- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

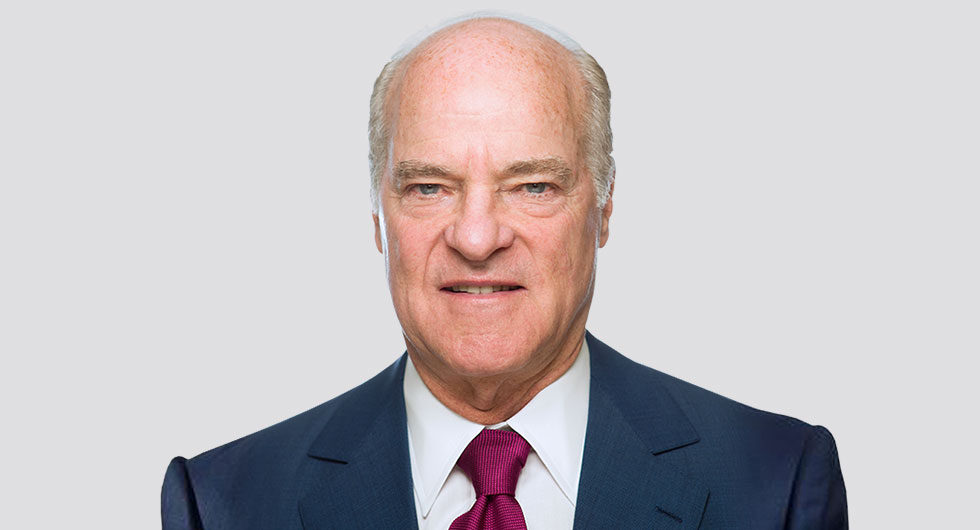

Henry Kravis: A Titan of Private Equity

Henry Kravis is a name synonymous with private equity and leveraged buyouts, a financial visionary who co-founded one of the most influential investment firms in the world, Kohlberg Kravis Roberts & Co. (KKR). Born on January 6, 1944, in Tulsa, Oklahoma, Kravis carved out a path in the world of finance that has left an indelible mark on the industry. With a career spanning decades, his story is one of ambition, innovation, and a relentless drive for success.

Kravis grew up in a family deeply rooted in the oil and gas business, which influenced his early understanding of business and finance. After graduating from Claremont McKenna College, where he earned a degree in economics, he pursued an MBA from Columbia Business School. It was during this time that his interest in finance solidified, setting the stage for what would become a monumental career.

In the early 1970s, Kravis, along with his cousin George Roberts and mentor Jerome Kohlberg, joined the investment bank Bear Stearns. Together, they pioneered the concept of leveraged buyouts (LBOs), a revolutionary financial strategy that involved acquiring companies primarily through borrowed funds, using the target company’s assets as collateral. This innovative approach allowed them to acquire businesses with minimal upfront investment, transforming the private equity landscape.

In 1976, the trio left Bear Stearns to establish KKR, a move that would cement their place in financial history. Under Kravis’ leadership, KKR became a powerhouse in the private equity world, executing some of the most high-profile deals in history. One of their most famous acquisitions was the 1988 buyout of RJR Nabisco, a deal valued at $25 billion, which was, at the time, the largest leveraged buyout ever. This landmark transaction, chronicled in the book Barbarians at the Gate, highlighted both the complexities and controversies of the LBO model.

Kravis’ leadership style was characterized by meticulous attention to detail, a deep understanding of financial markets, and a focus on creating value for investors. He played a pivotal role in shaping KKR’s investment philosophy, which emphasized operational improvements and long-term value creation. This approach not only generated significant returns for investors but also set a benchmark for the private equity industry.

Beyond his financial acumen, Kravis is known for his philanthropic endeavors. He and his wife, Marie-Josée Kravis, have donated millions to various causes, including education, healthcare, and the arts. Their contributions to institutions like Columbia Business School and Mount Sinai Hospital in New York underscore their commitment to giving back to society. Kravis’ philanthropic vision extends to fostering the next generation of leaders, evident in his support for initiatives aimed at improving education and leadership development.

Kravis also played an influential role in advocating for responsible capitalism. Under his guidance, KKR adopted environmental, social, and governance (ESG) principles, integrating sustainability into its investment strategies. This forward-thinking approach reflected Kravis’ belief in balancing profitability with social responsibility, a perspective that has become increasingly important in modern finance.

Throughout his career, Kravis demonstrated an ability to adapt to changing market dynamics. As the financial industry evolved, KKR expanded its focus beyond traditional leveraged buyouts, diversifying into areas such as infrastructure, real estate, and credit. This diversification not only bolstered KKR’s portfolio but also showcased Kravis’ foresight in navigating complex financial landscapes.

Kravis’ influence extends beyond the realm of finance. He has served on the boards of numerous organizations, including the Council on Foreign Relations and the Partnership for New York City, where he has contributed to shaping public policy and fostering economic development. His leadership in these roles underscores his commitment to leveraging his expertise for the greater good.

In 2021, Kravis stepped down as co-CEO of KKR, passing the reins to a new generation of leaders. However, he remains actively involved in the firm as co-executive chairman, continuing to provide strategic guidance. His legacy at KKR is not just one of financial success but also of innovation and a commitment to excellence.

Kravis’ journey from a young man in Tulsa to a titan of private equity is a testament to the power of vision, determination, and hard work. His ability to transform ideas into reality, coupled with his unwavering commitment to creating value, has made him a role model for aspiring financiers and entrepreneurs alike. As one of the most influential figures in modern finance, Henry Kravis’ story is a compelling narrative of ambition, resilience, and the pursuit of excellence.

- business strategy

- Columbia Business School

- Corporate governance

- credit investments

- Economic Development

- Economic Policy

- Entrepreneurship

- ESG principles

- finance innovation

- finance leader

- financial adaptability

- financial diversification

- Financial Education

- financial influence

- financial innovation

- financial leadership

- financial legacy

- Financial Markets

- Financial resilience

- financial visionary

- Henry Kravis

- iconic deals

- industry benchmark

- Infrastructure

- investment firm

- Investment philosophy

- investment strategies

- KKR

- Kohlberg Kravis Roberts

- Leadership Development

- leveraged buyout model

- leveraged buyouts

- long-term value

- Market Dynamics

- Mount Sinai Hospital

- operational excellence

- operational improvements

- philanthropic contributions

- philanthropic leadership

- Philanthropy

- Private Equity

- private equity landscape

- private equity pioneer

- real estate investments

- responsible capitalism

- responsible investing

- RJR Nabisco

- Social Responsibility

- Strategic Guidance

- Sustainability

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment