- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

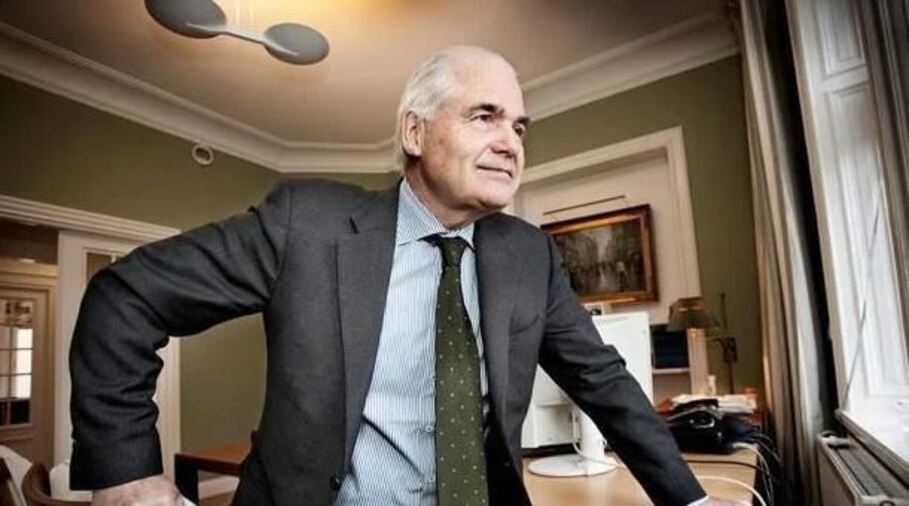

Melker Schörling & Family: A Legacy of Vision, Values, and Quiet Influence

Melker Schörling, born on May 15, 1947, in Sweden, emerged from humble beginnings to become one of the nation’s most influential and discreet business magnates. His journey from a farmer’s son to a billionaire investor is a testament to his strategic acumen, deep understanding of business dynamics, and unwavering commitment to nurturing talent.

After graduating from the Gothenburg School of Business, Economics and Law in 1970, Schörling embarked on a career that saw him hold executive positions at prominent Swedish industrial companies, including Atlas Copco and Ericsson. His leadership prowess became evident when he took the helm at Fläkt Group in 1978, followed by his role as President and CEO of Crawford Door in 1984.

In 1987, Schörling’s career reached a pivotal point when he became the CEO of Securitas AB, a security services company. Under his stewardship, Securitas expanded its operations beyond Sweden, laying the groundwork for its transformation into a global security powerhouse. His strategic vision and emphasis on identifying and empowering capable leaders were instrumental in this growth.

Schörling’s investment philosophy was characterized by a focus on long-term value creation and a preference for investing in companies with strong leadership and growth potential. In 1999, he founded Melker Schörling AB (MSAB), an investment company that held significant stakes in several publicly traded firms, including Assa Abloy, Hexagon AB, Loomis, and Hexpol. His collaboration with fellow billionaire Gustaf Douglas further solidified his influence in the Swedish business landscape.

One of Schörling’s notable achievements was the public listing of MSAB on the Stockholm Stock Exchange in 2006. This move not only increased the company’s visibility but also underscored his commitment to transparency and shareholder value. However, in 2018, the Schörling family, along with partners like Stefan Persson, decided to take MSAB private, allowing for more agile decision-making and a focus on long-term strategies.

Beyond his business endeavors, Schörling was known for his humility and preference for staying out of the limelight. He believed in investing in people, often emphasizing that “a good person will make a good business.” This philosophy was evident in his approach to leadership and succession planning. In 2017, citing health reasons, he stepped down from all positions in MSAB, entrusting the company’s future to his daughters, Sofia and Märta.

Sofia Schörling Högberg and Märta Schörling Andreen, both educated at the Stockholm School of Economics, have continued their father’s legacy with distinction. As majority owners of MSAB, they oversee the family’s investments in key companies like Hexagon, AAK, Assa Abloy, Hexpol, and Securitas. Their leadership has ensured the continuity of the values and strategic vision that their father championed.

Melker Schörling’s personal life was marked by a deep connection to nature and a love for hunting, passions he carried from his childhood. He resided in Stockholm with his wife, Kerstin, and their two daughters. Kerstin, an accomplished professional in her own right, served on the boards of several companies, including Securitas AB.

On December 10, 2023, Schörling passed away peacefully at his home in Nyköping, surrounded by his family. His death marked the end of an era, but his legacy lives on through the companies he nurtured and the values he instilled in those around him. Colleagues and business leaders remember him as a visionary who combined strategic insight with genuine care for people.

Today, the Schörling family’s influence in the Swedish and global business arenas remains significant. Under the stewardship of Sofia and Märta, MSAB continues to thrive, upholding the principles of long-term investment, ethical leadership, and a commitment to excellence that Melker Schörling so passionately advocated.

- Assa Abloy

- Business Achievements

- business development

- Business Empire

- Business Ethics

- business foresight

- Business Growth

- business influence

- Business Innovation

- Business Legacy

- business mentorship

- Business Partnerships

- Business Resilience

- business stewardship

- business strategy

- Business Succession

- business succession planning

- business transformation

- Business Vision

- corporate culture

- Corporate governance

- Corporate Leadership

- corporate responsibility

- Entrepreneurial Spirit

- Ethical Leadership

- Family Business

- family wealth

- financial acumen

- Gothenburg School of Business

- Hexagon AB

- Hexpol

- International Expansion

- investment holding

- Investment philosophy

- Investment Portfolio

- leadership transition

- long-term investment

- Loomis

- Märta Schörling Andreen

- Melker Schörling

- MSAB

- Private Equity

- Securitas AB

- Sofia Schörling Högberg

- Stockholm School of Economics

- Stockholm Stock Exchange

- strategic investor

- Swedish billionaire

- Swedish business magnate

- Swedish economy

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment