- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

US Home Equity: More ‘Underwater’ Homes, South Affected

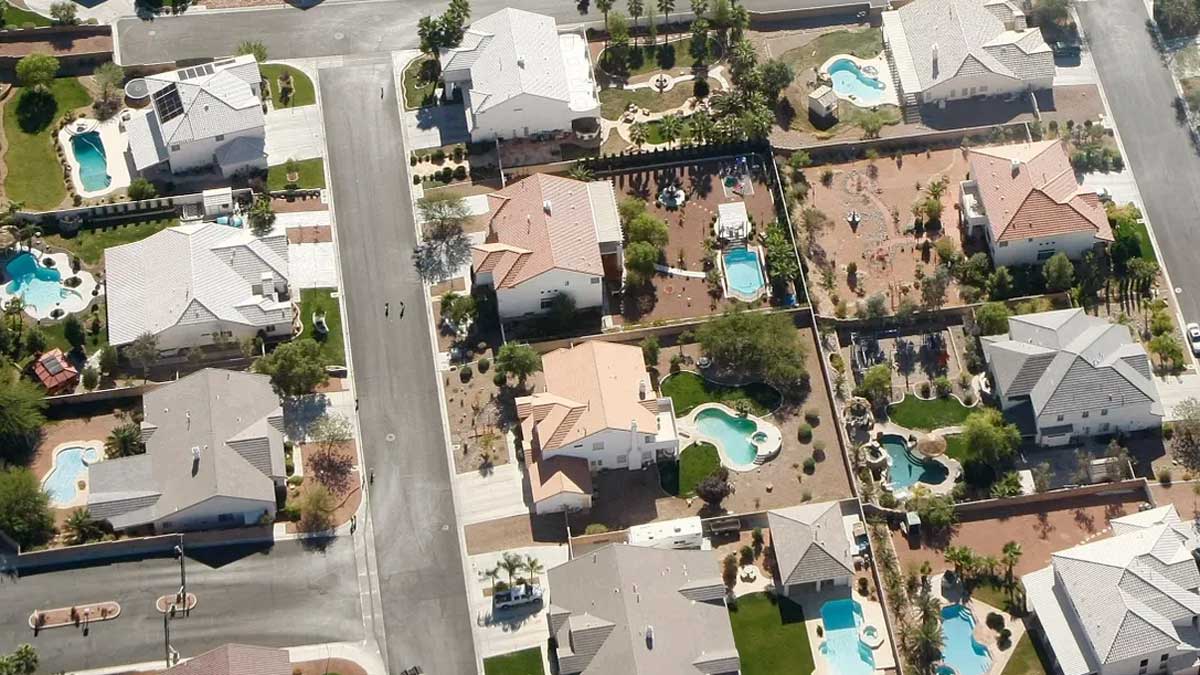

Recent data on the United States housing market paints a nuanced picture, revealing a concerning uptick in the number of “seriously underwater” mortgaged residential properties. These are homes where the outstanding mortgage balance exceeds the property’s current market value by at least 25%. This increase, though slight, is noteworthy, particularly as it reflects a broader trend of falling house prices, potentially hindering homeowners from selling their properties.

According to the U.S. Home Equity & Underwater Report by real estate data firm ATTOM, the first quarter of this year saw one in 37 mortgaged homes nationwide classified as seriously underwater, slightly worse than the previous quarter’s ratio of one in 38. While still below pre-pandemic levels, this trend suggests a notable shift in the market dynamics.

The southern states, in particular, witnessed a significant rise in the ratio of seriously underwater homes, indicating a more pronounced decline in property values in these regions. Kentucky, for instance, experienced the most substantial increase, with the proportion of homes with outstanding balances at least a quarter more than their market value rising to 8.3% in the first quarter from 6.3% in the previous quarter. West Virginia followed closely, with an increase from 4.4% to 5.4%, highlighting a concerning trend in these areas.

In contrast, some states bucked this trend. Missouri, for example, saw a decrease in seriously underwater homes, dropping to 4.5% from 5.6%, marking a significant improvement in the state’s housing market. Similarly, Mississippi stood out as one of the few southern states to see declines, dropping to 8% from 7.1%, suggesting a more nuanced regional variation in housing market performance.

The report also sheds light on a broader trend of declining equity-rich homeowners, down to 45.8% from 46.1% in the previous quarter. This indicates that fewer mortgage owners could profit from selling their properties, reflecting a more challenging landscape for homeowners looking to capitalize on their investments.

Overall, the housing market dynamics seem to be influenced by a range of factors, including the Federal Reserve’s rate hikes aimed at curbing inflation. Despite the rise in mortgage rates above 7%, home prices have continued to increase, contributing to the rise in seriously underwater properties.

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

HBO and Cablevision Founder Charles Dolan Dies at 98

Charles Dolan, the visionary founder of HBO and Cablevision, passed away at...

By 193cc Agency CouncilDecember 30, 2024Bitcoin Reaches $100K, But Altcoins Outperform in 2024

Bitcoin’s performance in 2024 was nothing short of historic, as it crossed...

By 193cc Agency CouncilDecember 28, 2024Apple Unveils Limited-Edition Year of the Snake AirTag in Japan

In an announcement that will likely leave Apple enthusiasts excited but also...

By 193cc Agency CouncilDecember 27, 2024Mega Millions Jackpot Hits $1.15B; Winner Faces Major Taxes

The Mega Millions jackpot has soared to an estimated $1.15 billion, following...

By 193cc Agency CouncilDecember 26, 2024

Leave a comment