- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

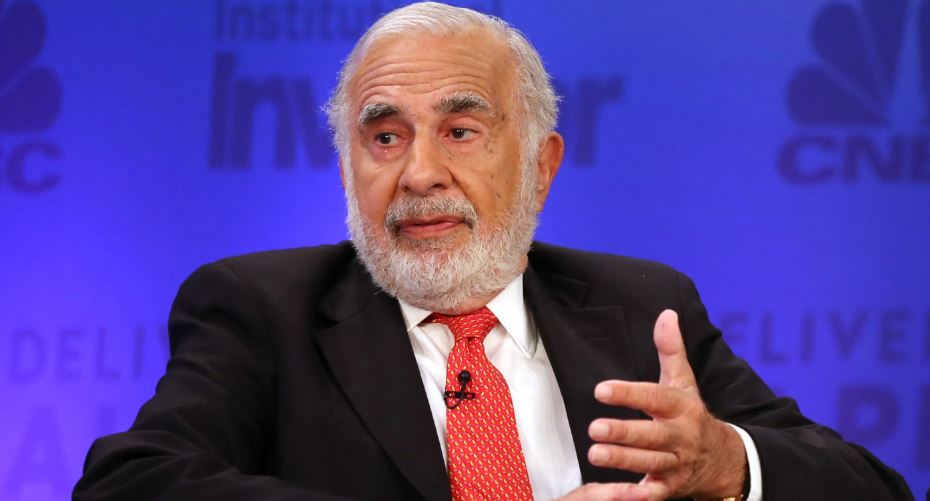

Carl Icahn: The Relentless Capitalist Who Redefined Wall Street

Carl Icahn is one of the most prominent, controversial, and influential figures in American finance. With a career that spans decades, he has become synonymous with the term “corporate raider,” although he prefers to be known as an “activist investor.” Born on February 16, 1936, in Queens, New York, Icahn rose from modest beginnings to become a billionaire financier and a towering presence on Wall Street. His aggressive investment tactics, unyielding personality, and relentless drive have left a profound mark on corporate America.

Icahn’s story begins in a working-class neighborhood of Far Rockaway, where he was raised by a schoolteacher mother and a cantor father. His parents valued education, and he went on to attend Princeton University, majoring in philosophy. After graduating in 1957, he briefly studied medicine at New York University but dropped out to join the Army. In 1961, he began his career on Wall Street as a stockbroker and eventually used a $400,000 investment, partly funded by his uncle, to purchase a seat on the New York Stock Exchange. This was the launchpad for what would become a legendary financial journey.

Icahn started by specializing in options trading, but it wasn’t long before he shifted his attention to undervalued companies. He developed a strategy of acquiring significant stakes in companies he believed were poorly managed or undervalued by the market. He would then push for changes to unlock shareholder value—often through asset sales, share buybacks, management shakeups, or strategic restructuring. These tactics earned him a reputation as a feared corporate raider during the 1980s, a label he both embraced and resented.

One of his early high-profile takeovers was TWA (Trans World Airlines) in 1985. He acquired control of the company, sold off its assets, and walked away with hundreds of millions in profits. Critics argued that his actions left the company hollowed out and vulnerable, but Icahn maintained that he had merely done what was necessary to generate value for shareholders. This deal cemented his status as a controversial figure in the business world.

Over the decades, Icahn has targeted a vast array of companies across multiple industries, including RJR Nabisco, Texaco, Western Union, Motorola, Yahoo, Time Warner, eBay, Apple, and Dell. His presence on a company’s shareholder list has often caused its stock price to rise simply due to speculation that major changes would follow. While many CEOs have publicly bristled at his involvement, shareholders have frequently welcomed him as a necessary catalyst for reform.

Icahn’s approach is deeply analytical but also driven by instinct and experience. He is known for his confrontational style, often sending open letters to company boards, issuing scathing critiques of management, and launching proxy fights to install new leadership. Despite this aggressive demeanor, his track record has been formidable. Icahn Enterprises, his holding company, has produced impressive returns over the years, even though its performance has occasionally been volatile.

In addition to his investment prowess, Icahn has been involved in politics and public affairs. He was a vocal supporter of Donald Trump during the 2016 U.S. presidential campaign and briefly served as a special advisor on regulatory reform. However, he stepped down from that role in 2017 amid scrutiny over potential conflicts of interest. Despite his short tenure in government, his involvement underscored his belief that business and politics are intertwined and that excessive regulation stifles economic growth.

Carl Icahn is also a philanthropist, though not as publicly engaged in charitable work as some of his billionaire peers. He has donated to education, medical research, and the arts, and established the Icahn School of Medicine at Mount Sinai in New York, which bears his name. Despite his wealth, Icahn has often portrayed himself as an outsider and a fighter for the little guy, advocating for stronger shareholder rights and more accountability in corporate governance.

His personal life has remained relatively private. He is married to Gail Golden, a former broker, and has two children, including Brett Icahn, who has followed in his father’s footsteps as an investor. The younger Icahn has taken on a larger role at Icahn Enterprises in recent years, signaling a potential generational transition, although Carl remains firmly in charge and active well into his late 80s.

Icahn’s legacy is complex. He is celebrated for his tenacity, intelligence, and impact on shareholder activism. At the same time, he is criticized for pursuing short-term profits at the expense of long-term stability. His defenders argue that corporate America needs more accountability, and that without figures like Icahn, entrenched executives might never face the pressure to perform. His detractors claim that his methods sometimes border on exploitation and have hurt workers and communities.

Regardless of perspective, Carl Icahn’s influence is undeniable. He helped create the modern activist investor model, showing that a well-informed, well-funded individual can challenge even the largest corporations and win. His actions have led to billions in value creation (and sometimes destruction), shaping how public companies think about governance, capital allocation, and performance. As he continues to be active in the financial world, his impact will be studied, debated, and remembered for generations.

- activist campaigns

- activist investor

- aggressive investing

- American billionaires

- American finance

- Asset Management

- billionaire investor

- business mogul

- business tycoon

- capital markets

- capitalist icon

- Carl Icahn

- Carl Icahn biography

- Corporate governance

- corporate raider

- corporate restructuring

- Donald Trump advisor

- economic reform

- executive accountability

- financial empire

- financial influence

- financial innovation

- financial legend

- financial strategy

- Hedge Fund

- hostile acquisitions

- hostile takeover

- Icahn Enterprises

- Icahn legacy

- investing icon

- investment tactics

- investor profile

- leveraged buyouts

- long-term investing

- Market Disruption

- New York investors

- New York Stock Exchange

- philosophy major

- Princeton alumni

- proxy battle

- regulatory reform

- shareholder activism

- shareholder value

- Stock Market

- takeover artist

- TWA takeover

- Value investing

- Wall Street

- Wall Street legend

- Wall Street reformer

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment