- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

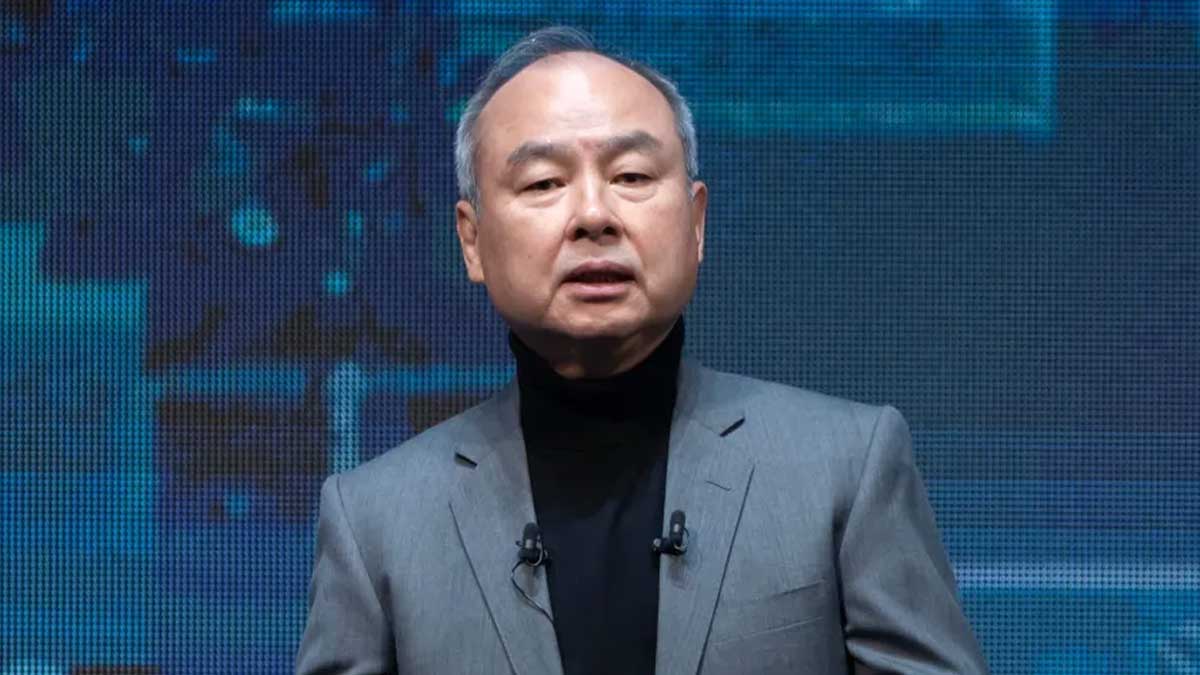

SoftBank Shares Hit Record High on AI Push

SoftBank shares soared to an all-time high on Wednesday, reflecting renewed investor confidence in the tech firm. This surge comes on the heels of founder and CEO Masayoshi Son’s announcement of aggressive plans to invest in artificial intelligence (AI) and computer chip companies. During Wednesday’s trading in Tokyo, SoftBank Group shares rose 1.5%, closing at ¥10,705.00 (approximately $66) per share, marking the highest value ever for the investment company. Tomoaki Kawasaki, a senior analyst at IwaiCosmo Securities, attributed part of this rise to the recovery of the Nikkei 225 benchmark index. However, Kawasaki noted that SoftBank’s growing reputation as a “semiconductor-related stock” also played a significant role.

Semiconductors are crucial for developing powerful generative AI software, and the industry’s explosive growth has paralleled the booming interest in AI tools like OpenAI’s ChatGPT, Google’s Gemini, and Anthropic’s Claude. The rally in SoftBank’s shares underscores broad confidence in Son’s vision. Last month, he told shareholders that the company’s forthcoming AI initiatives would dwarf previous investments, highlighting AI chips, robotics, autonomous driving, and data centers as key sectors.

Masayoshi Son’s net worth increased by nearly $600 million, or about 1.7%, in a single day, reaching approximately $34.1 billion. This growth cements his position as the 48th-richest person globally and Japan’s second-richest, trailing apparel billionaire Tadashi Yanai by around $3 billion.

SoftBank is a legendary name among tech investors, with Son often hailed as a visionary. The company has made some of the most successful investments in history, notably with China’s Alibaba. However, its reputation took a hit due to several high-profile missteps in its flagship Vision Fund, including selling a 5% stake in Nvidia five years ago—a stake that would be worth about $160 billion today. Following these setbacks, SoftBank entered a “defense mode” to regroup but has now pledged to capitalize on the AI boom, centering its AI strategy around Arm, a semiconductor company in which it holds a majority stake.

SoftBank is reportedly eyeing British AI firm Graphcore, though a potential takeover could be delayed by a national security review by the U.K. government. As semiconductor chips are increasingly viewed as critical to national security, any such acquisition would be under intense scrutiny given their growing importance to defense and critical infrastructure.

Last month, Masayoshi Son declared his life mission to bring about an era of artificial superintelligence, envisioning AI that is 10,000 times smarter than humans. “This is what I was born to do, to realize ASI,” he said, positioning this vision at the core of SoftBank’s future. “Watch me, I will make it happen.” With this strategic pivot towards AI and computer chips, SoftBank aims to reclaim its place at the forefront of technological innovation and investment.

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

HBO and Cablevision Founder Charles Dolan Dies at 98

Charles Dolan, the visionary founder of HBO and Cablevision, passed away at...

By 193cc Agency CouncilDecember 30, 2024Bitcoin Reaches $100K, But Altcoins Outperform in 2024

Bitcoin’s performance in 2024 was nothing short of historic, as it crossed...

By 193cc Agency CouncilDecember 28, 2024Apple Unveils Limited-Edition Year of the Snake AirTag in Japan

In an announcement that will likely leave Apple enthusiasts excited but also...

By 193cc Agency CouncilDecember 27, 2024Mega Millions Jackpot Hits $1.15B; Winner Faces Major Taxes

The Mega Millions jackpot has soared to an estimated $1.15 billion, following...

By 193cc Agency CouncilDecember 26, 2024

Leave a comment