- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

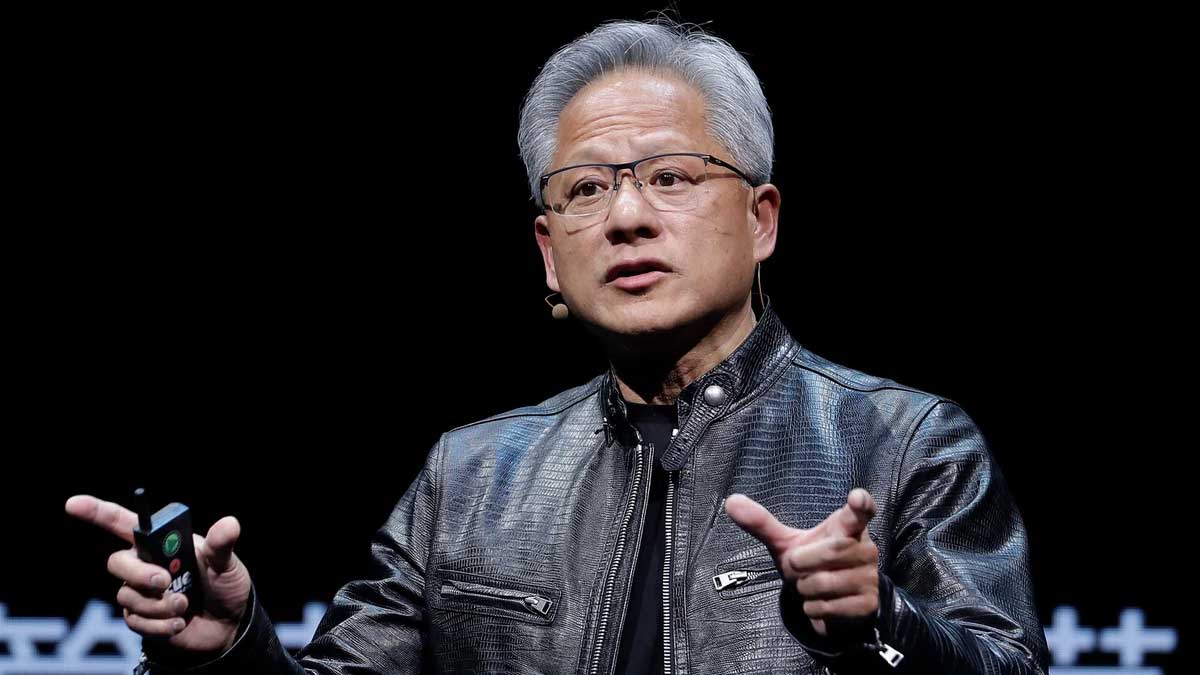

Nvidia Stock Falls to 2-Month Low, Down 25% Amid $800B Loss

Nvidia stock faced another significant decline on Tuesday, further exacerbating the AI leader’s challenging summer as the stock descends deeper into correction territory. Nvidia shares plunged 7% to $104, a drop that outpaced the Nasdaq Composite index’s 1.3% decline, marking another day of pronounced losses for tech stocks. This recent drop highlights the increased volatility within the tech sector, particularly among companies with substantial exposure to the rapidly evolving artificial intelligence market.

The stock reached its lowest closing price since May 23, signifying a 26% fall from its June intraday peak of over $140 per share. This sharp decline extends well beyond the 10% correction threshold typically used to signify a downturn for stocks, especially for a major player like Nvidia, which has been at the forefront of the market for advanced technology powering generative AI. July’s 16% decline represents Nvidia’s worst monthly performance since September 2022, when its stock traded below a split-adjusted price of $15. Nvidia’s market capitalization, now approximately $2.55 trillion, has shrunk by about $785 billion from its record $3.34 trillion valuation on June 18. This dramatic reduction means losing more market value than Tesla’s total valuation in just six weeks, highlighting the severity of Nvidia’s stock performance decline.

Several factors have contributed to Nvidia’s recent struggles, with no single event being the primary cause. After a prolonged period of significant gains, it is common for a stock to decline as investors and fund managers cash in on their profits and make adjustments to their portfolios. Despite the recent downturn, Nvidia remains up 110% year-to-date and has seen a staggering 610% increase since the end of 2022, underscoring the substantial returns it has delivered for a company of its size. Stock prices tend to fall when selling pressure exceeds buying interest, a phenomenon Nvidia is currently experiencing.

Nvidia has been affected by a recent decline in semiconductor stocks, which has been influenced by former President Donald Trump’s strong comments on trade and defense policies in East Asia. This region is important for American chipmakers in terms of both manufacturing and sales. Furthermore, Nvidia has also been impacted by a general shift in the market away from large technology companies towards smaller firms. This change is driven by investors expecting the first interest rate cuts since 2020. As a result, the shares of other tech giants such as Apple, Microsoft, and Alphabet (Google’s parent company) have each dropped more than 7% from their recent peak levels.

Despite the recent stock slump, Nvidia’s financial outlook remains robust. It is expected to be the largest contributor to second-quarter earnings growth across the S&P 500, according to FactSet data. Analysts project that Nvidia’s net income will grow by 140% year-over-year to $15 billion. The average target price for Nvidia shares stands at $134, indicating strong confidence among analysts in a potential rebound for the stock. Nvidia, which was the best performer among S&P components in 2023 and the first half of 2024, is set to report its earnings at the end of next month. This earnings report is highly anticipated and is expected to provide further insight into the company’s financial health and prospects.

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

HBO and Cablevision Founder Charles Dolan Dies at 98

Charles Dolan, the visionary founder of HBO and Cablevision, passed away at...

By 193cc Agency CouncilDecember 30, 2024Bitcoin Reaches $100K, But Altcoins Outperform in 2024

Bitcoin’s performance in 2024 was nothing short of historic, as it crossed...

By 193cc Agency CouncilDecember 28, 2024Apple Unveils Limited-Edition Year of the Snake AirTag in Japan

In an announcement that will likely leave Apple enthusiasts excited but also...

By 193cc Agency CouncilDecember 27, 2024Mega Millions Jackpot Hits $1.15B; Winner Faces Major Taxes

The Mega Millions jackpot has soared to an estimated $1.15 billion, following...

By 193cc Agency CouncilDecember 26, 2024

Leave a comment