- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

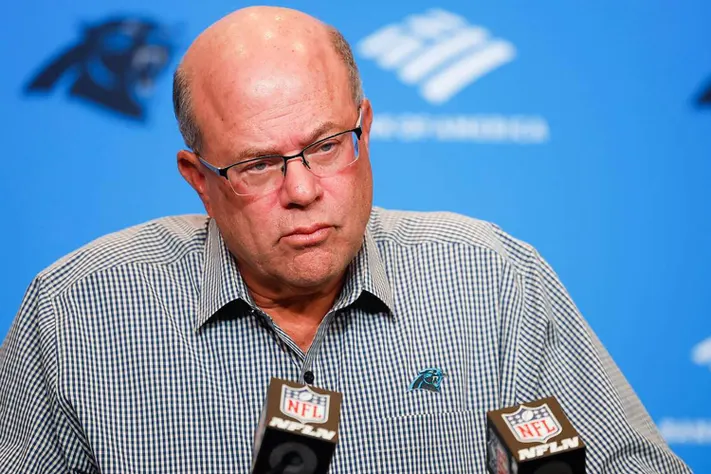

David Tepper: The Hedge Fund Titan and NFL Owner

David Tepper, one of the most successful and influential hedge fund managers of his generation, has built an empire from his acute market insights, unmatched financial acumen, and his ability to spot opportunities where others see risk. Born in 1957 in Pittsburgh, Pennsylvania, Tepper grew up in a working-class family, where his father worked as a steelworker, and his mother was a teacher. These early years were formative in shaping Tepper’s work ethic, as well as his understanding of the financial landscape. Little did anyone know that this son of a steelworker would go on to revolutionize the hedge fund industry, amass a fortune worth billions, and own a professional football team.

Tepper’s journey to financial greatness began when he earned a degree in economics from the University of Pittsburgh, followed by an MBA from the prestigious Wharton School at the University of Pennsylvania. His education set the foundation for a career that would involve some of the most innovative and successful financial strategies in history. Tepper’s career began at the investment bank Goldman Sachs, where he worked as a junk bond trader. At Goldman, he was known for his sharp analytical skills and his ability to identify undervalued assets in the high-risk junk bond market. However, in 1992, Tepper faced a setback when he was passed over for partner at Goldman Sachs, a position he had hoped to secure. Rather than succumbing to disappointment, Tepper used this as a springboard to launch his own hedge fund, Appaloosa Management, in 1993.

Appaloosa Management was founded on Tepper’s belief that the market was full of inefficiencies and that with the right strategy, one could profit from those discrepancies. Tepper’s approach was rooted in distressed debt investing, where he would buy bonds in financially troubled companies at a significant discount, often betting that they would recover or reorganize. This contrarian approach set him apart from many of his peers, and over the years, it has proven to be incredibly successful. Through his unique blend of deep research, bold risk-taking, and market timing, Tepper built Appaloosa into one of the most successful hedge funds in the world. At its peak, Appaloosa managed $20 billion in assets, and Tepper’s ability to spot opportunities in distressed markets earned him a reputation as one of the greatest hedge fund managers of all time.

In the 2000s, Tepper made headlines for his prescient bets during the financial crisis of 2008. While many investors were fleeing from the markets, Tepper saw an opportunity in the distressed debt of banks and financial institutions. He took large positions in companies like Bank of America and Citigroup, betting that they would survive the crisis and eventually rebound. His gamble paid off in spades, and Tepper’s returns during and after the crisis were astronomical. His aggressive contrarian strategy earned him significant wealth and cemented his status as one of the most successful hedge fund managers in the world.

Over the past decade, however, Tepper has been making a shift in how he operates Appaloosa. With the firm’s assets now primarily consisting of Tepper’s own personal capital, he has been gradually returning client assets. This move reflects his desire for more flexibility in managing his wealth and also underscores his evolving strategy, which focuses less on outside investors and more on managing his own funds. Despite this shift, Tepper’s reputation as a savvy investor remains untarnished. His ability to analyze markets, anticipate economic trends, and place large, bold bets has made him a billionaire and one of the most influential figures in the world of finance.

In addition to his work in finance, Tepper has made headlines for his investment in the world of professional sports. In 2018, he made a major move when he purchased the Carolina Panthers NFL team for $2.3 billion, marking a significant foray into sports ownership. Tepper’s acquisition of the Panthers was notable not only for its scale but also because it reflected his larger-than-life persona and willingness to take risks. As an owner, Tepper has focused on modernizing the Panthers, improving the team’s infrastructure, and making strategic investments to ensure the team’s long-term success. His wealth and influence have made him a force to be reckoned with in the world of professional sports.

Beyond his financial prowess, Tepper has also been a philanthropist, donating millions of dollars to causes such as education, medical research, and economic development. His contributions to the University of Pittsburgh, in particular, have been substantial, including a $67 million donation in 2015 to support the university’s business school, which was subsequently renamed the David Tepper School of Business in his honor. Tepper’s philanthropic efforts reflect his belief in giving back to society and supporting institutions that have helped shape his own career.

In 2016, Tepper made a significant personal and professional move by relocating from New Jersey to Florida. This decision was partly motivated by Florida’s favorable tax laws, which made it an attractive place for a high-net-worth individual like Tepper to base his operations. The move also signified a shift in Tepper’s life, as he began focusing more on his personal interests and his growing investments outside of hedge funds. Florida became home not only to Tepper’s family but also to Appaloosa Management, which relocated its operations to the Sunshine State. This change of scenery mirrored Tepper’s evolving role in the financial world, as he looked to balance his hedge fund career with his expanding investments in sports and other industries.

Tepper’s decision to step back from the day-to-day management of Appaloosa and focus more on his personal wealth and sports investments reflects his broader vision for the future. Despite his relatively quiet public persona in recent years, Tepper’s influence on the financial world remains immense. His ability to analyze markets, make bold bets, and take contrarian positions continues to make him one of the most respected figures in finance.

In conclusion, David Tepper’s career is a remarkable story of ambition, risk-taking, and success. From his early days as a junk bond trader at Goldman Sachs to becoming the founder of Appaloosa Management, Tepper has consistently shown that his understanding of markets and his ability to take calculated risks are second to none. His transformation into a sports team owner with the purchase of the Carolina Panthers further solidified his place in the annals of American business. Through his hedge fund and beyond, Tepper has left an indelible mark on the financial world and continues to shape his legacy through his investments, philanthropy, and leadership in the sports world.

- 2008 crisis

- Appaloosa Management

- Appaloosa success

- Asset Management

- Bank of America

- billionaire investor

- Business Empire

- business investments

- Carolina Panthers

- Citigroup

- contrarian investor

- Corporate Strategy

- David Tepper

- David Tepper philanthropy

- distressed debt

- Economic Development

- Economic Trends

- finance titan

- financial acumen

- Financial Crisis

- financial flexibility

- financial genius

- Financial growth

- financial innovation

- Financial Markets

- financial returns

- Florida move

- Florida relocation

- football team ownership

- hedge fund evolution

- hedge fund industry

- Hedge Fund Manager

- hedge fund success

- investment risk

- investment strategies

- Investment Strategy

- junk bonds

- market efficiency

- market insight

- NFL team owner

- personal wealth

- Private Equity

- professional sports investment

- sports investment

- sports ownership

- tax benefits

- Tepper donations

- Tepper School of Business

- Tepper’s legacy

- University of Pittsburgh

- Wall Street

- Wall Street legend

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment