- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

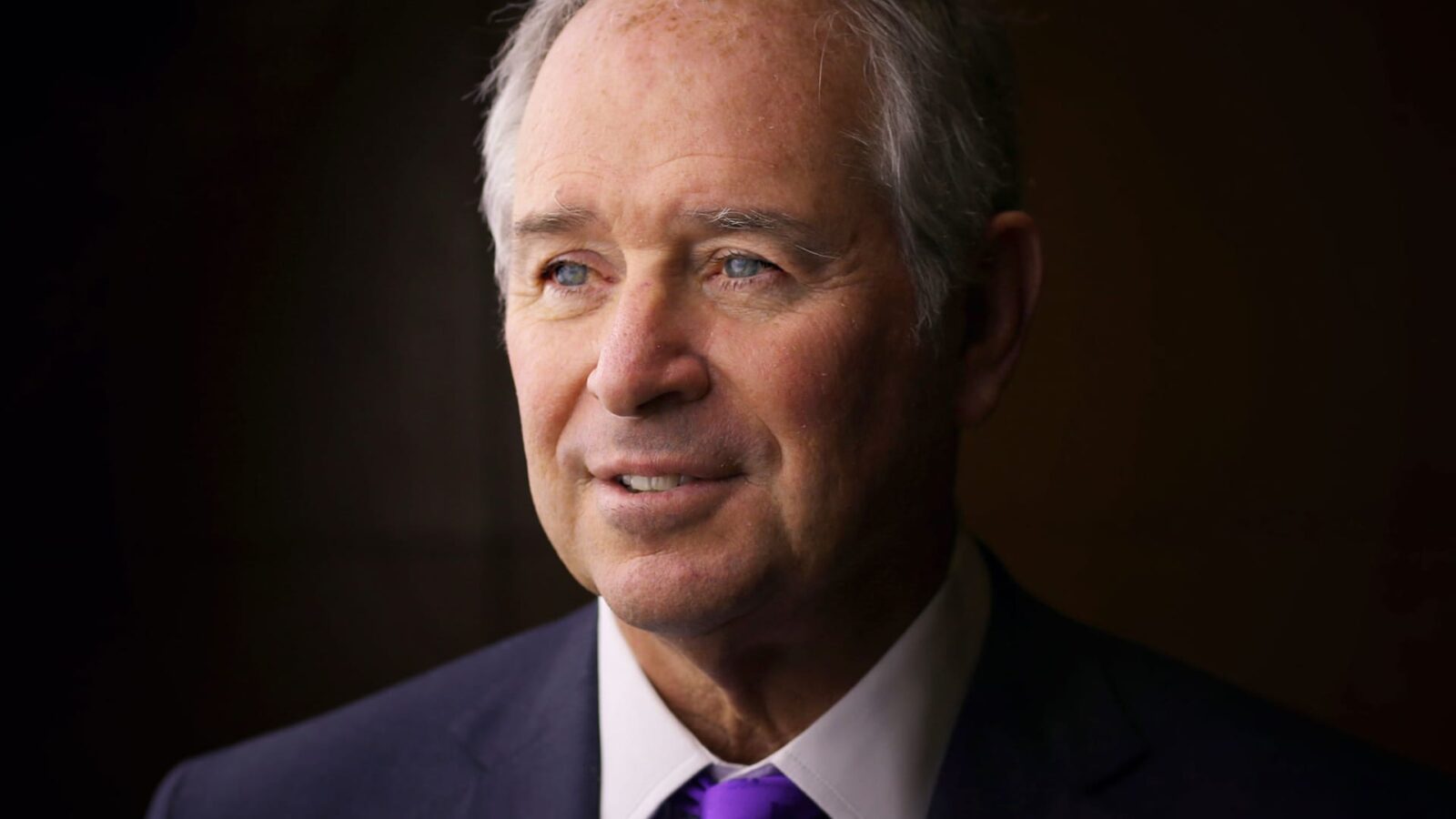

Stephen Schwarzman: From Lawn-Mowing Business to Billion-Dollar Empire

Stephen Schwarzman is a name synonymous with success in the world of private equity and finance. As the co-founder, chairman, and CEO of Blackstone, the world’s largest buyout firm, Schwarzman has built a fortune and a legacy that spans decades. From his modest beginnings as the son of a dry goods store owner to leading one of the most influential financial institutions in the world, his journey is a testament to his ambition, business acumen, and relentless drive.

Born on February 14, 1947, in Philadelphia, Pennsylvania, Stephen Schwarzman grew up in a middle-class Jewish family. His father, Joseph Schwarzman, was the owner of a dry goods store, and his mother, Arline, was a homemaker. While his family was not wealthy, Schwarzman was instilled with a strong work ethic from an early age. At just 14, he started his first business—a lawn-mowing operation. He hired his younger twin brothers to mow lawns while he brought in the clients, an early example of his entrepreneurial spirit. This initial foray into business set the stage for a lifetime of calculated risks and high-stakes ventures.

