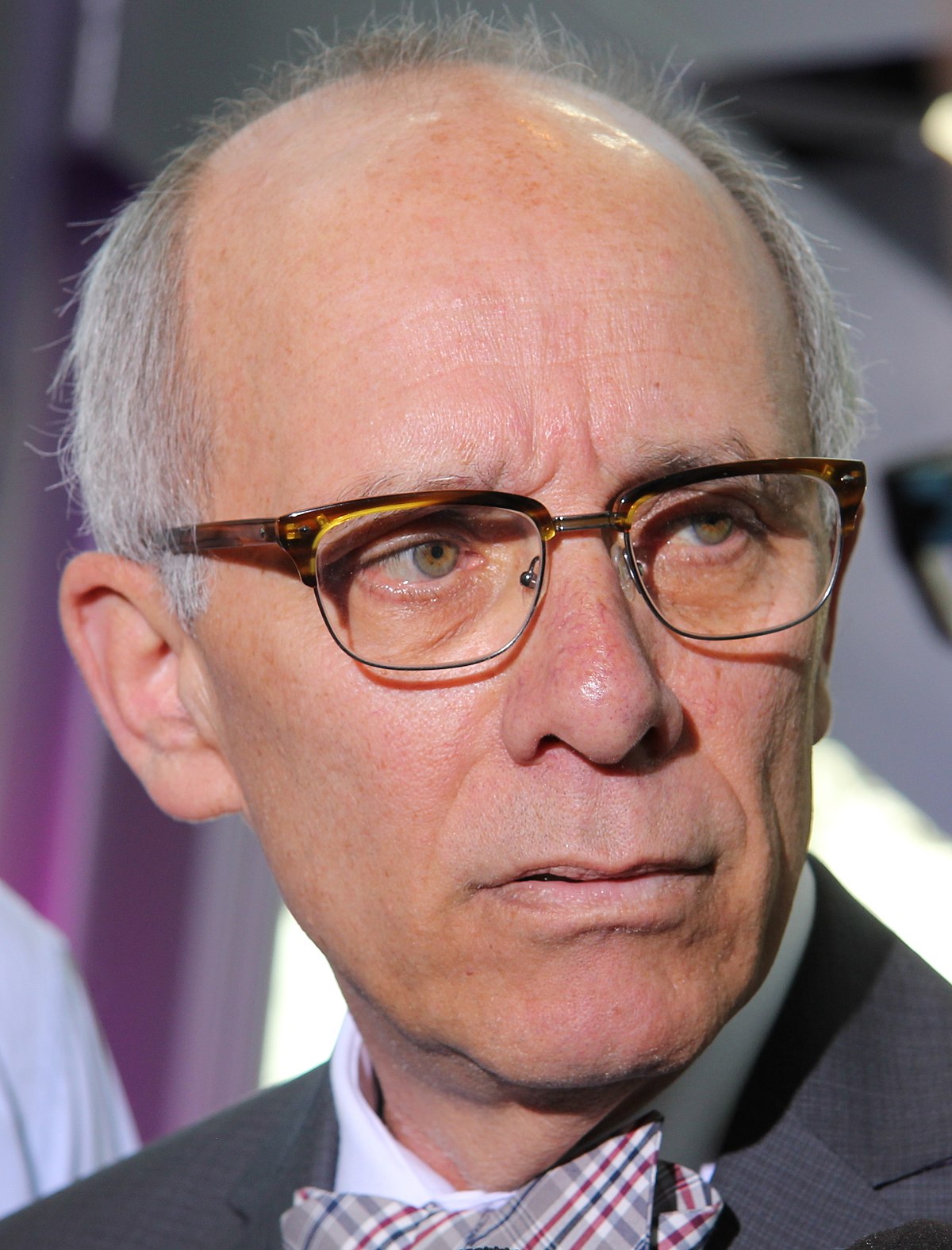

Stephen Mandel, Jr.: A Visionary in Hedge Funds and Philanthropy

Stephen Mandel, Jr. is a prominent figure in the world of finance and philanthropy, known for his sharp investment strategies and profound commitment to social causes. Born into a family that valued education and civic responsibility, Mandel’s journey to becoming a billionaire hedge fund manager and philanthropist is marked by relentless ambition, strategic thinking, and a deep-seated desire to give back to society.

Mandel’s academic path laid a strong foundation for his career in finance. He attended Dartmouth College, where he earned a Bachelor of Arts degree, followed by an MBA from Harvard Business School. These prestigious institutions not only honed his analytical skills but also expanded his network, paving the way for his future endeavors in investment management. His early career included a stint at Goldman Sachs, where he developed a keen understanding of the financial markets. Mandel later joined Julian Robertson’s Tiger Management, a hedge fund renowned for nurturing some of the most successful investors in the industry. Under Robertson’s mentorship, Mandel sharpened his expertise in fundamental analysis and bottom-up stock picking, skills that would later define his investment philosophy.

In 1997, Mandel founded Lone Pine Capital, a hedge fund firm that quickly rose to prominence. Named after a solitary tree at Dartmouth College, Lone Pine Capital became synonymous with meticulous research and disciplined investment strategies. Mandel’s approach to investing was grounded in in-depth analysis of companies, focusing on their fundamentals and long-term growth potential. This strategy enabled Lone Pine Capital to deliver impressive returns, establishing Mandel as one of the most respected figures in the hedge fund industry. His ability to identify undervalued companies and capitalize on market inefficiencies earned him a reputation as a master stock picker.

Despite the volatility inherent in financial markets, Mandel’s disciplined investment approach allowed Lone Pine Capital to navigate economic downturns and market upheavals successfully. His leadership and strategic vision propelled the firm to manage billions of dollars in assets, making it one of the largest and most successful hedge funds globally. Mandel’s commitment to excellence and continuous learning contributed significantly to his sustained success over the years.

In January 2019, Mandel announced his decision to step back from managing investments at Lone Pine Capital, though he remained a managing director. This transition marked a new chapter in his career, allowing him to focus more on philanthropic endeavors while maintaining a strategic role within the firm. Mandel’s decision to shift his focus underscores his belief in the importance of giving back to society and fostering positive change.

Philanthropy has always been a cornerstone of Mandel’s life. He established the Zoom Foundation, through which he has donated hundreds of millions of dollars to various causes. His philanthropic efforts are primarily centered around education reform and environmental conservation. Mandel’s commitment to education is evident in his substantial support for charter schools and his involvement with Teach for America, where he serves on the national board of directors. He believes in the transformative power of education and has dedicated significant resources to improving educational opportunities for underserved communities.

In addition to the Zoom Foundation, Mandel’s Lone Pine Foundation further exemplifies his dedication to philanthropy. The foundation supports a wide range of initiatives, including educational programs, environmental projects, and community development efforts. Mandel’s philanthropic philosophy is rooted in creating sustainable, long-term impact, reflecting his strategic mindset as an investor.

Mandel’s contributions to education and social causes have earned him widespread recognition and respect. His strategic approach to philanthropy mirrors his investment philosophy—focused, analytical, and driven by a desire to achieve meaningful results. By leveraging his financial success, Mandel has been able to support initiatives that align with his values and vision for a better society.

Beyond his professional achievements and philanthropic endeavors, Mandel is known for his humility and discretion. He maintains a low public profile, preferring to let his work speak for itself. This understated approach has only enhanced his reputation as a thoughtful and effective leader, both in the financial sector and in the realm of social impact.

Stephen Mandel, Jr.’s legacy is one of exceptional financial acumen and unwavering commitment to societal betterment. His journey from a young finance professional to a billionaire hedge fund manager and dedicated philanthropist serves as an inspiring example of how success can be leveraged to make a positive difference in the world. Through Lone Pine Capital and his philanthropic foundations, Mandel continues to influence the financial industry and contribute to meaningful social change. His story is a testament to the power of strategic thinking, disciplined execution, and a deep-rooted sense of responsibility toward society,

- Asset Management

- billionaire investor

- bottom-up investing

- charter schools

- Community Development

- corporate responsibility

- Dartmouth College

- disciplined investor

- Economic Downturns

- Economic Growth

- Education initiatives

- education reform

- Environmental Conservation

- financial acumen

- financial discipline

- Financial Industry Leader

- financial innovation

- Financial Markets

- Financial success

- fundamental analysis

- Goldman Sachs

- Harvard Business School

- Hedge Fund Manager

- hedge fund success

- impactful donations

- investment excellence

- investment strategies

- investor mentorship

- Julian Robertson

- Lone Pine Capital

- Lone Pine Foundation

- long-term growth investing

- market analysis

- market inefficiencies

- Philanthropy

- philanthropy in education

- Social Impact

- Social Responsibility

- Stephen Mandel Jr

- stock picking

- Strategic Leadership

- Strategic Philanthropy

- sustainable philanthropy

- Teach for America

- Tiger Cubs

- Tiger Management

- transformative education

- Zoom Foundation

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment