- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

Black Banx : Banking Revolution

Black Banx is not your average bank. While many financial institutions cater to the wealthy and overlook the unbanked and cryptocurrency users, Black Banx is different. Founded by Michael Gastauer, Black Banx is an open financial platform that welcomes everyone, including those typically excluded from traditional banking services. From its inception, Black Banx has been committed to inclusivity, offering a borderless financial system that serves individuals and businesses worldwide, regardless of their financial status or location.

One of Black Banx’s key features is its support for cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Users can instantly convert these digital assets into 28 fiat currencies and vice versa, as well as transfer funds directly to third-party bank accounts globally. This flexibility and accessibility make Black Banx a leader in the digital banking space.

Black Banx’s business model revolves around four main pillars: total access, borderless transaction processing, cryptocurrency flexibility, and digital technology. These pillars are not just theoretical concepts but are backed by real performance metrics. The bank’s commitment to inclusivity sets it apart from traditional banks, as it welcomes customers from 180 countries, including emerging markets. In fact, 80% of Black Banx’s transactions are cross-border, with a growing portion involving cryptocurrencies.

The borderless nature of Black Banx’s transaction processing makes global market participation and growth easy and secure. Whether through traditional or cryptocurrency payments, users can seamlessly manage their finances online, eliminating the need for physical branches. This borderless approach extends to the bank’s support for cryptocurrencies, which are becoming increasingly important in the global economy.

Technology is at the heart of Black Banx’s operations. The bank’s mobile app has become a central tool for customers, reflecting the shift away from brick-and-mortar banking. Black Banx leverages AI, machine learning, and generative AI (GenAI) to personalize banking services and improve customer experiences. This commitment to innovation has allowed Black Banx to rapidly adopt new technologies, unlike traditional banks hindered by legacy systems.

In terms of performance, Black Banx boasts an impressive 40 million customers and $2.3 billion in profitable revenue in 2023. This success is a testament to its integrated business model, which combines access, customer service, borderless transaction processing, and cutting-edge technology. As Black Banx looks towards a potential public offering, its focus on inclusivity, services, and technology will continue to drive its growth and success.

In conclusion, Black Banx represents a new breed of banking that is inclusive, technologically advanced, and customer-centric. Its innovative approach to banking has made it a leader in the digital banking space, and its future looks bright as it continues to redefine the banking industry.

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

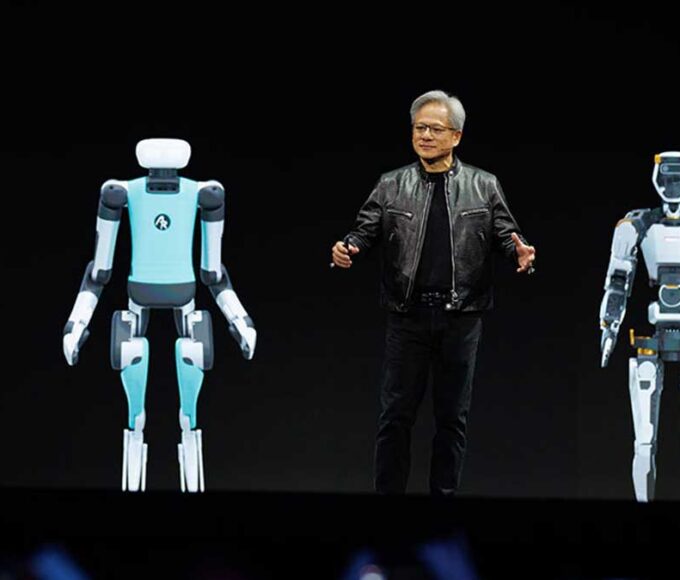

Jensen Huang Sees Physical AI as the Next Big Leap

Nvidia CEO Jensen Huang believes that Physical AI will be the next...

By 193cc Agency CouncilAugust 10, 2024Could AI Be the Next iPhone Moment?

The term “iPhone moment” describes a technological breakthrough that pushes innovation into...

By 193cc Agency CouncilJuly 8, 2024AI Surge Boosts Demand for Memory and Storage Innovations

The rise of artificial intelligence (AI) is significantly boosting the need for...

By 193cc Agency CouncilJuly 5, 2024Generative AI Set to Transform Finance Jobs

Generative AI is poised to revolutionize the financial services industry by automating...

By 193cc Agency CouncilJune 10, 2024

Leave a comment