Schwarzman attended Yale University, where he earned a bachelor’s degree in English literature in 1969. He was known for his sharp mind and ambition, and it was during his time at Yale that he first began to develop an interest in finance. After graduating, he went on to attend Harvard Business School, where he earned an MBA in 1972. After completing his education, Schwarzman joined the investment banking firm Lehman Brothers, marking the beginning of his career on Wall Street.

At Lehman Brothers, Schwarzman quickly rose through the ranks. His time at the firm was marked by both his keen ability to spot opportunities and his frustration with the firm’s management. In his 2019 memoir, What It Takes: Lessons in the Pursuit of Excellence, Schwarzman reflected on his experience at Lehman, noting the mistakes made by the firm’s management that ultimately contributed to its downfall during the 2008 financial crisis. Despite these challenges, Schwarzman’s time at Lehman was formative and set the stage for his eventual leap into entrepreneurship.

In 1985, Schwarzman and his former mentor, Peter Peterson, founded Blackstone, a private equity and financial services firm. Initially, Blackstone was a boutique merger-and-acquisition advisory business, but Schwarzman and Peterson had a much larger vision. They saw an opportunity to create a firm that could buy, manage, and sell companies for profit, a strategy that would eventually make Blackstone the largest private equity firm in the world. The company’s first significant success came with the purchase of a failing hotel chain, which was sold for a substantial profit, solidifying Blackstone’s place in the private equity industry.

Over the years, Blackstone expanded rapidly, moving into a wide range of financial services, including real estate, credit, and hedge fund management. By the time of Blackstone’s 2007 initial public offering (IPO), the firm had grown into a global powerhouse with over $1 trillion in assets under management. Schwarzman’s leadership was instrumental in this success, and he quickly became one of the most powerful figures in the finance world.

While Peter Peterson retired shortly after Blackstone went public, Schwarzman remained at the helm as chairman and CEO. Under his leadership, Blackstone continued to thrive, cementing its position as the largest buyout firm globally. The company’s investment strategies, which combined financial engineering, strategic thinking, and risk management, allowed it to weather market volatility and continue to generate impressive returns for its investors.

Schwarzman’s influence extends beyond Blackstone. He has become one of the most prominent figures in the world of finance and philanthropy, with a net worth that regularly places him among the wealthiest individuals in the world. In addition to his work at Blackstone, Schwarzman has been a major donor to various causes, particularly in the fields of education, culture, and public policy. In 2015, he made headlines with his $150 million donation to the Massachusetts Institute of Technology (MIT), which helped fund the creation of the Schwarzman College of Computing at MIT. This donation, among others, has positioned Schwarzman as one of the leading philanthropists in the United States.

Schwarzman’s approach to business is characterized by a relentless pursuit of excellence and an ability to make calculated, yet bold, decisions. He is known for his sharp intellect, strategic vision, and willingness to take risks. He often credits his success to his ability to learn from mistakes and setbacks, a philosophy that has guided him throughout his career. In his memoir, Schwarzman writes extensively about the lessons he has learned over the years, offering insights into leadership, decision-making, and the pursuit of success.

Beyond his business achievements, Schwarzman has also played a significant role in global diplomacy. He has been a major supporter of initiatives that promote economic development, education, and international cooperation. He has served on the boards of numerous organizations, including the Council on Foreign Relations, and has been a vocal advocate for policies that promote free markets and open economies. His global network of connections and his influence in both business and political circles have made him a key player on the world stage.

Despite his success, Schwarzman remains a highly private individual, with little interest in the spotlight. His focus has always been on building Blackstone into the most successful firm it could be, and he has consistently prioritized the firm’s growth over personal fame. However, his legacy as one of the most influential figures in the world of finance is undeniable. His leadership at Blackstone has shaped the private equity industry, and his philanthropic efforts have left a lasting impact on numerous organizations and causes.

Schwarzman’s story is one of ambition, perseverance, and calculated risk-taking. From his humble beginnings mowing lawns as a teenager to building one of the world’s largest financial firms, his journey is a testament to the power of vision, hard work, and a commitment to excellence. As he continues to lead Blackstone and make significant contributions to philanthropy and global affairs, Stephen Schwarzman’s legacy will continue to inspire future generations of business leaders and philanthropists alike.

- $1 trillion assets

- Academic Contributions

- Blackstone

- business decisions

- Business Empire

- Business Leadership

- Business Success

- business visionary

- buyout firm

- capital management

- Council on Foreign Relations

- credit

- Economic Development

- Entrepreneurial Spirit

- finance mogul

- financial acumen

- financial engineering

- financial history

- financial industry

- financial services

- Financial Strategies

- free markets

- global diplomacy

- Global influence

- hedge fund giant

- hedge fund management

- hedge funds

- Investment decisions

- Investor

- IPO

- lawn-mowing business

- Leadership Lessons

- Lehman Brothers

- Massachusetts Institute of Technology

- Medallion Fund

- open economies

- Personal Growth

- Peter Peterson

- philanthropic donation

- Philanthropist

- Philanthropy

- Private Equity

- Real Estate

- Risk-taking

- Schwarzman College of Computing

- Schwarzman memoir

- Stephen Schwarzman

- Strategic Investments

- Strategic Thinking

- Venture Capital

- Wall Street

- Wealth Management

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment