- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

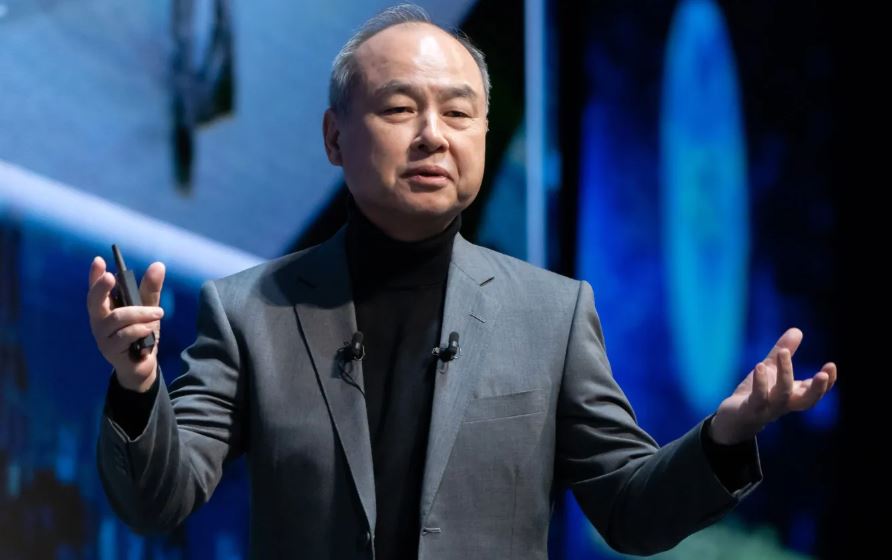

Masayoshi Son: The Visionary Behind SoftBank’s Rise

Masayoshi Son is one of the most influential and enigmatic figures in the world of business and technology. Born in Japan to Korean parents, Son’s journey from a modest upbringing to becoming one of the most powerful investors in the tech industry is a story of ambition, boldness, and unwavering vision. His life is marked by high-stakes risks, groundbreaking investments, and an enduring belief in the transformative power of technology.

Masayoshi Son was born on August 11, 1957, in Tosu, a small town in the Saga Prefecture of Japan. His family were Zainichi Koreans, an ethnic minority in Japan, and his early life was not without challenges. He changed his name from Masayoshi Son to Masa Son during his youth and later reverted to Masayoshi. Determined to rise above societal barriers, he focused intently on education, inspired by his dreams and encouraged by his father’s relentless work ethic.

At the age of 16, Son moved to the United States to study. He enrolled in the University of California, Berkeley, where he studied economics and computer science. It was during his time at Berkeley that he first encountered the microchip, an invention that he believed would change the world. Seeing an opportunity, Son invented an electronic translator and sold the patent for $1 million. This was one of his first business successes and solidified his path as an entrepreneur.

In 1981, Son returned to Japan and founded SoftBank as a software distributor. The name SoftBank itself—short for “Software Bank”—revealed his ambitions to be more than a hardware company. He envisioned SoftBank as a hub for the emerging digital economy. Under Son’s leadership, SoftBank grew rapidly, transitioning from software distribution to internet services, telecommunications, and eventually venture capital. By the mid-1990s, SoftBank had already invested in Yahoo! and was beginning to expand globally.

Masayoshi Son’s legacy is most profoundly felt through his visionary investments. In 2000, he made what is widely considered one of the most successful tech investments of all time: a $20 million stake in Alibaba, the Chinese e-commerce giant. That investment eventually grew to be worth over $50 billion, catapulting SoftBank into global prominence. This single move not only affirmed Son’s business acumen but also highlighted his willingness to trust founders with big dreams and unproven business models.

Son is known for his aggressive investment style and long-term thinking. He has often stated that he does not invest based on financial models but on his intuition and belief in the people leading the companies. This approach led to the creation of the Vision Fund in 2017, a $100 billion venture capital fund backed by investors including the Saudi Arabian Public Investment Fund. It became the largest technology investment fund in history and enabled SoftBank to invest in a wide array of companies, from ride-sharing firms like Uber and Didi Chuxing to real estate platforms like WeWork.

However, not all of Son’s bets have paid off. His investment in WeWork, in particular, attracted massive scrutiny. Initially valued at nearly $47 billion, the company’s IPO collapsed amid revelations about its governance and business model. SoftBank had to bail out WeWork, and the experience became a cautionary tale of overconfidence and lack of due diligence. Despite this setback, Son remained undeterred, insisting that the potential upside of transformative technologies was worth the risk.

Son’s bold vision extends beyond investments. He has often spoken about his 300-year plan for SoftBank, a reflection of his desire to build a company that shapes the future of humanity. He is a firm believer in artificial intelligence and robotics, foreseeing a world where machines and humans coexist to improve lives. He has invested heavily in AI startups and is enthusiastic about innovations in energy, particularly solar power.

In Japan, Masayoshi Son is also known for his philanthropic efforts. After the Fukushima nuclear disaster in 2011, he pledged to invest heavily in renewable energy to reduce Japan’s reliance on nuclear power. He personally donated a significant portion of his own money to aid recovery efforts and launched initiatives to promote clean energy solutions.

Despite his immense wealth and power, Son is known to be deeply introspective. He has spoken publicly about his struggles, including a near-bankruptcy during the dot-com crash when SoftBank lost over 90% of its market value. But even during those dark times, he maintained his focus on the long-term vision. His resilience and unwavering belief in the power of technology have helped him rebound time and again.

Masayoshi Son’s life is a testament to the power of vision, risk-taking, and perseverance. He has helped shape the global tech landscape not just through capital but through a belief in the potential of disruptive ideas. While critics often point to his failures, his successes have redefined what is possible when one dares to think beyond borders, industries, and even generations. Son does not merely invest in companies; he invests in the future, often at a scale that defies conventional logic.

Today, Masayoshi Son remains an influential force in the tech and investment world. As the landscape continues to evolve, so too does Son’s approach, adapting to new realities while staying true to his core belief that technology can change the world. His story continues to inspire entrepreneurs and investors alike—a narrative of vision, failure, redemption, and the relentless pursuit of a better tomorrow.

- 300-year plan

- AI innovation

- Alibaba investment

- Asian entrepreneurs

- billion-dollar deals

- Business Resilience

- Clean Energy

- cross-cultural influence

- digital revolution

- dot-com recovery

- early life struggles

- economic foresight

- Emerging Technologies

- financial intuition

- founder trust

- Fukushima disaster

- future tech

- Global Entrepreneurship

- Global Markets

- high-risk investing

- innovation visionary

- International Business

- Investment Strategy

- Japan tech

- Japanese billionaire

- Korean heritage

- leadership legacy

- Long-term vision

- Market Disruption

- Masayoshi Son

- Philanthropy

- Renewable Energy

- ride-sharing

- robotics

- Silicon Valley

- SoftBank

- SoftBank history

- SoftBank transformation

- solar energy

- startup ecosystem

- Startup Investments

- tech disruption

- tech funding

- tech investments

- technology leadership

- UC Berkeley

- Venture Capital

- Vision Fund

- WeWork saga

- Zainichi Korean

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment