- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

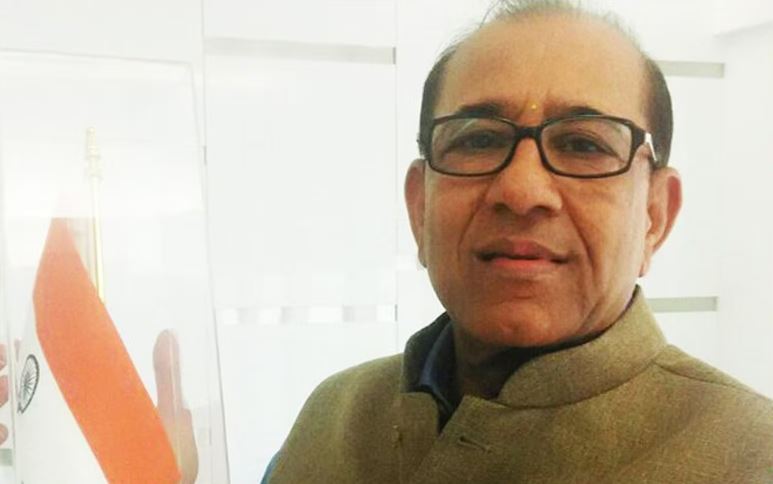

Vinod Adani: The Discreet Billionaire Behind the Scenes

Vinod Adani is a name that, until recently, rarely appeared in mainstream media despite being associated with one of the world’s most prominent business empires. Known for his quiet demeanor and private lifestyle, Vinod Adani is the elder brother of Gautam Adani, the chairman of the Adani Group. While Gautam Adani is often in the spotlight for his business ventures in infrastructure, energy, and logistics, Vinod Adani has maintained a lower profile, operating mainly from abroad and handling critical international operations of the Adani empire.

Born into a modest Jain family in Gujarat, India, Vinod Adani embarked on his professional journey with the same entrepreneurial spirit that defines the Adani family. Unlike Gautam, who built his presence in India, Vinod chose to operate from overseas, eventually settling in Dubai. His choice to remain outside India was strategic, allowing him to manage the offshore entities that would play a crucial role in the Adani Group’s global expansion. Over the years, he has managed businesses in trading and energy and has been instrumental in establishing the Adani Group’s global supply chain and logistics network.

Vinod Adani’s business acumen came into greater focus as the Adani Group began expanding beyond Indian borders. He is believed to have been the brain behind many of the Group’s international deals, including ventures in coal trading, mining, and renewable energy. His companies, which are based in tax-friendly jurisdictions such as the UAE, Mauritius, and Singapore, have helped the Group in raising funds and managing international assets. This offshore presence has not only helped in navigating regulatory landscapes but also in maintaining a financial structure that aligns with global corporate strategies.

Though not listed as a direct shareholder in many Adani companies, Vinod Adani has been mentioned in financial disclosures and media reports as the ultimate beneficiary of several offshore entities linked to the Group. This has raised both interest and scrutiny over his role in the conglomerate. Despite being a low-key figure, regulatory bodies and investigative journalists have paid increasing attention to Vinod Adani’s financial dealings, particularly amid global discussions around transparency, tax havens, and corporate governance.

In early 2023, Vinod Adani’s name became a focal point during the controversy triggered by a report from Hindenburg Research. The report accused the Adani Group of stock manipulation and accounting fraud, and it cited Vinod Adani as a key player in managing a web of offshore shell companies that allegedly facilitated these actions. The report claimed that these companies were used for inflating stock prices and shuffling funds across borders. Although the Adani Group vehemently denied all allegations and maintained that all operations were legal and transparent, the controversy brought unprecedented media attention to Vinod Adani.

In response to the allegations, the Adani Group issued multiple statements defending its practices and highlighting its compliance with local and international regulations. The Group also emphasized that Vinod Adani was not a member of the Group’s executive leadership or board of directors. Nonetheless, the media portrayal painted him as a shadowy figure pulling financial strings from behind the curtain. Despite this portrayal, those close to the business landscape argue that Vinod’s strategic financial positioning is not unusual for conglomerates of such magnitude operating globally.

Vinod Adani’s approach to business is deeply rooted in discretion and operational effectiveness. Unlike his younger brother Gautam, who often represents the Group publicly, Vinod has always chosen to operate from the background. He is rarely seen at public events, avoids interviews, and maintains a tight circle. This preference for privacy has made him an enigmatic figure, often misunderstood or mischaracterized by those outside the business world. For insiders, however, Vinod is respected as a shrewd strategist who has played a pivotal role in the success of the Adani Group’s international ventures.

Despite the controversies, there is no denying that Vinod Adani has helped transform the Adani Group into a global conglomerate. From handling commodity trading in the Middle East to managing legal and financial structures in the Caribbean and Southeast Asia, his contributions have been critical in building a foundation for global operations. These efforts have enabled the Group to access international capital markets, form joint ventures with global corporations, and expand into new sectors like renewable energy and data infrastructure.

In terms of wealth, Vinod Adani is among the richest Indians, although his net worth is often difficult to assess accurately due to the opaque nature of offshore holdings. In 2023, Forbes and other wealth trackers began listing him among the world’s billionaires, marking a shift in public recognition of his financial stature. This acknowledgment also sparked debates around wealth concentration, corporate opacity, and the influence of family-run conglomerates in emerging economies like India.

In the broader context of Indian business history, Vinod Adani represents a category of businesspersons who operate from the shadows but wield significant power. His career illustrates how global finance, corporate structuring, and regulatory arbitrage can be used to expand influence without attracting public attention. While his role might not fit into conventional definitions of corporate leadership, it is undeniably central to the Group’s international strategy and resilience.

As the Adani Group continues to expand into new markets and industries, the role of Vinod Adani remains crucial. Whether through financial engineering, strategic acquisitions, or capital raising, his influence will likely continue to shape the trajectory of the Group. While public scrutiny may compel more transparency in the future, Vinod Adani seems committed to his behind-the-scenes approach—operating quietly but effectively, away from the limelight that follows other billionaires. His story is a reminder that power in the business world is not always about visibility, but about vision, strategy, and execution.

- Adani controversies

- Adani family

- Adani Group

- Adani offshore entities

- Billionaire Lifestyle

- Business Expansion

- business in UAE

- business influence

- Business Leadership

- Business Legacy

- business tycoons

- capital markets

- Coal Trading

- commodity trading

- Corporate governance

- corporate transparency

- discreet businessmen

- Dubai businessmen

- Energy Sector

- financial strategy

- financial structuring

- Forbes Billionaires

- Gautam Adani

- Global Finance

- global logistics

- hidden wealth

- Hindenburg report

- Indian billionaires

- Indian conglomerates

- Indian Economy

- Indian Entrepreneurs

- infrastructure magnates

- International Business

- International Markets

- Mauritius finance

- Middle East business

- mining investments

- multinational operations

- offshore companies

- offshore wealth

- private billionaires

- Private Equity

- regulatory scrutiny

- renewable energy investors

- shell companies

- Singapore offshore

- Stock Market

- Strategic Investments

- tax havens

- Vinod Adani

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment