- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

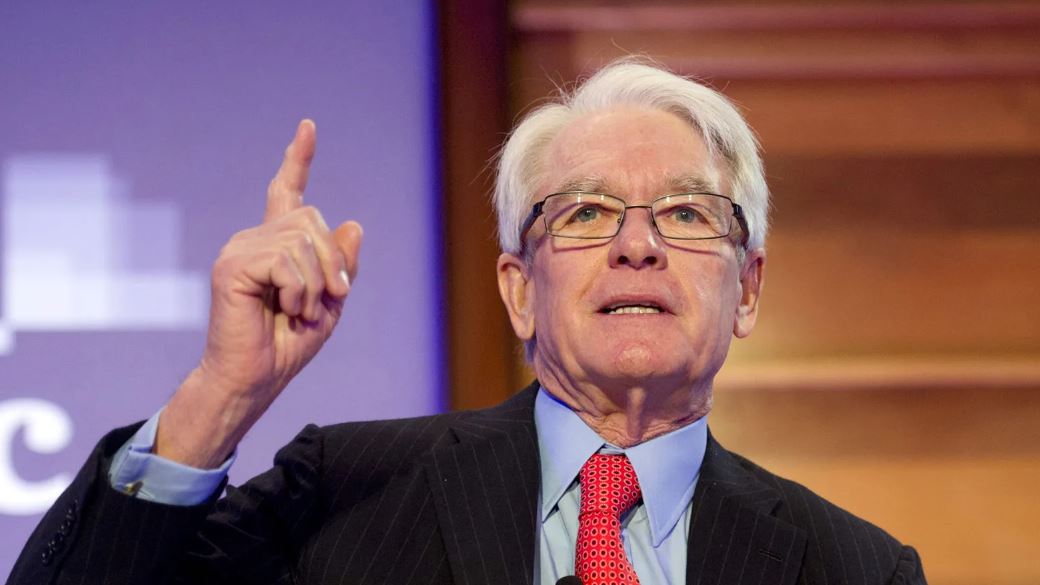

Charles Schwab: The Man Who Revolutionized Investing

Charles Schwab, a name synonymous with financial empowerment and innovation, is one of the most influential figures in modern American finance. As the founder of the Charles Schwab Corporation, he transformed the investment landscape by democratizing access to financial markets, making investing more affordable, transparent, and accessible to the average American. His journey from a young man with a learning disability to a titan of finance is a compelling story of resilience, vision, and a relentless drive to disrupt the status quo.

Born on July 29, 1937, in Sacramento, California, Charles Robert Schwab Jr. faced challenges early in life, including a struggle with dyslexia—a condition that was little understood at the time. Despite this, Schwab exhibited a strong entrepreneurial spirit from a young age. He went on to attend Stanford University, earning a degree in economics in 1959, and later received an MBA from the Stanford Graduate School of Business in 1961. His academic achievements, despite his learning difficulties, demonstrated a determination that would define his career.

In the early 1970s, Schwab recognized a significant gap in the financial services industry. At that time, investing was largely reserved for the wealthy, with high fees, limited transparency, and a gatekeeper-like approach by traditional brokerage firms. Schwab envisioned a different future—one where individual investors could access the markets easily and inexpensively. In 1971, he founded a company originally called First Commander Corporation, which would eventually become the Charles Schwab Corporation. His goal was to create a brokerage firm that prioritized the needs of everyday investors over institutional elites.

Schwab’s breakthrough came in 1975, when the U.S. Securities and Exchange Commission deregulated brokerage commissions. This opened the door for discount brokers to offer lower fees than traditional firms. Schwab seized the opportunity and pioneered a new business model that emphasized low costs, excellent customer service, and user-friendly platforms. His company introduced no-frills stock trading, allowing investors to buy and sell securities at a fraction of the cost they were previously paying. This move was not just innovative; it was revolutionary.

Over the decades, Schwab’s company grew rapidly, becoming one of the largest and most respected financial services firms in the United States. By emphasizing integrity, transparency, and client-first principles, Charles Schwab helped millions of Americans take control of their financial futures. His leadership emphasized the importance of education, offering investors access to tools, research, and guidance that were once the domain of professional advisors. Schwab’s firm also embraced technological change, launching online trading platforms and mobile applications that kept pace with the digital revolution.

Charles Schwab’s influence extended beyond his own company. He helped create an industry that is now filled with discount brokers, robo-advisors, and digital platforms that cater to investors of all experience levels. His work pushed traditional firms to evolve and adapt, resulting in a more competitive, client-focused financial industry overall. Schwab’s efforts helped shift the balance of power from Wall Street to Main Street, giving individual investors unprecedented influence and control.

