- Home

- Billionaires

- Investing Newsletters

- 193CC 1000

- Article Layout 2

- Article Layout 3

- Article Layout 4

- Article Layout 5

- Article Layout 6

- Article Layout 7

- Article Layout 8

- Article Layout 9

- Article Layout 10

- Article Layout 11

- Article Layout 12

- Article Layout 13

- Article Layout 14

- Article Sidebar

- Post Format

- pages

- Archive Layouts

- Post Gallery

- Post Video Background

- Post Review

- Sponsored Post

- Leadership

- Business

- Money

- Small Business

- Innovation

- Shop

Recent Posts

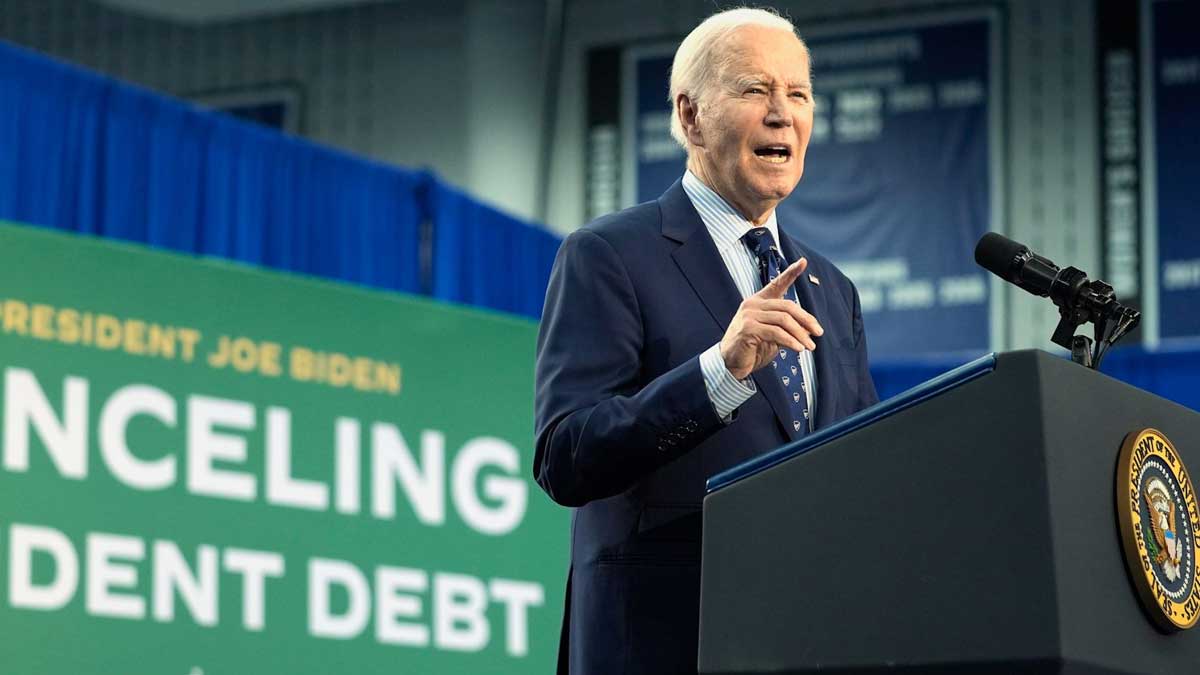

Biden Proposes Student Loan Forgiveness Rules

The Biden Administration’s latest move to address the student loan crisis involves a multifaceted approach, with the Department of Education unveiling its first draft rules for a comprehensive student loan forgiveness plan. This plan aims to alleviate the burden on millions of federal student loan borrowers, offering significant relief for those struggling with debt.

The proposed rules, announced on Tuesday, include nine key provisions that closely align with President Biden’s new forgiveness plan. One notable provision is the proposal to cancel accrued interest, providing much-needed relief for borrowers facing mounting interest charges. Another important aspect is the plan to eliminate debt for borrowers who have been making payments for at least 20 years, offering a path to debt freedom for long-term borrowers.

Additionally, the draft rules outline different avenues for debt cancellation for borrowers eligible under various forgiveness plans, such as the Saving on a Valuable Education (SAVE) plan. This provision aims to address the challenges faced by borrowers who have not been able to successfully apply for forgiveness due to paperwork requirements, bad advice, or other obstacles.

The Department of Education’s proposal also includes forgiveness for borrowers who took out commercial loans under the Federal Family Education Loan (FFEL) Program, which ended in 2010. Borrowers who began making payments on or before July 1, 2000, would be eligible for this forgiveness program, providing relief for a significant number of borrowers.

Furthermore, the Department plans to propose a separate rule in the coming months aimed at forgiveness for borrowers experiencing financial hardship. This rule will include proposals to authorize the automatic forgiveness of loans for borrowers at high risk of future default. It will also cover borrowers indicating hardship for reasons other than student loans, including high medical and caregiving expenses.

The release of the draft rules marks the beginning of a 30-day public comment period, during which stakeholders and the public can provide feedback on the proposed rules. If implemented as proposed, the rules would provide relief to more than 30 million borrowers, significantly reducing the total amount of student loan debt burdening individuals across the country.

In addition to the proposed rules, the Biden administration has already taken steps to address the student loan crisis, including the forgiveness of $153 billion in student loan debt. The most recent round of forgiveness, totaling $7.4 billion, was announced last Friday, indicating the administration’s commitment to addressing the issue of student loan debt.

Background information on the Biden administration’s efforts reveals a broader strategy to tackle the student loan crisis. Biden’s initial attempt at a widespread forgiveness plan in 2022 aimed to provide relief for individual borrowers with incomes below $125,000, offering up to $20,000 in relief. However, this plan was ultimately struck down by the Supreme Court last August, leading the administration to explore alternative approaches.

One such approach involves using the 1960s-era Higher Education Act to provide relief to borrowers, leading to the development of the new forgiveness plan. The administration has also announced incremental debt cancellations and the launch of the SAVE plan as part of its efforts to address the student loan crisis.

Despite these efforts, the administration has faced legal challenges, with several states filing lawsuits against the SAVE plan. These lawsuits allege that the president is unilaterally imposing an expensive and controversial policy that he could not pass through Congress. The lawsuits underscore the challenges the administration faces in implementing its student loan forgiveness plan.

Overall, the Biden administration’s proposed student loan forgiveness rules represent a significant step towards addressing the student loan crisis. If implemented, these rules would provide much-needed relief for millions of borrowers, offering a path to financial stability and debt freedom.

Recent Posts

Categories

- 193cc Digital Assets2

- 5G1

- Aerospace & Defense21

- AI17

- Arts1

- Banking & Insurance11

- Big Data3

- Billionaires153

- Boats & Planes1

- Business134

- Careers13

- Cars & Bikes39

- CEO Network1

- CFO Network16

- CHRO Network1

- CIO Network1

- Cloud6

- CMO Network17

- Commercial Real Estate7

- Consultant1

- Consumer Tech46

- CxO1

- Cybersecurity12

- Dining1

- Diversity, Equity & Inclusion4

- Education6

- Energy8

- Enterprise Tech24

- Events11

- Fintech1

- Food & Drink2

- Franchises1

- Freelance1

- Future Of Work2

- Games61

- GIG1

- Healthcare28

- Hollywood & Entertainment41

- Houses1

- Innovation21

- Investing2

- Investing Newsletters4

- Leadership62

- Lifestyle9

- Manufacturing1

- Markets19

- Media101

- Mobile phone1

- Money13

- Personal Finance2

- Policy109

- Real Estate1

- Research6

- Retirement1

- Small Business1

- SportsMoney4

- Style & Beauty1

- Success Income1

- Taxes1

- Travel9

- Uncategorized1

- Vices1

- Watches & Jewelry1

- world's billionaires127

Related Articles

Menendez Corruption Trial Begins with New Bribery Allegations

The corruption trial against Senator Bob Menendez, D-N.J., begins today, with jury...

By 193cc Agency CouncilMay 14, 2024Trump’s Sleepiness in Hush Money Trial: Key Moments

Former President Donald Trump’s behavior in his hush money trial, particularly his...

By 193cc Agency CouncilMay 14, 2024Cohen Testifies: Trump’s Former Ally Turns Witness

Michael Cohen, once a stalwart attorney for Donald Trump, has transitioned into...

By 193cc Agency CouncilMay 14, 2024Michael Cohen Testifies in Trump Trial Amid Witness Criticism

Former Trump attorney Michael Cohen is anticipated to be a central figure...

By 193cc Agency CouncilMay 13, 2024

Leave a comment