Throughout his career, Schwab remained committed to innovation. He continued to expand the services offered by his company, including retirement accounts, mutual funds, ETFs, and financial planning. Under his leadership, the Charles Schwab Corporation grew to manage trillions in client assets and serve millions of customers worldwide. Despite its size, the company maintained its founding principles of fairness, affordability, and accessibility.

Beyond business, Charles Schwab is known for his philanthropy and advocacy for education and learning disabilities. He and his wife, Helen, have donated millions to causes related to education, dyslexia awareness, and medical research. Schwab has been open about his own struggles with dyslexia, helping to raise awareness and reduce stigma for others facing similar challenges. His story has been an inspiration to countless individuals who face learning difficulties, showing that with perseverance and determination, limitations can be overcome.

In 2007, Schwab published his autobiography, “It’s Your Ship: Management Techniques from the Best Damn Ship in the Navy,” sharing insights from his life and career. The book emphasizes leadership, innovation, and the importance of empowering individuals within organizations. It reflects Schwab’s lifelong philosophy that success is built not just on intelligence or talent, but on courage, vision, and the willingness to challenge conventional thinking.

Charles Schwab stepped down as CEO of his company in 2008 but remained involved as chairman and a guiding force in the firm’s direction. His legacy is firmly embedded in the financial world, not just as a businessman but as a transformative figure who redefined how people think about investing. He proved that finance doesn’t have to be elitist or intimidating—it can be inclusive, empowering, and even liberating.

Today, Charles Schwab’s name continues to symbolize trust, value, and innovation in finance. His life’s work has reshaped the investing experience for millions, creating a more equitable financial landscape. Schwab didn’t just build a successful company—he created a movement that challenged an industry to be better, more open, and more responsive to the needs of everyday people. His enduring impact is a testament to the power of vision, integrity, and the belief that everyone deserves a chance to build a better financial future.

- 1975 brokerage reform

- American business

- American success story

- business biography

- Business Leadership

- business transformation

- Business Visionaries

- Charles Schwab

- Charles Schwab Corporation

- Charles Schwab legacy

- customer service

- democratizing finance

- deregulation

- digital finance

- discount brokerage

- dyslexia

- Entrepreneur

- ETFs

- finance pioneer

- Financial Accessibility

- Financial disruption

- Financial Empowerment

- financial equity

- financial innovation

- Financial Literacy

- Financial Planning

- financial services

- Financial Technology

- inclusive finance

- Innovation in Finance

- Investing

- investment revolution

- investor education

- investor tools

- Leadership

- learning disabilities

- low-cost investing

- Main Street investing

- mobile trading

- modern investing

- mutual funds

- online trading

- Personal Finance

- Philanthropy

- retirement planning

- Schwab values

- SEC

- Stanford graduate

- stock market access

- stock trading

- Wall Street

Recent Posts

Categories

- 193 Countries Consortium Partner1

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense48

- AI37

- Arts3

- Banking & Insurance11

- Big Data3

- Billionaires1,497

- Boats & Planes1

- Business332

- Careers13

- Cars & Bikes79

- CEO Network1

- CFO Network17

- CHRO Network1

- CIO Network1

- Cloud10

- CMO Network18

- Commercial Real Estate7

- Consultant1

- Consumer Tech194

- CxO1

- Cybersecurity73

- Dining1

- Diversity, Equity & Inclusion4

- Education7

- Energy8

- Enterprise Tech29

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games149

- GIG1

- Healthcare79

- Hollywood & Entertainment203

- Houses1

- India’s 1000 Richest1

- Innovation46

- Investing2

- Investing Newsletters4

- Leadership65

- Lifestyle11

- Manufacturing1

- Markets20

- Media326

- Mobile phone1

- Money13

- Personal Finance2

- Policy569

- Real Estate1

- Research6

- Retail1

- Retirement1

- Small Business1

- SportsMoney42

- Style & Beauty1

- Success Income1

- Taxes2

- Travel10

- Uncategorized15

- Vices1

- Watches & Jewelry2

- world's billionaires1,467

- Worlds Richest Self-Made Women2

Related Articles

Francine von Finck and the Legacy of a Discreet Fortune

Francine von Finck, a name that commands respect in elite business circles,...

By 193cc World's BillionairesJune 6, 2025The Life and Legacy of Stefano Pessina

Stefano Pessina, one of the most influential figures in the global pharmaceutical...

By 193cc World's BillionairesJune 6, 2025John Morris: A Life of Vision, Growth, and Legacy

John Morris, the founder of Bass Pro Shops, is an iconic figure...

By 193cc World's BillionairesJune 6, 2025Zheng Shuliang and His Legacy

Zheng Shuliang was a man whose name resounds not only because of...

By 193cc World's BillionairesJune 6, 2025

Leave a comment